First Mover Americas: Bitcoin Retreats Slightly From 12-Month High

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Bitcoin (BTC) has slid about 3% after rallying to a one-year high on Friday above $31,300, trading currently at $30,300. The crypto’s roughly 20% drive higher over the past 10 days began after asset management giant BlackRock filed to launch a spot bitcoin ETF, with analysts suspecting that’s green-lit a move from large institutional investors to push further into the space. Making a big move higher on Monday morning is NEAR Protocol’s NEAR token, up 10% on the day and the top performing digital asset. The token climbed as the company’s foundation announced it would partner with Alibaba Cloud, the Chinese tech giant’s arm for computing and storage.

Last week, ProShares’ Bitcoin Strategy ETF (BITO) – a Bitcoin futures fund offered in the U.S. – recorded the highest weekly inflow in over a year as bitcoin prices breached the $30,000 level, according to Bloomberg senior ETF analyst Eric Balchunas. BITO allows investors to gain exposure to bitcoin-linked returns with a regulated product and the latest holdings numbers show it holds over $1 billion worth of CME Bitcoin Futures. Investors poured $65 million into BITO in the past week, breaking a previous 2023 high of just over $40 million in April. The product did not see meaningful inflows in May and most of June alongside a retreat in the price of bitcoin.

Belgium’s top markets regulator is ordering embattled crypto exchange Binance to immediately cease serving local customers, according to a Friday notice. The Financial Services and Markets Authority (FSMA) said Binance is “offering and providing exchange services in Belgium between virtual currencies and legal currencies, as well as custody wallet services, from countries that are not members of the European Economic Area,” which the regulator says is in violation of a prohibition. “The FSMA has therefore ordered Binance to cease, with immediate effect, offering or providing any and all such services in Belgium,” the notice said.

-

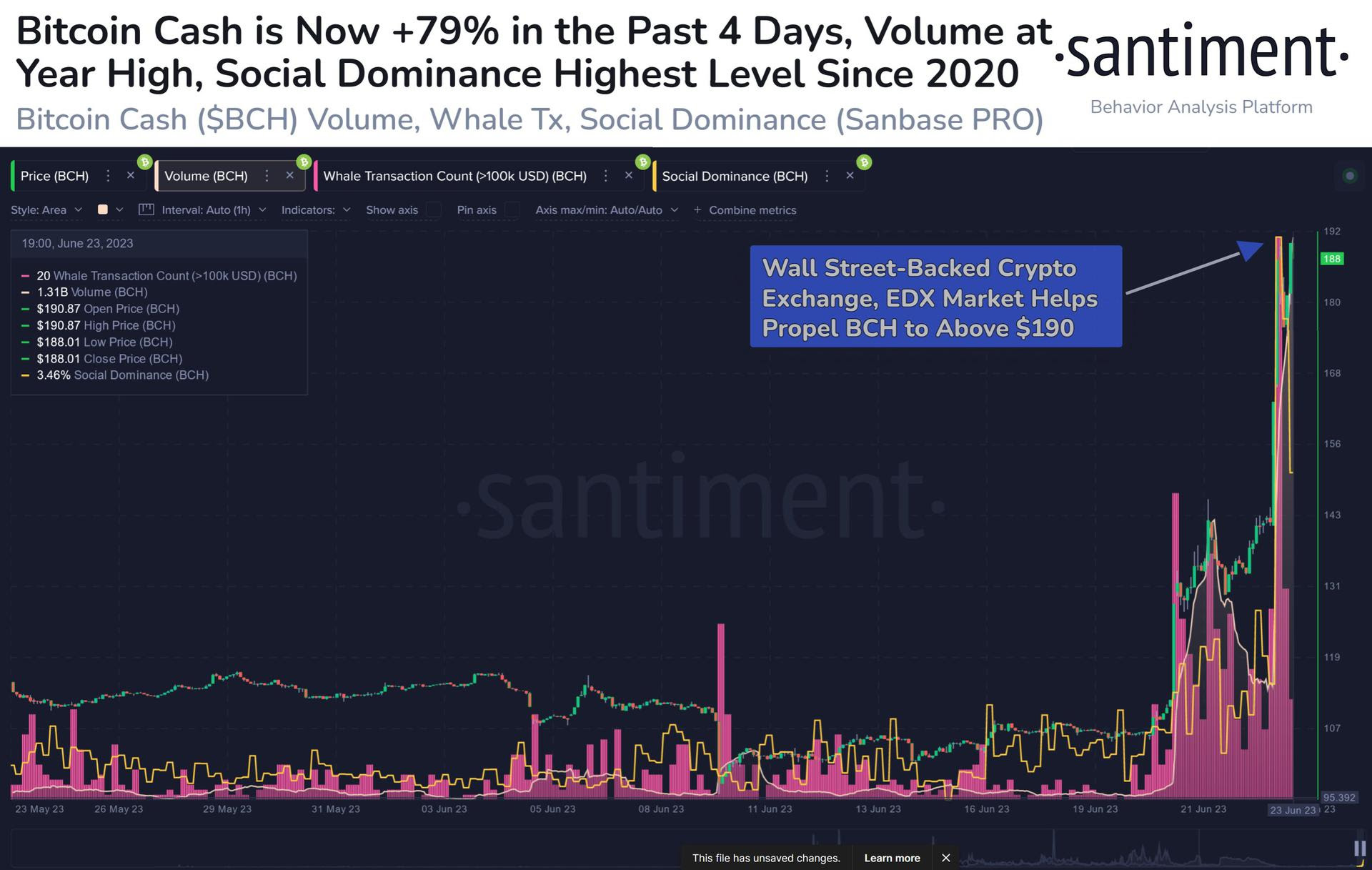

The chart shows a recent spike in bitcoin cash is accompanied by a rise in trading volumes and an uptick in social volume, a metric representing the degree of crowd chatter about the cryptocurrency on various social media channels.

-

An increase in trading volume alongside an uptick in prices confirms the uptrend. However, increased social chatter is often seen as interim market tops.

Edited by Stephen Alpher.