First Mover Americas: BoJ Comments Offer Relief to Crypto

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 1,869 +4.9% Bitcoin (BTC): $57,145 +3.5% Ether (ETC): $2,482 +0.9% S&P 500: 5,240.03 +1.0% Gold: $2,438 +2.1% Nikkei 225: 35,089.62 +1.19%

Top Stories

Cryptocurrencies continued their recovery from Monday’s crash, with bitcoin trading above $57,000, over 4% higher in the last 24 hours. Bank of Japan deputy governor Shinichi Uchida said that the central bank would not hike borrowing costs, which may have provided some relief for investors of risk assets such as crypto. “As we’re seeing sharp volatility in domestic and overseas financial markets, it’s necessary to maintain current levels of monetary easing for the time being,” Uchida said in a speech to business leaders in Hakodate, Hokkaido. The broader crypto market, measured by the CoinDesk 20 Index (CD20), has risen over 5%, with SOL continuing to lead the gains. The altcoin has regained the $150 mark, on the back of climbing nearly 10%.

Memecoins from the Solana ecosystem surged more than 30% in the past 24 hours, leading gains in the crypto market, as the network’s underlying token SOL, recovered from losses earlier in the week. Cat-themed popcat (POPCAT) and dog token dogwifhat (WIF) surged as much as 25%, before slightly retreating, while smaller tokens MUMU and catdog (CATDOG) rose 30%, data show. Major memecoins on other blockchains, such as DOGE and PEPE, lost as much as 5%. Solana network volumes more than doubled to over $3.3 billion from Monday’s $1.5 billion, banking in fees of at least $750,000 per day, DefiLlama data shows.

Crypto asset manager CoinShares recorded profits after tax of around $513.1 million in Q2, a considerable bump from $12.7 million in the equivalent quarter a year ago. The firm also noted a loss of $481.4 million on the fair value of digital assets, as the crypto market pulled back from its all-time high levels of Q1. Once accounted for this depreciation, CoinShares’ comprehensive income for the quarter was $32.6 million, almost five-times the figure for Q2 2023 of $6.3 million. The firm saw its asset management fees more than double to $28.45 million, helped by its acquisition of the ETF unit of Valkyrie, which gave CoinShares a U.S. arm to its ETP business.

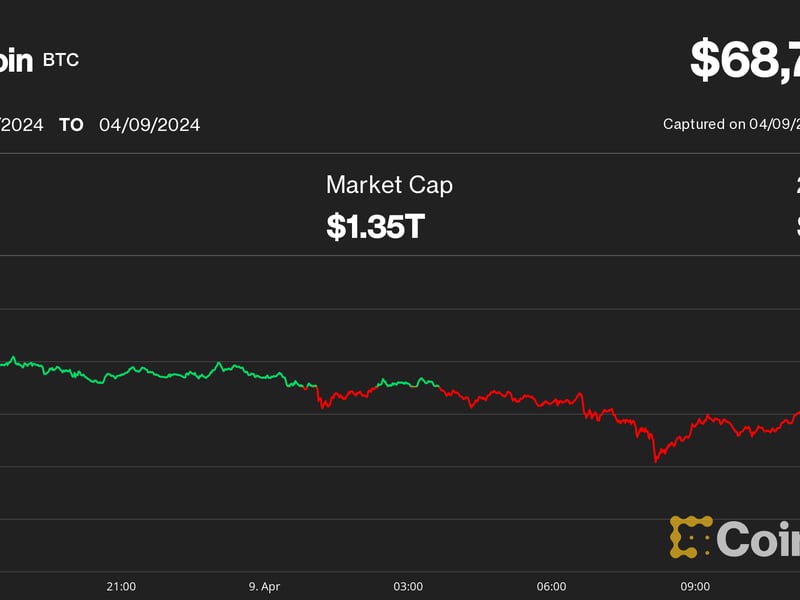

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4RIETVN7MFBK7GAI3E5RBNW7ZE.png)

-

The Crypto Fear & Greed Index fell to 17 on Tuesday, the lowest in two years.

-

Readings below 20 represent extreme fear often observed at market bottoms.

-

Source: Alternative.me

Trending Posts

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.