First Mover Americas: Bitcoin Little Changed After Liquidation Rout

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/57XUQIFUHZC4FL67URCCKFFALI.JPG)

Top Stories

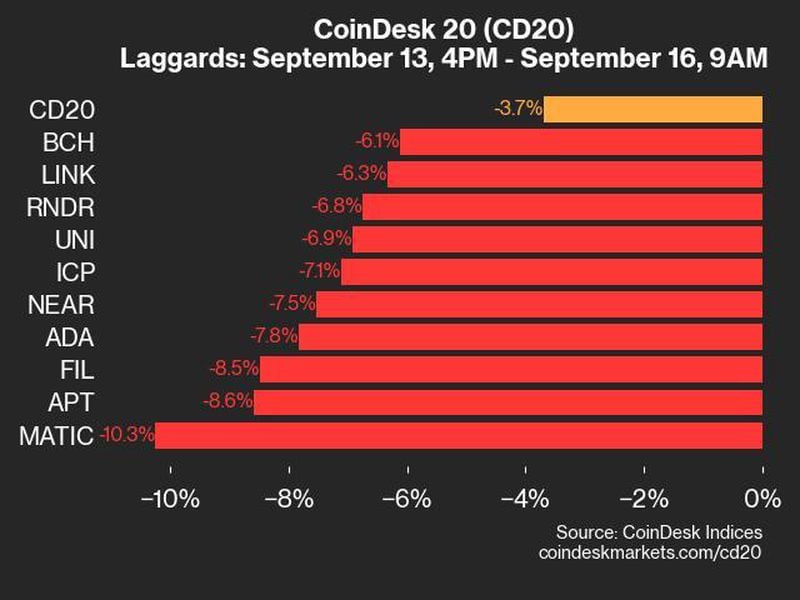

Bitcoin was little changed over the weekend following a $400 million liquidation rout on Friday. BTC fell to under $69,000 from over $71,000 after U.S. non-farm payrolls data came in stronger than expected, which saw open interest and trading volume slump. Since Friday, the number of unsettled futures contracts across various tokens slid to $60 billion from $99 billion, suggesting traders significantly pared bets. However, analysts at Presto Research told CoinDesk that they expect market volatility to return in the week ahead with macroeconomic catalysts such as the CPI release on Wednesday. BTC traded around $69,450 during early European hours. The CoinDesk 20 Index (CD20) has fallen around 0.5% in the past 24 hours.

Crypto investment products took on nearly $2 billion of inflows last week, extending a five-week run to over $4.3 billion, asset manager CoinShares said. Trading volumes in exchange-traded products rose to $12.8 billion for the week, up 55% from the week before. Bitcoin led investment activity at over $1.97 billion inflows for the week, while ether saw its best week of inflows since March at nearly $70 million. “Unusually, inflows were seen across almost all providers, with a continued slowdown in outflows from incumbents,” CoinShares analyst James Butterfill said. “Positive price action saw total AUM rise above the $100 billion mark for the first time since March.” Butterfill said ETH buying was likely in reaction to the surprise SEC decision to allow spot ether ETFs.

The agreement to buy Bitstamp shows crypto is becoming an increasingly important part of Robinhood’s business, according to investment bank Architect Partners. “This acquisition instantly expands global reach to ensure participation regardless of U.S. actions,” the report said. Robinhood is continuing to expand its digital asset offering despite receiving a Wells Notice from the SEC last month, Architect added. The Bitstamp acquisition will also expand Robinhood’s institutional offering, which positions the trading platform as one of the “few publicly traded crypto-influenced companies that will be able to serve institutions as they come into the digital asset space,” the note said. Architect also said the price of $200 million in cash is a significant discount to the $500 million valuation that Bitstamp received in the 2018 majority investment.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/2YKD3PBMIJABNCIQM442ICUTKM.png)

-

The chart shows bitcoin’s price and Bollinger bands, which are volatility bands placed two standard deviations above and below the price’s 20-day moving average.

-

At present, the Bollinger bands are in a state of contraction, a clear sign of a market lull.

-

The longer the Bollinger band squeezes, the bigger the eventual volatility explosion.

-

Source – TradingView

Trending Posts

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.