First Mover Americas: Bitcoin Settles Above $67K After Biden Drops Out

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RMTZ5KNP4BDBBKCZZFQV3L44XY.JPG)

Top Stories

Bitcoin settled above $67,000 following a brief surge above $68,000 on Sunday after President Biden said he would not seek reelection. BTC initially slumped after Biden’s announcement before recovering to over $68,400 and was trading around $67,450 at the time of writing, 0.7% higher than 24 hours ago. The CoinDesk 20 Index (CD20), which measures the broader digital asset market, rose 1.25%. SOL and DOGE led the gains with increases of around 4.3% and 5% respectively.

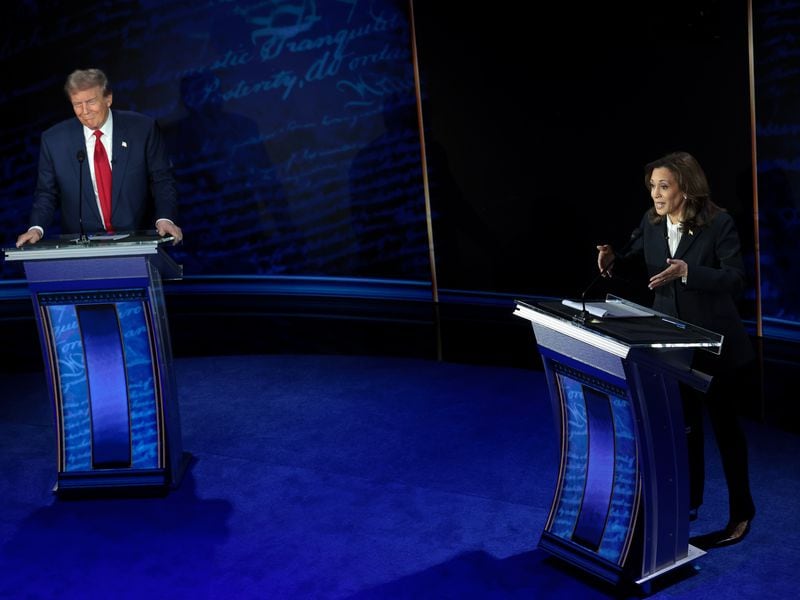

President Biden’s withdrawal from the November election dropped pro-crypto candidate Donald Trump’s probability of victory from 71% to 65% on Polymarket. Vice President Kamala Harris’ odds almost doubled to 30% from 16%. While Biden’s decision tempered Trump’s White House prospects, the market’s response was initially positive. “Biden’s withdrawal has opened up a possibility where, regardless of who sits in the White House, the U.S. government may embrace a more constructive stance towards the digital asset industry after November,” Singapore-based crypto research firm Presto wrote in a Monday note. “Whether Harris or any other contenders will pursue such a path remains to be seen, but the optionality that hardly existed before is now there.”

Bitcoin’s price is too high compared to its production cost of $43,000 and any increase is likely to be a short-term one, JPMorgan said in a report last week. BTC’s volatility-adjustment comparison to gold was $53,000, further suggesting it is overpriced, the bank said. JPMorgan noted that momentum in bitcoin futures has been weak in recent weeks due to BTC liquidations by creditors of Gemini, Mt. Gox creditors and the German government. Liquidations are expected to subside this month and the bank continues to look for a rebound in Chicago Mercantile Exchange bitcoin futures positioning into August.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RI333IBQI5DJFBDWW6YXUBCI3I.png)

-

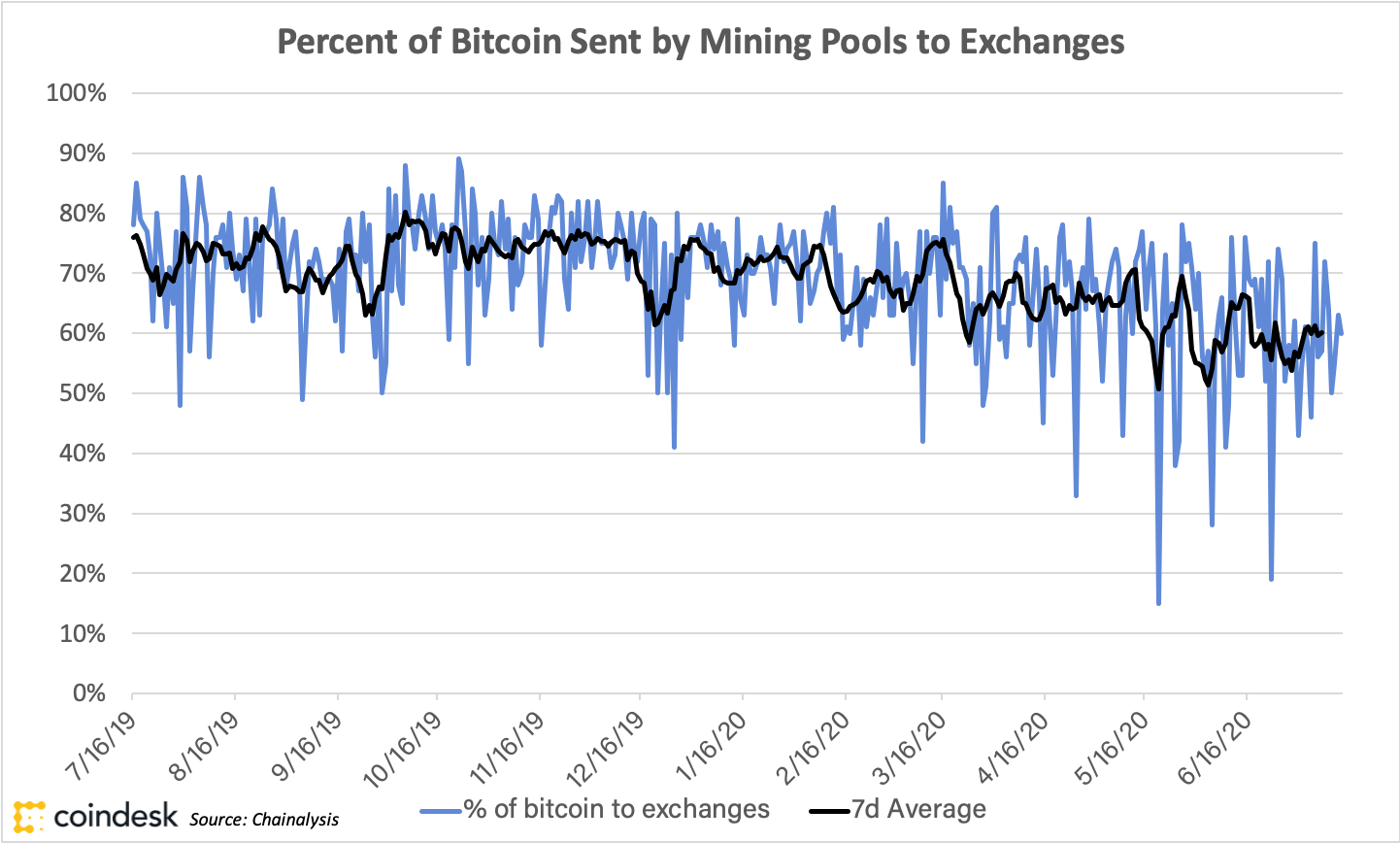

The chart shows bitcoin’s Korea Premium Index, which measures the gap between South Korean and Western exchanges.

-

The index has dropped to nearly zero for the first time since November, a sign of decreased retail investor participation in the market.

-

Source: CryptoQuant

Trending Posts

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.