First Mover Americas: Bitcoin Retreats Following Ascent to $64K

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 2,029.51 +0.74%

Bitcoin (BTC): $63,558.29 +0.07%

Ether (ETH): $2,6421.07 -0.81%

Nikkei 225: 37,870.26 -0.19%

Top Stories

Bitcoin traded at around $63,600 during the European morning having retreated from a peak of $64,780 late on Tuesday. BTC is little changed in the last 24 hours, while the broader crypto market has risen just over 0.85%, as measured by the CoinDesk 20 Index. A week on from the Fed’s first interest-rate cut in four years, traders are optimistic that the move will create a snowball effect with other central banks taking similar steps. “It’s becoming clear that the Fed has finally started its rate cut cycle, removing such concerns. This implies that we may see more from the People’s Bank of China as the Fed continues to cut rates and the negative rate differential narrows,” Presto Research said in a note.

Bitcoin ETFs saw inflows of $136 million on Tuesday, the biggest in almost a month. More importantly, the inflows were equivalent to 2,132 BTC, according to data by HeyApollo, which represents nearly five times the daily mined supply being removed from the market. Ether ETFs recorded $62.5 million in total inflows, the third-largest day for ether ETF inflows since their launch. This rebound came just a day after Ether ETFs saw their largest outflows since July. Nevertheless, ether ETFs remain firmly in the red, having experienced net outflows of $624 million since they listed on July 23.

Assetera, an investment and trading firm for blockchain-based financial instruments, tapped Polygon to power its secondary market RWAs platform. The platform offers tokenized assets, such as securities, funds and money market instruments in a regulated digital trading venue. Assetera will use Ethereum scaling network Polygon to secure transactions and utilize stablecoins for purchase, clearing and settlement to ensure the process is fast and efficient. The Austria-regulated company holds both MiFID II and virtual asset service provider (VASP) licenses, and plans to upgrade to meet MiCA standards, which would open the door to offering its services across the European Union. The platform is open to both retail and professional clients.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/OLWJ3BLXTNHI5BOQ6OQN2QMTME.png)

-

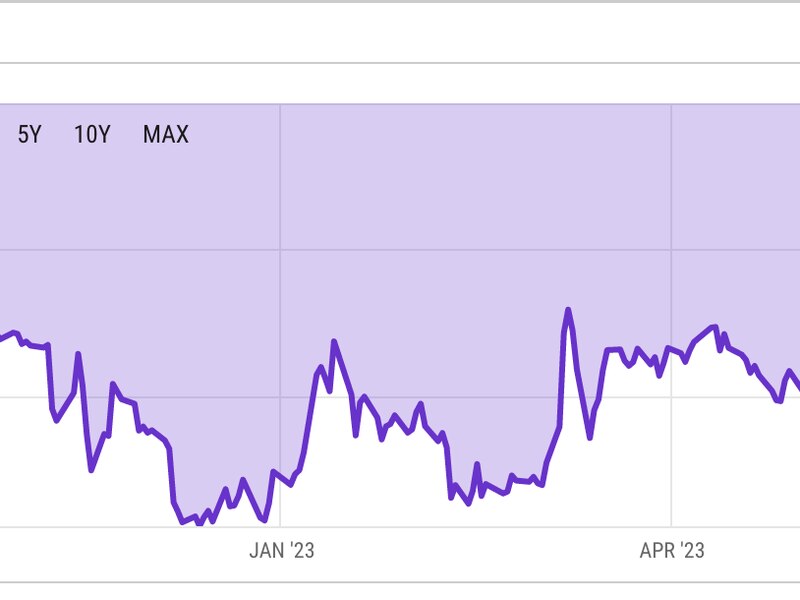

The chart shows the ratio between the U.S. Conference Board’s leading and lagging economic indicators since 1958.

-

The ratio has tanked to a record low in a slide reminiscent of the previous eight meltdowns that portended recessions.

-

Source: Jeff Weniger, WisdomTree head of equities

Trending Posts

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.