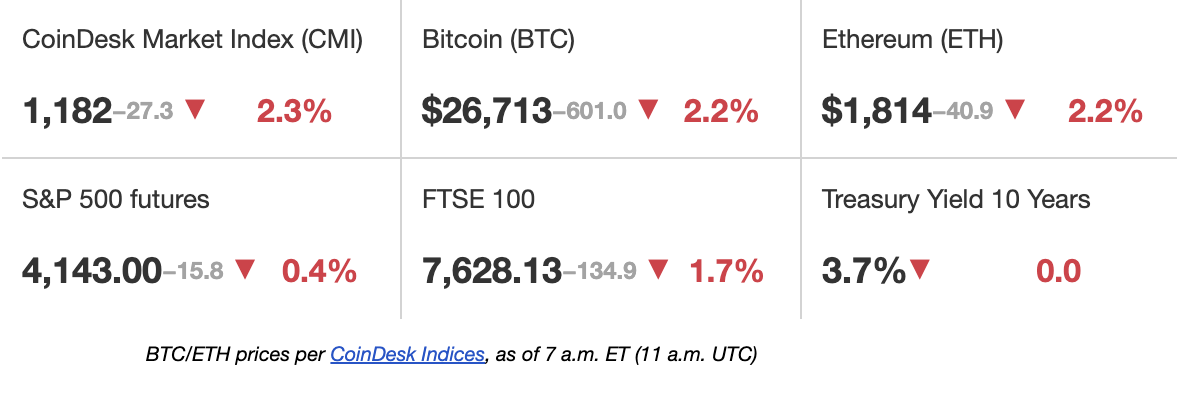

First Mover Americas: Bitcoin Dips Below $27K After Hot UK Inflation Report

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Bitcoin slid under the $27,000 level early Wednesday, leading a broad decline in major cryptocurrencies as markets reacted to poor U.K. inflation figures. The core Consumer Price Index (CPI) for the U.K. came in at 6.8% in April. That was the fastest pace of core inflation since 1992, and sizably ahead of March’s 6.2% pace as well as the 6.2% consensus forecast. It’s the third consecutive month that U.K. inflation has come in hotter than expected and the news is likely to add to pressure on the Bank of England to keep raising interest rates in the coming months.

Binance is firing back at a Reuters special report from Tuesday that said the crypto exchange commingled customer funds with company revenue. The report, citing unnamed “former insiders,” said the funds in question “ran into billions of dollars” and that “commingling happened almost daily” in accounts the exchange had at collapsed U.S. lender Silvergate Bank. Reuters noted that it did not find evidence that clients’ funds were lost or taken. Binance took major exception with the Reuters story, with the exchange’s Chief Communications Officer Patrick Hillmann calling it “weak” and full of “conspiracy theories.” Though not outright denying the allegations in the report, Hillman said the Reuters journalist was “desperate … to publish a negative story.”

Japan is set to implement stricter anti-money laundering measures, including the so-called “travel rule” of the Financial Action Task Force (FATF) from June 1, according to local news outlet Kyodo News. The decision was made by Japan’s cabinet on Tuesday after the nation’s anti-money laundering steps were deemed insufficient by global financial crimes watchdog FATF, the report said. In 2019, the FATF recommended the travel rule to combat money laundering and terrorist financing using crypto. By June 2022, the FATF was urging member nations to introduce travel rule legislation “as soon as possible.”

-

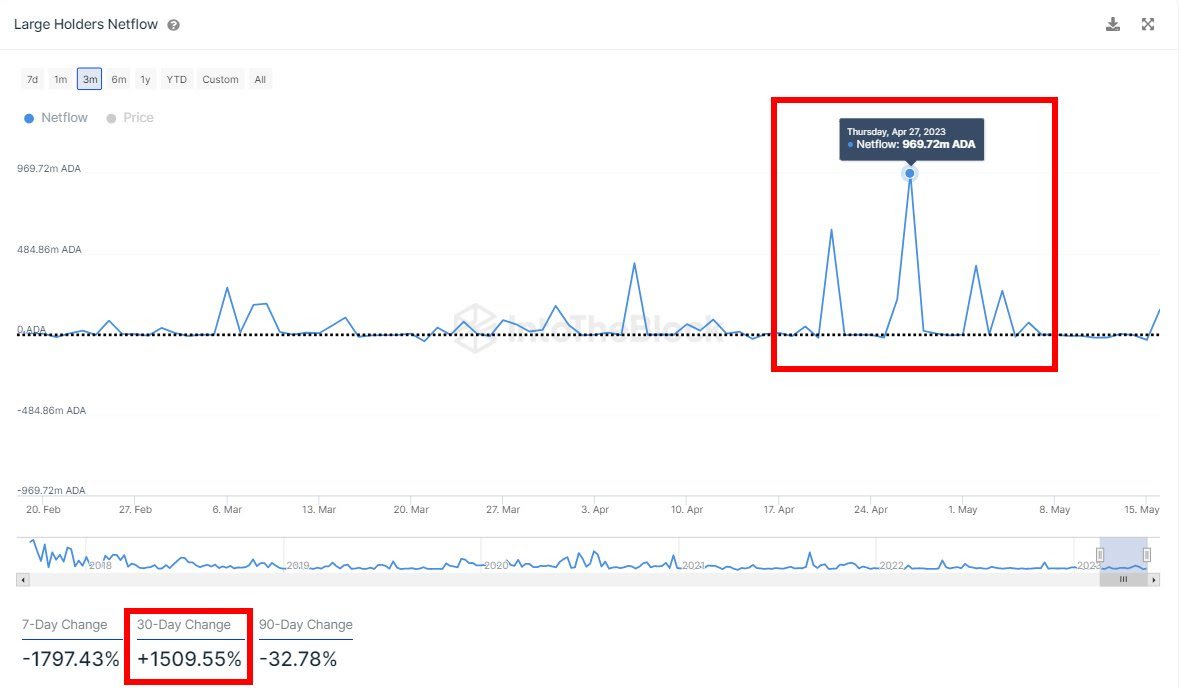

The chart shows daily net flows into large ADA holders since February.

-

In the past 30 days, net inflows have surged by 1,500%, indicating whale accumulation.

-

Blockchain data firm IntoTheBlock defines large holders as wallets holding at least 0.1% of the large market cap cryptocurrencies like Cardano’s ADA.

Edited by Stephen Alpher.