First Mover Americas: BlackRock Received $100K Seed Funding for Its Spot BTC ETF

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/FO2DY35BBVDOFADEIG3GOMPMXI.png)

Top Stories

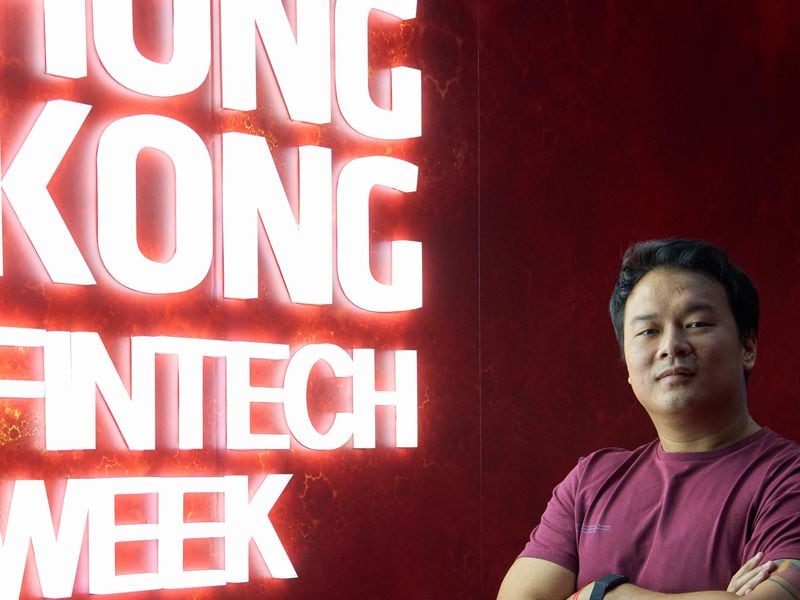

BlackRock (BLK) received $100,000 as “seed capital” for its proposed spot bitcoin (BTC) exchange-traded fund, the investment giant disclosed in a fresh application with the U.S. Securities and Exchange Commission (SEC). “The seed capital investor agreed to purchase $100,000 in shares on October 27, 2023, and on October 27, 2023 took delivery of 4,000 shares at a per-share price of $25.00 (the “seed shares”),” the filing said. Seed capital represents the initial funding that allows an ETF to fund the creation units underlying the ETF so that shares can be offered and traded in the open market.

Business intelligence company MicroStrategy (MSTR) was sitting on a more than $2 billion profit on its massive bitcoin (BTC) holdings on Monday following the cryptocurrency’s rally above $42,000. Led by then CEO and now Executive Chairman Michael Saylor, MicroStrategy began purchasing bitcoin in August 2020. The company’s most recent purchases took place last month and as of Nov. 30, it held 174,530 bitcoin acquired for $5.28 billion, or an average price of $30,252 each. With bitcoin at $42,000, the value of MSTR’s holdings rose to roughly $7.3 billion. The price at press time had pulled back to $41,700.

The president of El Salvador took to the X platform early Monday morning to note his country’s bitcoin (BTC) investment was now profitable by more than $3 million following the cryptocurrency’s rally. “We have no intention of selling; that has never been our objective,” he wrote. “We are fully aware that the price will continue to fluctuate in the future, this doesn’t affect our long-term strategy.” Based on public statements from Nayib Bukele, CoinDesk three weeks ago calculated that the country at that time owned roughly 2,744 bitcoins at an average price a bit lower than $42,000 and was sitting on a loss of about $16 million.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OSCZP7P33VGB7NUBNZYGYFBBPY.png)

-

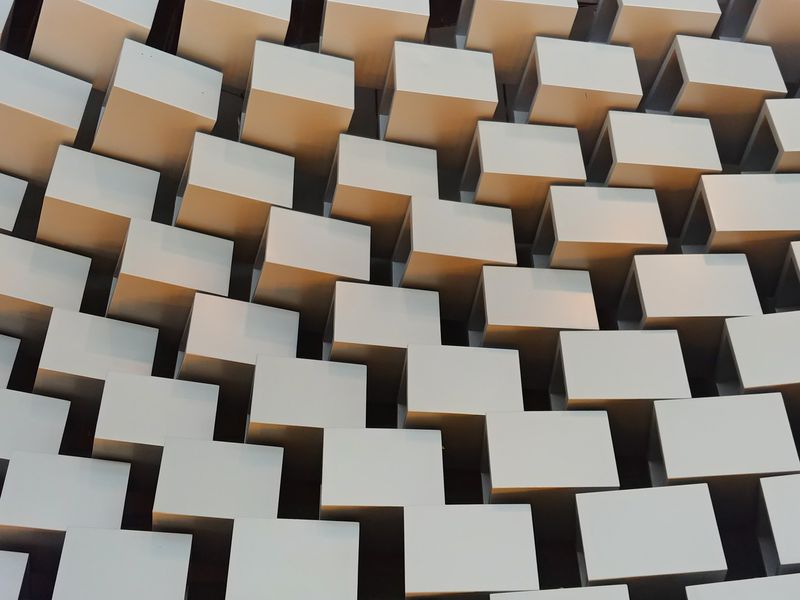

The chart shows changes in short-term and long-term bitcoin call-put skews over the past five weeks. The metric measures demand for calls relative to puts.

-

Skews have come off from multimonth highs reached in early November, failing to confirm bitcoin’s rise above $42,000 on Monday.

-

Perhaps sophisticated traders are anticipating a bull breather.

-

A call option offers protection against bullish moves, while a put offers insurance against price slides.

-

Source: Amberdata

Trending Posts

Edited by Sheldon Reback.