First Mover Americas: Bitcoin Hovers Below $26K; Stellar’s XLM Rallies

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YTTBHY7RTFBA5H7WNHXBL3Y7AM.png)

Top Stories

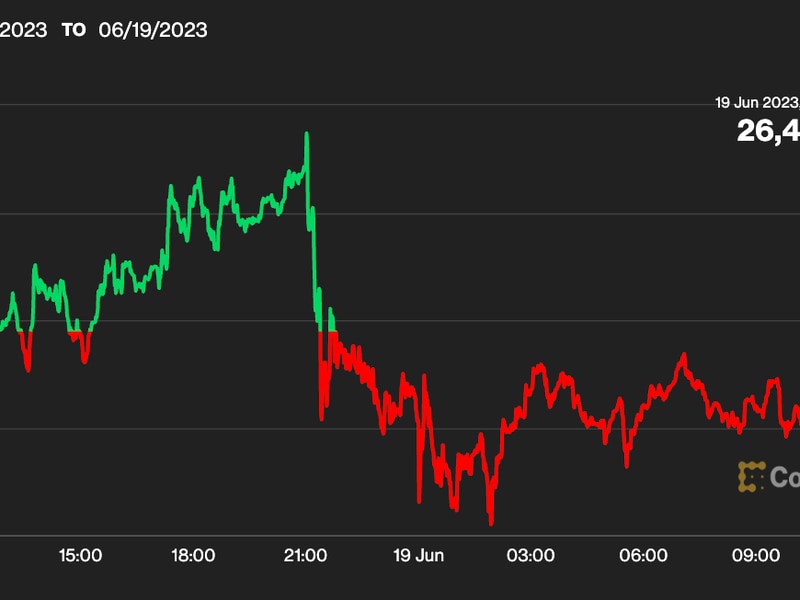

Bitcoin traded in a tight range in the past 24 hours, staying between $25,800 and $26,000 after a price spike last week when the cryptocurrency topped $28,000 after a federal appeals court ruled the SEC must review its rejection of Grayscale Investments’ attempt to convert its GBTC into an ETF. Bitcoin retreated as the SEC delayed key ETF decisions that were expected on Friday, damping traders’ hopes of a long-term recovery. “As we enter September, the cryptoasset market remains on the edge of its seat as various macroeconomic and regulatory narratives continue to leave investors guessing,” said Simon Peters, an analyst at eToro. “With the route to lower rates still unclear and bitcoin spot ETF approvals still waiting, the market will continue its guessing game on major cryptoassets’ direction of travel.” Stellar’s XLM was the only digital asset which saw notable gains on Monday, advancing 10% on the day.

It is more likely the Securities and Exchange Commission (SEC) will be forced to approve spot bitcoin (BTC) exchange-traded-fund (ETF) applications from several asset managers after a federal court said the regulator must review its rejection of Grayscale’s attempt to convert the Grayscale Bitcoin Trust (GBTC) into an ETF, JPMorgan (JPM) said in a report Friday. “The most important element of the Grayscale vs. SEC court ruling was that the denial by SEC was arbitrary and capricious because the Commission failed to explain its different treatment of similar products i.e., futures-based bitcoin ETFs,” analysts led by Nikolaos Panigirtzoglou wrote. Grayscale and CoinDesk are both owned by Digital Currency Group (DCG). The court argued that fraud and manipulation in the spot market posed a similar risk to both futures and spot products because the “spot bitcoin market and CME bitcoin futures market are so tightly correlated,” the report said.

Cryptocurrency exchange Binance has seen another senior executive depart, with Global Product Lead Mayur Kamat heading for the door. We can confirm that Mayur has stepped down,” a spokesperson said in an emailed statement. “We are grateful to him for helping guide Binance through some of our most explosive growth and we wish him the very best.” A former vice president of product at travel agent Agoda, Kamat joined Binance in April 2022. Kamat’s departure follows those of Chief Strategy Officer Patrick Hillmann, Senior Director of Investigations Matthew Price, SVP for Compliance Steven Christie, who left the company in early July, and Asia-Pacific Head Leon Foong, who quit in August.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/GBOQXQC5ORASJLK5A6H3BGOUFY.jpg)

-

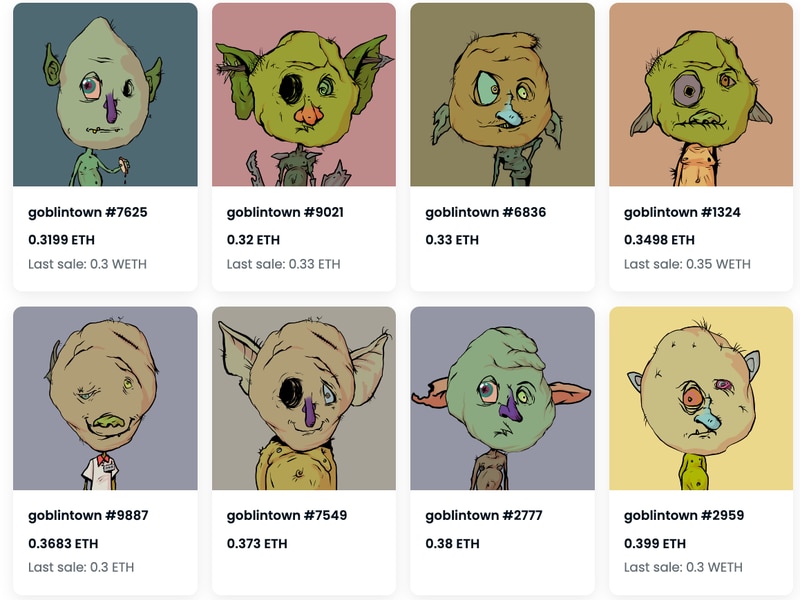

The chart shows the ratio between 30-day realized volatility for ether and bitcoin and the 20-day moving average of the ratio.

-

The ratio has dropped below 1, meaning ether has recently seen less volatility than bitcoin, an unusual situation, according to historical data.

-

Source: Markus Thielen, Matrixport

Trending Posts

Edited by Sheldon Reback.