First Mover Americas: Bitcoin Continues in Holding Pattern Ahead of June U.S. Inflation Data

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

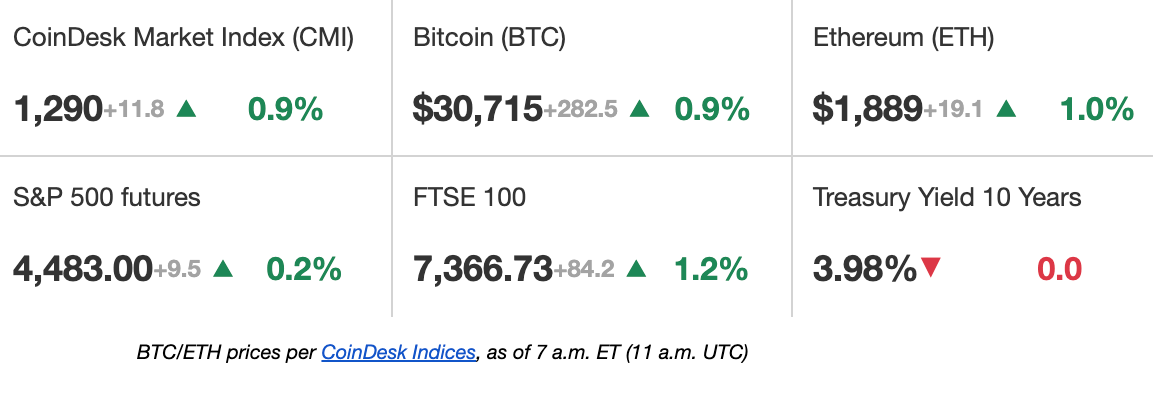

Bitcoin (BTC) is trading slightly higher on Wednesday ahead of the U.S. inflation report for June, up just shy of 1% at about $30,700. According to SEBA Bank, $29,500 and $31,500 are key levels to watch on the downside and upside for the cryptocurrency, and the team takes note of bitcoin’s twenty-day moving average as close to the psychologically significant $30,000 mark. “We may see a breakout of these key levels post today’s data,” said the bank in a morning note. Economists forcasts the headline year-on-year CPI is likely to have cooled to 3.1% in June from May’s 4.0%, with the core figure slowing to 5% from 5.3%. Altcoins also saw some gains early Wednesday, with AAVE adding just under 7% over the past 24 hours and bitcoin cash (BCH) up 4.5%.

Shares of Coinbase (COIN) jumped as much as 16% Tuesday after disclosure of a deal with Cboe’s BZX Exchange to maintain a surveillance-sharing agreement for five of its spot bitcoin exchange-traded fund (ETF) applications. The shares ultimately closed higher by just shy of 10%. The agreement was made on June 21 for each of these applications, amendments to original filings filed showed. The surveillance-sharing agreement, also referred to as SSA, has become an integral part of all ETF applications filed recently as the U.S. Securities and Exchange Commission (SEC) has stated for years that these arrangements are necessary to prevent market manipulation.

Cathie Wood’s ARK Invest sold $12 million worth of Coinbase’s shares on Tuesday as the stock surged higher following the above-mentioned surveillance-sharing agreement. The sales, however, were only a small fraction of the nearly 11 million shares owned across all of ARK’s funds, with COIN being a 6.2% holding for the fund management company. The estimated cost average for COIN across the various funds are, $239.60 for the Ark Fintech Innovation ETF (ARKF), $254.65 for Ark’s ARK Innovation ETF (ARKK), and $242 for ARK Next Generation Internet ETF (ARKW), according to market data. Though COIN is now ahead 165% for 2023, yesterday’s closing price of $89.15 remains far below those levels.

