First Mover Americas: Bitcoin Buckles the Day Before U.S. Jobs Report

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

Jenny Johnson

President and CEO

Franklin Templeton

Jenny will discuss developing crypto-linked investment products in a bear market, the mood among her clients and her lon…

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

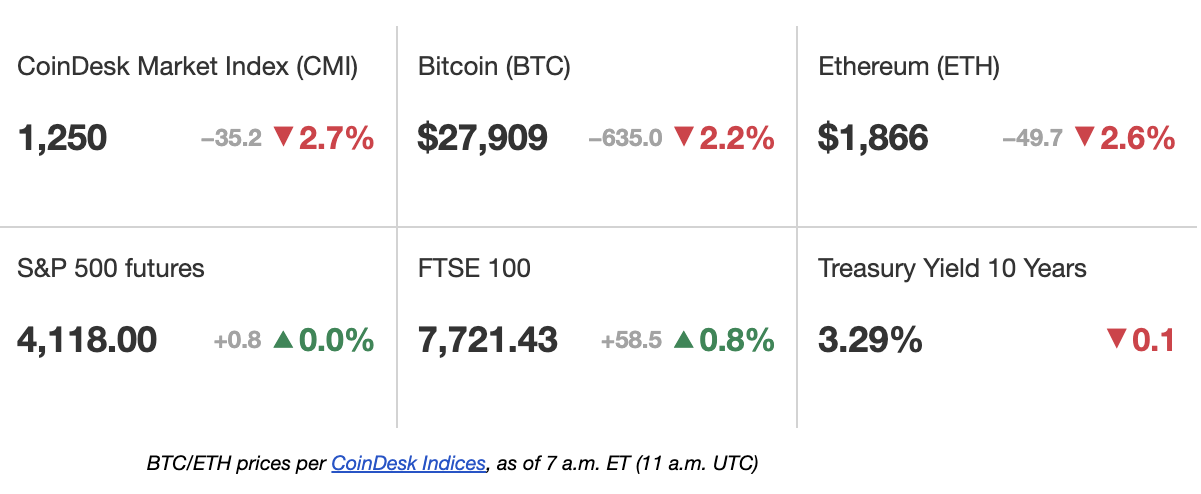

Bitcoin is showing signs of weakness ahead of a long Easter weekend in many countries and the release of the U.S. jobs report for March on Friday. The world’s largest cryptocurrency by market value dropped 2% in the past 24 hours to below $27,800, after reaching as high as $28,800 earlier this week. U.S. stock markets will be closed on Friday for Good Friday. Bitcoin, of course, always trades. It is estimated that U.S. employers added 238,000 jobs in March, with the unemployment rate set to hold steady at 3.6%, according to data from Trading Economics. Traders watch the report for signs of inflation, which affects the Federal Reserve’s interest-rate policy and in turn prices of risky assets like bitcoin. The dollar edged up slightly on Thursday, and the price of gold extended its gains.

The Australian Securities and Investments Commission has cancelled Binance Australia’s derivatives license, according to a press release on Thursday. Binance Australia, an arm of the world’s largest crypto exchange by trading volume, has been ordered by the regulator to close all of its customers’ open derivatives positions by April 21. ASIC has been reviewing of Binance’s businesses, the press release said. Binance found itself in hot water with regulators last week, when the U.S. Commodity Futures Trading Commission sued the exchange for selling unregistered derivatives products in the U.S.

Binance recently turned down an offer to acquire Tron blockchain founder Justin Sun’s ownership stake in rival exchange Huobi, according to a person familiar with the matter. Binance wasn’t interested because of rumors that Huobi has ties to mainland China, which the exchange wants nothing to do with, according to the person, who requested anonymity. In an interview last month with CoinDesk TV, Sun said Huobi wants to attain a license in Hong Kong and launch a new exchange there called Huobi Hong Kong. The scope of Sun’s involvement with Huobi has been cloaked in secrecy.

