First Mover Americas: Bitcoin Falls to $26K; Is $24K Next?

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

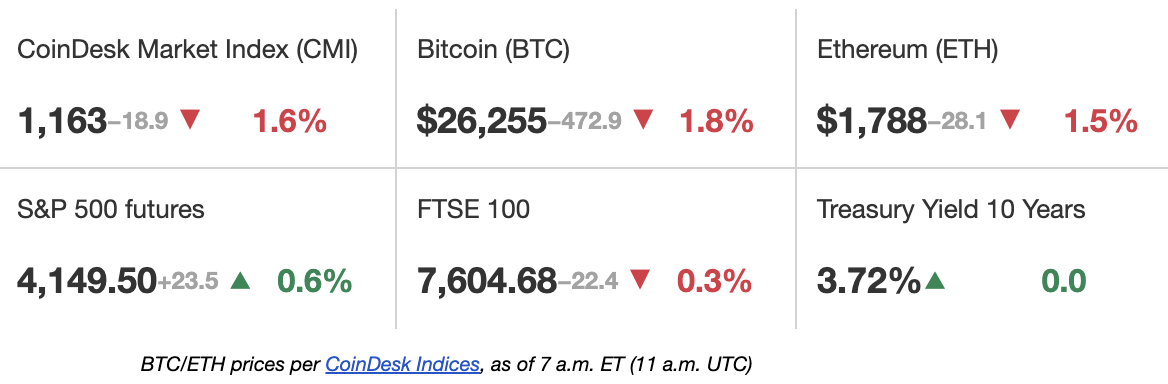

Bitcoin’s (BTC) recent price slide may have legs, according to technical analysis by alternative asset management firm Valkyrie Investments. The leading cryptocurrency by market value has declined by 10% to $26,200 this month – including a slide of nearly 4% over just the past day-plus – thanks in part to renewed bets the Fed will remain hawkish, a recovery in the U.S. dollar index, and lingering U.S. debt ceiling uncertainty. Per Valkyrie, a further decline toward $24,000 may be seen as bitcoin’s daily chart Ichimoku cloud – a momentum indicator – has flipped bearish. “This suggests an ongoing high-timeframe bullish trend with a decline in bullish momentum and the potential for near-term retrenchment,” wrote Chief Investment Officer Steven McClurg and team in a note to clients on Tuesday.

Crypto consortium Fahrenheit has won a bid to acquire insolvent lender Celsius Network, whose assets were previously valued at around $2 billion, according to court filings made early Thursday morning. The group will acquire Celsius’ institutional loan portfolio, staked cryptocurrencies, mining unit and additional alternative investments, and must pay a deposit of $10 million within three days to cement the deal, court filings show. A consortium of buyers that includes venture capital firm Arrington Capital and miner US Bitcoin Corp, Farenheit was selected as successful bidder following a lengthy auction process. Under the terms of the deal, the newly-formed company will get between $450 and $500 million in liquid cryptocurrency, and US Bitcoin Corp will construct a range of crypto mining facilities including a new 100 megawatt plant.

Terraform Labs co-founder Do Kwon will remain in detention while he faces charges of falsifying official documents in Montenegro, according to a court statement Thursday. Although the Basic Court in the country’s capital Podgorica had initially accepted a bail proposal from Kwon’s lawyers, Bloomberg reported that a higher court had later annulled the decision. The Basic Court of Podgorica confirmed to CoinDesk the high court’s decision, and that it had received the agreed payment of 400,000 euros ($428,000) from Kwon on May 17. Following the High Court ruling, the Basic Court has decided to extend Kwon’s detention.

-

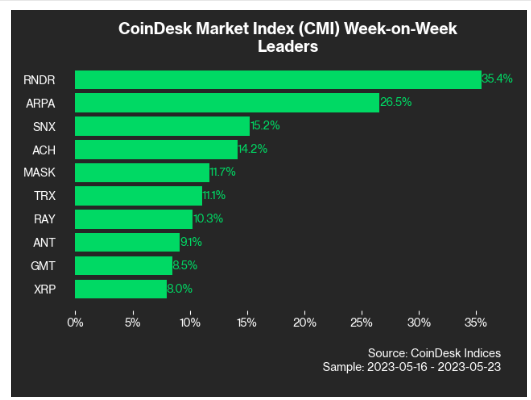

The chart shows smaller tokens like decentralized GPU-based rendering solution Render Network’s RNDR, and ARPA, the native token of privacy-preserving computation network ARPA Chain, outperformed market leaders by a big margin in the week ended May 23.

-

RNDR has perhaps benefitted from speculation that Apple’s virtual reality headset will utilize its decentralized graphics processing network.

-

APRA Chain’s impending mainnet launch, reportedly due in June, seems to have galvanized investor interest in the native cryptocurrency.

Edited by Stephen Alpher.