-

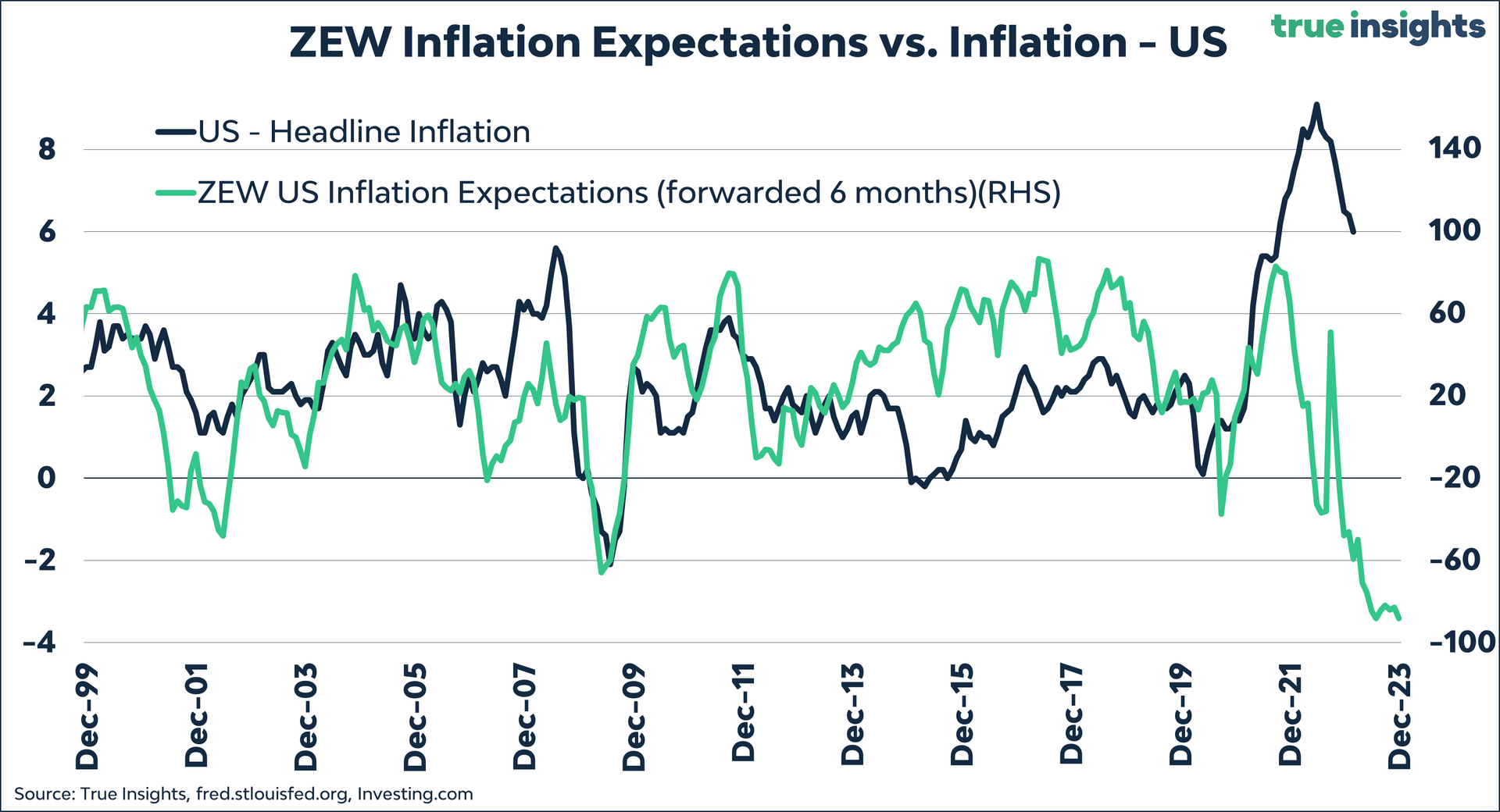

The chart shows the headline U.S. consumer price index (CPI) inflation rate has cooled over the past 12 months.

-

The decline is consistent with the forward-looking ZEW inflation expectations indicator, now pointing to deflation in the coming months.

-

For markets, the big question is whether the Federal Reserve will abandon its hawkish stance in response to dwindling inflation indicators.

Edited by Stephen Alpher.