First Mover Americas: Bitcoin Tops $58K After U.S. Tech Stocks Rise

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 1,831.41 +2.21%

Bitcoin (BTC): $58,088.29 +2.45%

Ether (ETH): $2,345.28 +0.99%

Nikkei 225: 36,833.27 +3.41%

Top Stories

Bitcoin rose above $58,000 on the back of a rally in U.S. technology stocks. U.S. inflation data on Wednesday seemed to solidify the prospect of a 25 basis-point interest-rate cut by the Fed this month, following which Nvidia, Microsoft, Google and Apple all registered gains. BTC is currently priced just above $58,000, 2.4% higher in the last 24 hours, while the broader crypto market has risen about 2.2%, as measured by the CoinDesk 20 Index. However, bitcoin ETFs’ inflow streak was halted after just two days, registering outflows of $43 million on Wednesday.

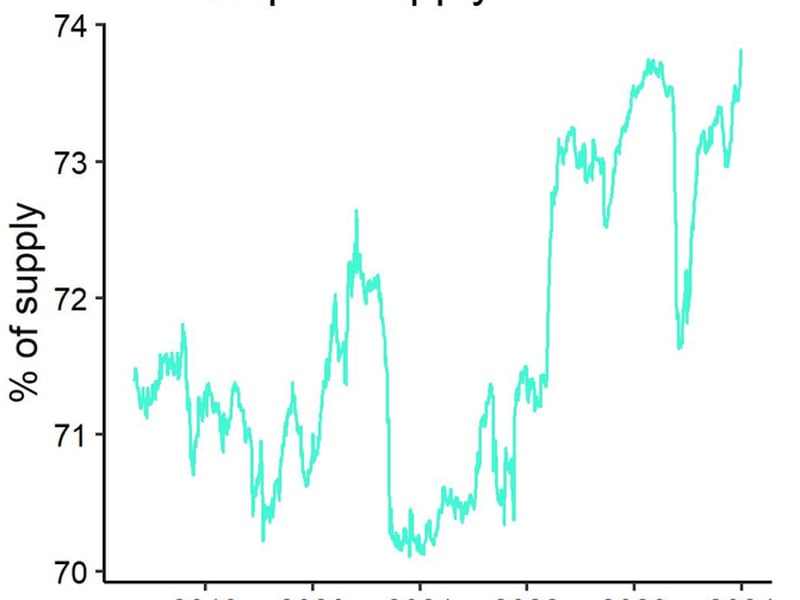

Leverage in the bitcoin market is increasing again, suggesting traders are looking to take on more risk. The estimated leverage ratio, which divides global futures open interest by the number of coins held on exchanges, jumped to 0.2060, the highest since October 2023, according to CryptoQuant. There was previously a months-long consolidation below 0.2, suggesting a more cautious approach. The increase indicates there is potentially more volatility being injected into the market. High-leverage liquidity is stacked at around $58,500, according to Hyblock Capital. So volatility could pick up once BTC approaches that level, especially because overall market liquidity remains low. That means a buy/sell order can have an outsized impact on the going market rate.

DeFi platform Pendle has started offering pools with variable yields of as high as 45% on a bitcoin-backed token in a move that expands the product’s fundamentals. The offering, which can also provide fixed yields of an annualized 10%, allows users to deposit LBTC, a liquid-staking token issued by restaking startup Lombard, in a Pendle pool made by Ethereum layer-2 network Corn. Data shows the pool has attracted over $13 million in user deposits since going live. It matures on Dec. 26. Lombard is a restaking service that converts wrapped bitcoin (WBTC) to a Lombard Bitcoin (LBTC) token that can be used in DeFi applications to capture yield. Corn, another startup, is a network that uses bitcoin as the main token to pay usage fees.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2U5XFKL42RBY7NR6NJEYN4AMZI.png)

-

The chart shows prices for Binance-listed bitcoin perpetual futures and the global bid-ask ratio.

-

The recent price drop has been characterized by a positive global bid-ask ratio, represented by the vertical green lines.

-

“It shows the underlying demand remains robust, positioning the market for a potential rebound,” Hyblock Capital said.

Trending Posts

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.