First Mover Americas: Bitcoin Soars Past $30K

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Featured SpeakerJenny Johnson

President and CEOFranklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

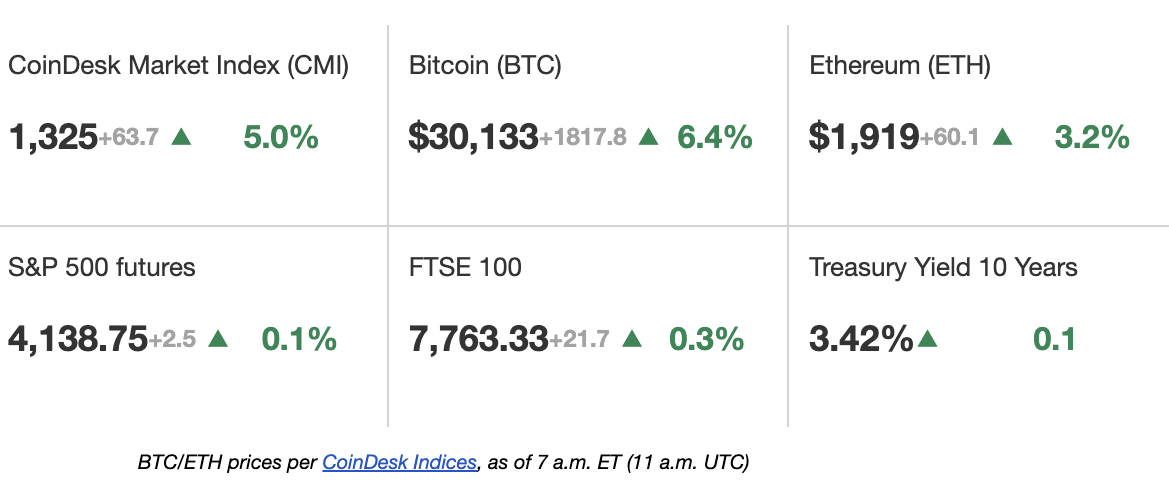

Bitcoin broke the $30,000 level for the first time since June on Tuesday as March’s banking turbulence fades further into the distance and investors grow more optimistic about the Federal Reserve’s monetary policy. Bitcoin was up 6% in the past 24 hours to $30,100. Trading volume, however, remains low, according to Matteo Bottacini, a trader at Crypto Finance AG. “This indicates that few are taking profits from the year-end low and new buyers are still hesitant to enter the market,” Bottacini wrote in a morning note. Crypto-related stocks also climbed on the back of bitcoin’s rise. Marathon Digital (MARA), Coinbase (COIN) and MicroStrategy (MSTR) all rose on Monday and were up further in premarket trading on Tuesday.

Tyler and Cameron Winklevoss recently lent their Gemini cryptocurrency exchange $100 million to support the business amid the market downturn, Bloomberg reported. The brothers provided the loan after trying to get outside investment for Gemini, Bloomberg said, citing anonymous sources. A Gemini spokesperson didn’t immediately respond to a request for comment. The $100 million figure stands out in part because that equals the amount Gemini agreed to give some of its customers as part of the Genesis bankruptcy case. Genesis, which, like CoinDesk, is owned by Digital Currency Group, froze withdrawals in the aftermath of crypto exchange FTX’s collapse last year, a decision that locked up money for customers of Gemini’s Earn yield product.

Millions of Aptos Labs’ APT tokens will be unlocked on Wednesday in a planned move that’s set to increase the circulating supply by 0.5%, data shows. APT rose nearly 8% in the past 24 hours, according to CoinGecko. The Aptos network has a market cap of over $2.3 billion, and the APT unlock is valued at over $50 million based on current prices. Unlocks refer to the automatic release of new tokens belonging to any blockchain network into the open market. They are often previously planned. Aptos is a blockchain that was founded by former employers of Facebook’s parent company, Meta Platforms (META), after Facebook abandoned its own plans to create a blockchain-based payments network called Diem (formerly Libra).