-

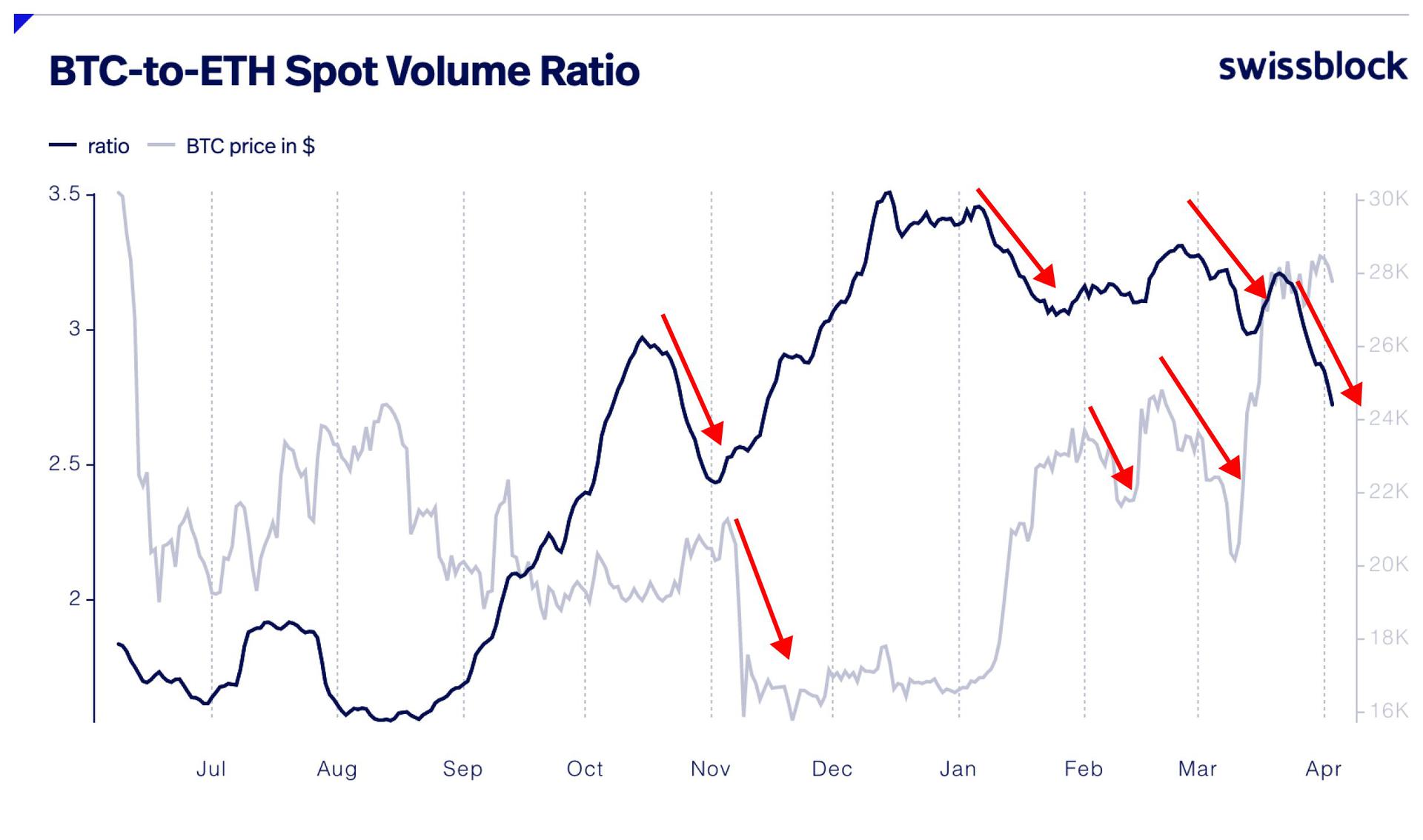

The chart shows the ratio between trading volumes in bitcoin and ether’s spot markets since June 2021.

-

The ratio has recently declined sharply, reaching its lowest point since late 2021.

-

Historically, such sharp declines have portended bitcoin price pullbacks.

Edited by Mark Nacinovich.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/www.coindesk.com/resizer/jX7WPvpd1pYeRAy6SoZTU_N_Zl0=/arc-photo-coindesk/arc2-prod/public/ISMDW3SATBA25J4ZU65XNCUANE.jpg)

Omkar Godbole was a senior reporter on CoinDesk’s Markets team.