First Mover Americas: BRC-20 Tokens Skyrocket

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

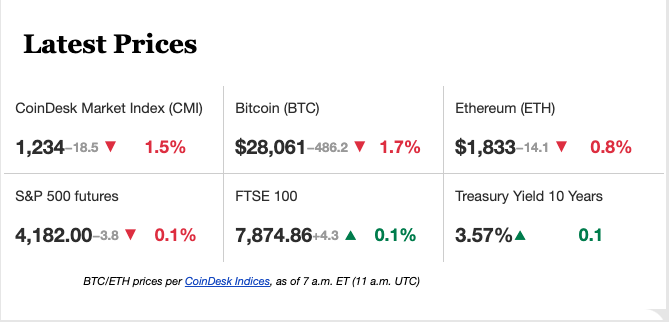

Latest prices 5/2/2023

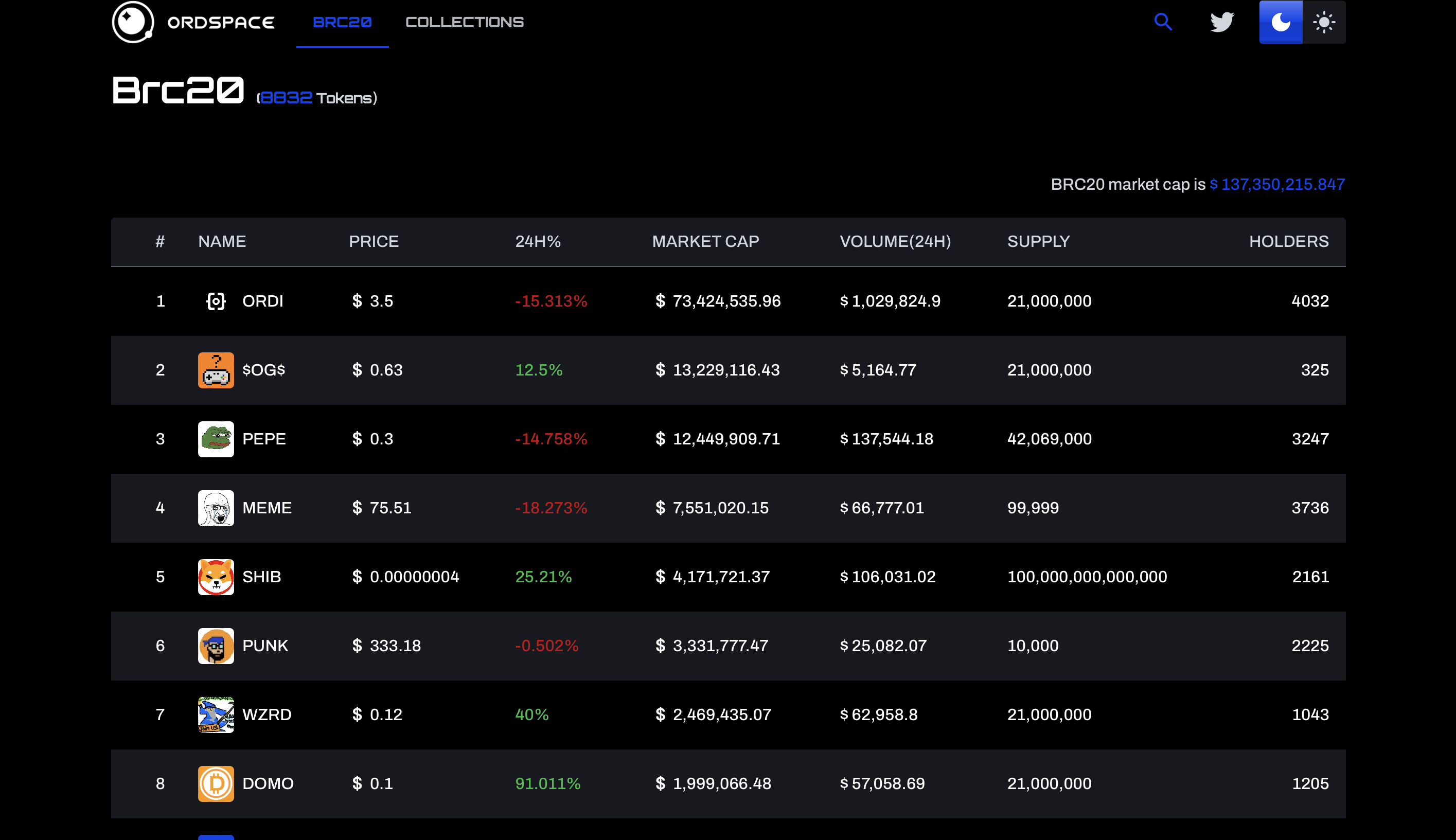

Interest in “Bitcoin Request for Comment” or BRC-20 tokens built with Ordinals and stored on the Bitcoin base chain has skyrocketed, lifting their market value by several hundred percent. As of writing, the combined market cap of more than 8,800 BRC-20 tokens was $137 million, a staggering 682% rise from $17.5 million seen a week ago, according to data tracked by Ordspace. A pseudonymous on-chain analyst named Domo created the BRC-20 token standard in early March to facilitate the issue and transfer of fungible tokens on the Bitcoin blockchain. The experimental invention came weeks after Ordinals Protocol went live, allowing users to inscribe digital art references into small transactions on the Bitcoin blockchain.The BRC-20 standard sounds like the popular ERC-20 standard, but the two are different, with the former lacking the ability to interact with smart contracts.