-

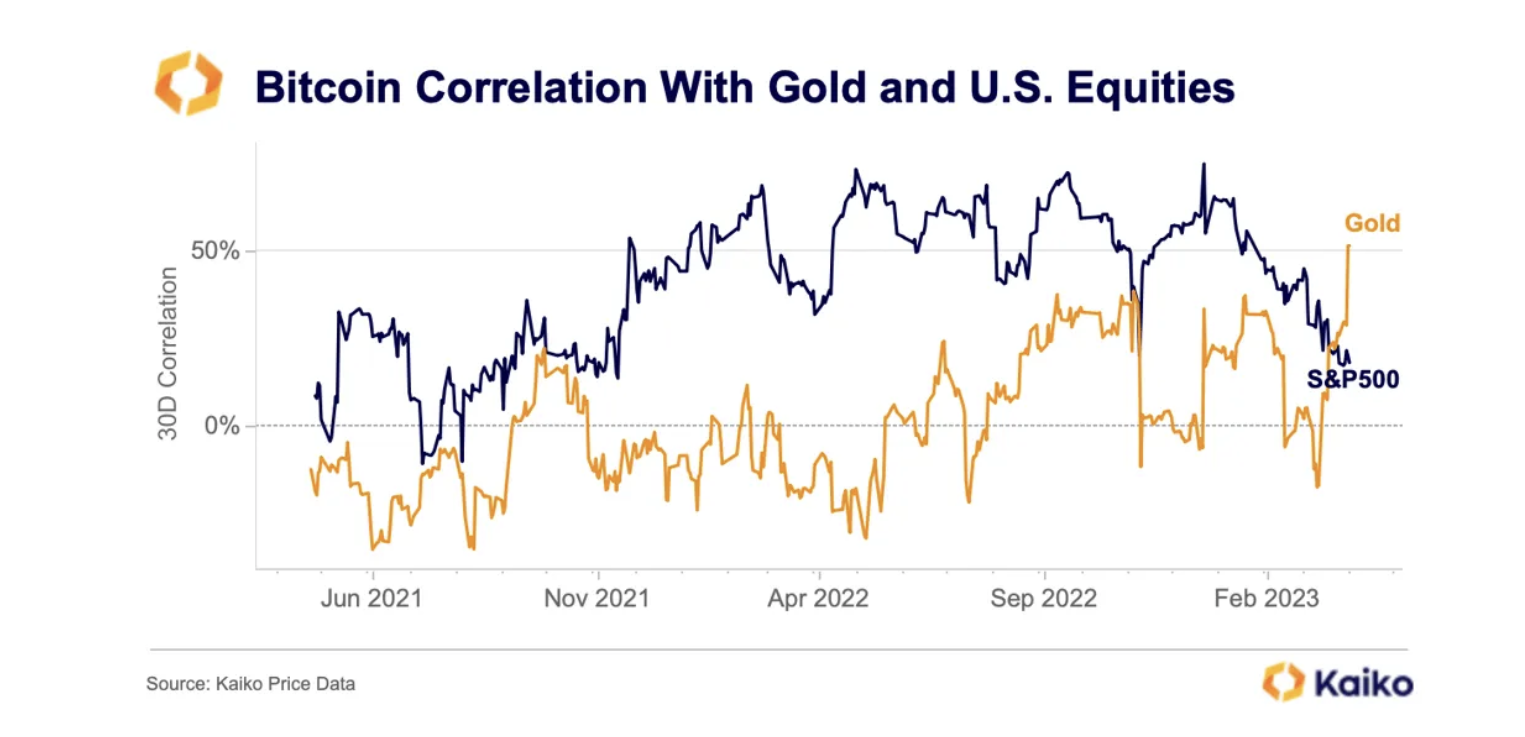

The chart shows changes in bitcoin’s 30-day rolling correlation with gold and U.S. equities since June 2021.

-

Bitcoin’s correlation with gold has topped 50%, surpassing the cryptocurrency’s positive correlation with stocks.

-

In other words, bitcoin’s immediate prospects are more closely tied to gold than stocks.

-

“Combined with on-chain data showing that the share of BTC long-term holders is steadily increasing, this could indicate that the attractiveness of BTC as a safe haven asset is on the rise,” Paris-based crypto data provider Kaiko said.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.