First Mover Americas: Bitcoin Hovers Below $26K

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MYT7DDBILVE7BF662Y5WF5OQEM.png)

Bitcoin, the world’s largest cryptocurrency by market value, dropped just below the $26,000 mark on Wednesday after trading in a tight range over the past 24 hours and hitting a weekly low of $25,500. The cryptocurrency rebounded slightly from the low, but remains down 9% over the last seven days as markets await developments from the central bankers’ meeting at Jackson Hole on Friday. “It is possible that any semblance of dovishness from Jay Powell on Friday could help inspire a recovery. Beyond that, we also have a potential ruling in the Grayscale case to look forward to,” Sean Farrell, head of digital asset strategy at Fundstrat, wrote in a note. Farrell said he thinks the market is closer to a local bottom rather than top, given the absence of industry-specific catalysts and a decline in liquidity.

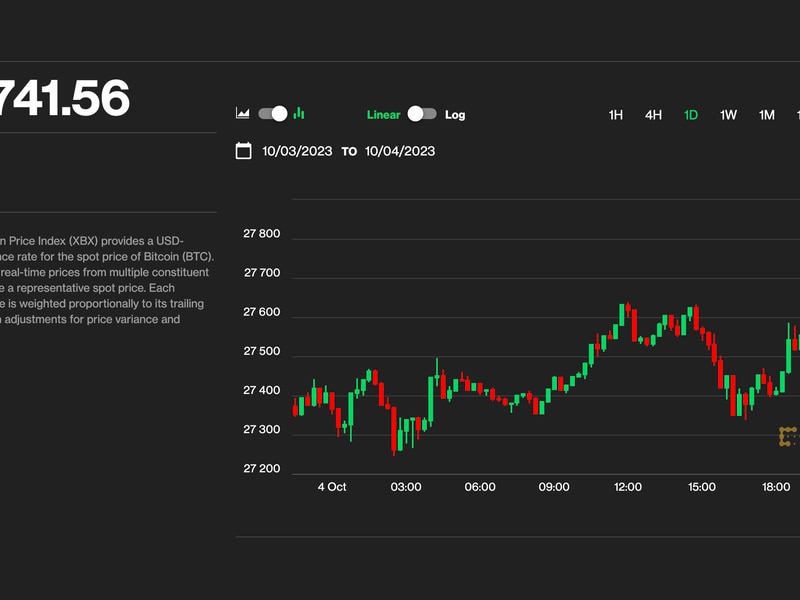

BNB, a cryptocurrency closely linked to Binance, fell to its lowest in more than a year after a report regarding fresh risks over Russia sanctions added to already mounting regulatory and legal pressure on the crypto exchange. The token sank to as low as $204 on Tuesday afternoon, its weakest level since June 2022’s crypto market crash. It’s since pared some of those losses, currently changing hands at $214, down about 7% over the past week. This latest decline happened after the Wall Street Journal reported that Binance was facilitating Russian users’ ability to move money abroad despite widespread international sanctions.

Australia will not be making any decision on a central bank digital currency (CBDC) for some years due to several unresolved issues that surfaced at the end of the pilot project, the country’s central bank announced on Wednesday. “Given the many issues that are yet to be resolved, any decision on a CBDC in Australia is likely to be some years away,” the report said, with the caveat that the project did not set out to provide a complete assessment of the costs, benefits, risks and other implications of introducing a CBDC. “Instead, it was more narrowly focused on exploring how a CBDC could be used by industry to enhance the functioning of the payments system.”

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/MQ3BFOJ5RZABPDB45UWSQMTMZI.jpg)

-

The chart shows daily changes in prices for BNB, a cryptocurrency closely tied to the digital assets exchange Binance.

-

Prices have recently tanked amid growing regulatory scrutiny and investor concerns about a distressed BNB-backed loan, nearing key support level at $200.

-

A potential break below $200 might prove costly as the next major price floor is seen directly at $130.

-

Source: Matrixport

Edited by Sheldon Reback.