The market cap has surged by more than 600% in less than two weeks. (Ordspace)

Crypto lender Celsius is seeking to mingle its U.K. and U.S. entities as court filings allege the distinction between the two was a “sham.” The bankrupt crypto firm is the latest to face allegations of poor record-keeping in its corporate structure, in a court fight which is pitting its customers against Series B investors. In 2021, the firm – whose Celsius Network Limited arm had been warned to cease U.K. operations by that country’s Financial Conduct Authority (FCA) – set up a limited liability company (LLC) in Delaware and sought to transfer assets through a series of financial transactions.

Tron founder Justin Sun on Monday said that he has arranged a full refund of a $56 million transfer to exchange platform Binance after a warning from the latter’s CEO against a potential token grab of the new SUI token. After the substantial transfer made in trueUSD (TUSD) got flagged by Whale Alert early Monday, Binance CEO Changpeng Zhao took to Twitter to say his platform has warned Sun it will take action if he used any of the funds to buy up large amounts of SUI tokens from Binance’s Launchpool. “Binance LaunchPool are meant as air drops for our retail users, not just for a few whales,” Zhao said. The SUI token drop, the native token of layer1 blockchain Sui, is set to take place once the mainnet goes live on May 3. On Sunday, Binance announced the SUI token will be available via its Launchpool, which allows users to stake their crypto assets to provide funds into a liquidity pool and get rewards in return.

(glassnode)

-

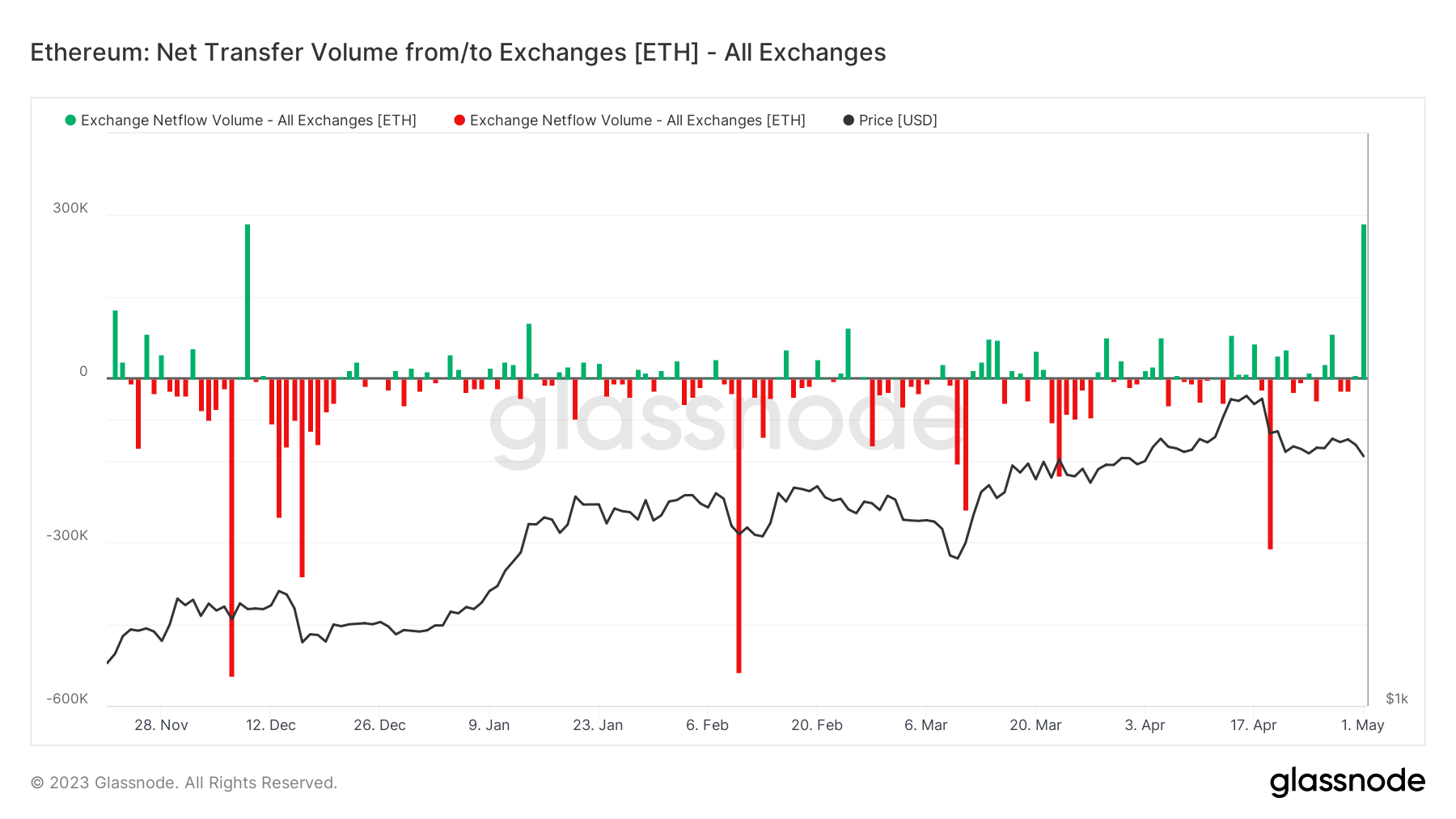

The chart shows the net inflow of ether into centralized exchanges going back to November.

-

On Monday, exchanges registered a net inflow of more than 285,000 ETH, the biggest single-day tally since Dec. 9.

-

Exchange inflows are often equated with investor intention to sell or use coins as a margin in derivatives trading.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.