First Mover Americas: Bitcoin Approaches $63K Ahead of U.S. CPI Data

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/CDHNHFT5NRB2HESZAPRUR3RZRI.JPG)

Top Stories

Bitcoin made some cautious gains on Wednesday ahead of the latest inflation data from the U.S. BTC is priced at $62,775 at the time of writing, up 1.8% in 24 hours. The wider digital market, as measured by the CoinDesk 20 Index (CD20), also ticked up, adding 0.55%. April’s U.S. Consumer Price Index (CPI) inflation data is due at 08:30 ET, with expectations that it will show a 3.4% year-on-year increase, slower than March’s 3.5%. Some analysts expect a softer-than-expected CPI reading could lift bitcoin above $65,000.

Bitcoin’s mean transaction fee has reversed the post-halving spike, squeezing miners’ revenue. Miners earn revenue from two sources: block rewards and transaction fees. Miners receive a fixed amount of BTC as a reward for adding new blocks, along with transaction fees for including transactions in the blocks they mine. The spike, driven by the new Runes protocol, helped to compensate for the block reward being cut in half, but this proved to be short-lived. In response, miners may liquidate around $5 billion worth of BTC in the coming months, according to Markus Thielen, head of 10x Research. “Why would they keep inventory when the price is not going up?” Thielen said.

Broker Canaccord Genuity expects Galaxy Digital’s positive momentum to continue after the crypto financial services firm reported an increase in net income of 40% on Tuesday. Galaxy saw an increase in the number of trading counterparties with trading revenue rising 79%, Canaccord noted in a report, citing the approval of spot bitcoin ETFs in the U.S. as the major catalyst. Mike Novogratz’s firm also increased its proprietary mining hashrate and the Helios facility “presents an opportunity for Galaxy to pursue both mining and AI hosting over time,” the broker said. Galaxy’s Toronto-listed shares fell 1.12% on Tuesday to close at C$12.41.

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/UD4ILCNYKVGLNG2ZFMS3RUUMUE.jpeg)

-

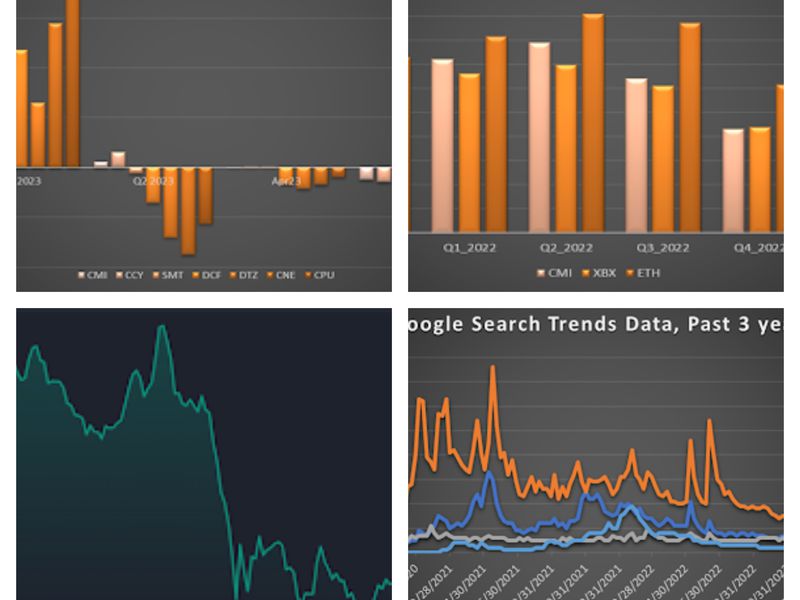

The chart shows that a record 55% of respondents in Bank of America’s latest survey of global fund managers with $562 billion in assets under management see global fiscal policy as “too stimulative.”

-

The increased government spending, though positive for risk assets, including cryptocurrencies, could eventually add to inflationary pressures.

-

Over 40% of fund managers see inflation as the top-tail risk.

-

Source: Bank of America

Trending Posts

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.