First Mover Americas: Bitcoin Drops on CFTC’s Suit vs. Binance

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

The U.S. Commodity Futures Trading Commission sued crypto exchange Binance and founder Changpeng Zhao on Monday on allegations the company knowingly offered unregistered crypto derivatives products in the U.S. against federal law. The lawsuit, which was filed in the U.S. District Court for the Northern District of Illinois, alleged that Binance operated a derivatives trading operation in the U.S., offering trades for cryptocurrencies including bitcoin, ether, litecoin (LTC), tether (USDT) and binance USD (BUSD), all of which the suit referred to as commodities. The suit also alleges that the company, under Zhao’s leadership, directed its employees to spoof their locations through the use of virtual private networks.

In a blog post Monday, Zhao said that the lawsuit contained “an incomplete recitation of facts,” saying that “we do not agree with the characterization of many of the issues alleged in the complaint” and calling the complaint “unexpected and disappointing.” Zhao touted the exchange giant’s compliance technology, including its know-your-customer program. He wrote that the exchange had 750 people in its compliance teams, “many with prior law enforcement and regulatory agency backgrounds,” and noted that the company had 16 licenses and registrations worldwide.

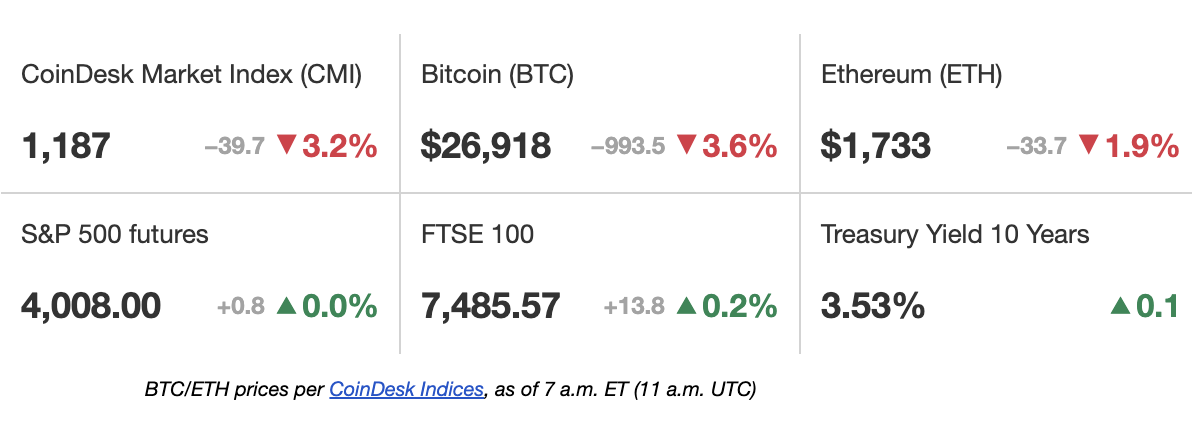

Bitcoin sank below $27,000 following news of the lawsuit, dropping to its lowest level since March 17. The world’s largest cryptocurrency by market cap is down 5% in the past 24 hours to about $26,700. Binance coin (BNB) declined by 5%. Matteo Bottacini, a trader at Crypto Finance AG, wrote in a morning note that investors are taking long positions in ether and other altcoins and short positions in bitcoin. “My bias is that upside for BTC looks now limited to the $30Ks while ETH and most of the altcoins are still waiting for the exploit,” he wrote. “Similarly, on the way down, despite BTC being the mega-cap here, I can easily see it trading in the $25k-$22.5k range.”

