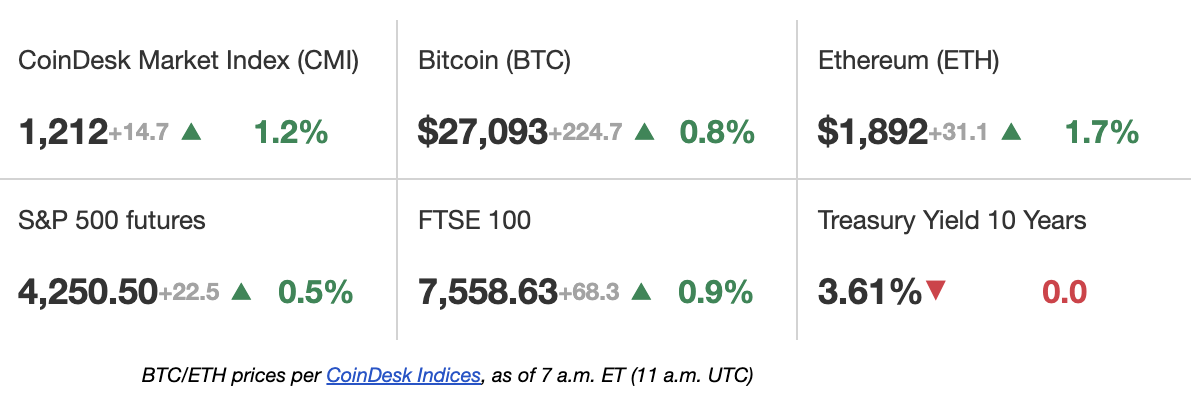

First Mover Americas: Bitcoin Bounces Back to $27K Ahead of Jobs Report

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Bitcoin climbed nearly 1% to back above $27,000 ahead of U.S. government’s Nonfarm Payrolls report set to release at 8:30 AM ET. The jobs report is expected to show that the economy added 180,000 jobs in May versus 253,000 in April. On Thursday, stocks continued to move higher as the debt ceiling drama mostly moved into the rearview mirror. Gold also inched upward, with some analysts predicting the jobs report might push the metal back above $2,000. As the week draws to a close, top performing digital assets include Quant Network (QNT), which gained 16% over the last seven days and The Graph (GRT), which gained 14% in the same period.

Coinbase Derivatives Exchange, the regulated futures offering by crypto exchange Coinbase, will offer bitcoin and ether tracked futures for institutional clients starting June 5, it said in a Thursday release. Coinbase said it created these products to cater to increased institutional demand following the issuance of its nano Bitcoin (BIT) and nano Ether (ETI) contracts last year. The BTI and ETI futures contracts, sized at 1 bitcoin and 10 ether per contract, respectively, will be settled in U.S. dollars monthly, and let institutional traders hedge market bets, express long-term market views or utilize the products in complex trading strategies.

Stablecoin issuer Tether’s USDT has hit an all-time high market capitalization even as the stablecoin market overall is shrinking. The market cap for USDT topped $83.2 billion on Thursday, the company reported, surpassing its previous peak from a little more than a year ago. The news means USDT has recovered all of the $18 billion it lost since the dramatic implosion of blockchain project Terra in May 2022 and subsequent market rout. Tether’s milestone is particularly significant as it runs counter to the 14-month shrinkage in the broader stablecoin market. The total stablecoin market capitalization dropped to $130 billion in May from nearly $200 billion in early 2022.

Edited by Stephen Alpher.