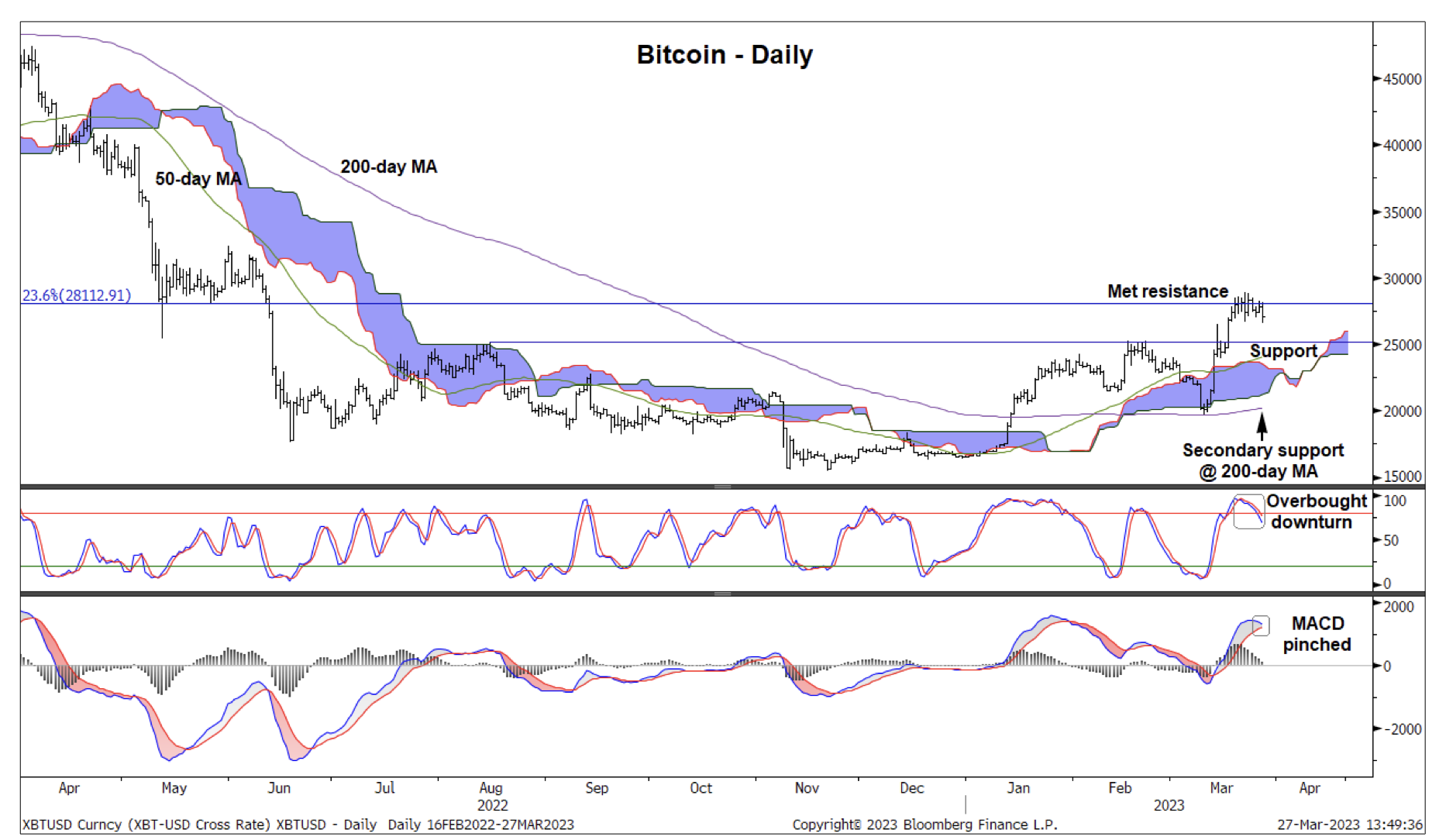

(Source: Fairlead Strategies)

-

Bitcoin’s daily chart shows the stochastic indicator has turned down from the above 80 or overbought reading, suggesting weakness ahead.

-

“In the near term, we expect a pullback for bitcoin, noting it has an overbought downturn in the daily stochastics,” analysts at Fairlead Strategies said in a note on Monday.

-

Former resistance, near $25.200, is now initial support for bitcoin,” the analysts added.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.