First Mover Americas: Binance Withdraws an Abu Dhabi License Application

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/YD7CXPPEQFH7JMKNPMOBKXDEEY.png)

Top Stories

Cryptocurrency exchange Binance withdrew its bid for an investment-management license in Abu Dhabi, deeming it unnecessary to the company’s “global needs.” The exchange still has an application to offer custody of digital assets to professional clients. “When assessing our global licensing needs, we decided this application was not necessary,” a Binance spokesperson said in an emailed statement. Binance is licensed in Dubai, and that is the company’s Middle East and North Africa headquarters, CEO Richard Teng said in an interview for a Financial Times conference on Tuesday. The decision is unrelated to the exchange’s legal settlement in the U.S., where it agreed to pay a $4.3 billion fine for violating anti-money laundering and money transmitter rules.

El Salvador is targeting bitcoin (BTC) and crypto millionaires in its latest push to attract long-term residents to the country. The nation kickstarted its “Freedom VISA” program on Thursday, doling out residency to a maximum of 1,000 people per year who invest at least $1 million worth of bitcoin or tether (USDT) stablecoins. Eligible participants receive a long-term residency permit and have a path to full citizenship. An application costs a non-refundable $999 in BTC or USDT, and the process is live as of Friday.

Popular U.S.-based brokerage platform Robinhood (HOOD) on Thursday started letting customers in the European Union (EU) trade crypto, hailing the region’s comprehensive digital asset rules. To spur customers to use the service, Robinhood will credit a percentage of their trading volume back every month, paid in bitcoin (BTC), according to a Thursday blog post. And users can earn more BTC for referring new customers. This expansion debuts as cryptocurrencies have been rallying after a brutal bear market, recovering to a $1.5 trillion total market capitalization, the highest level since May 2022. Rising trading volumes also mean more revenue for trading platforms.

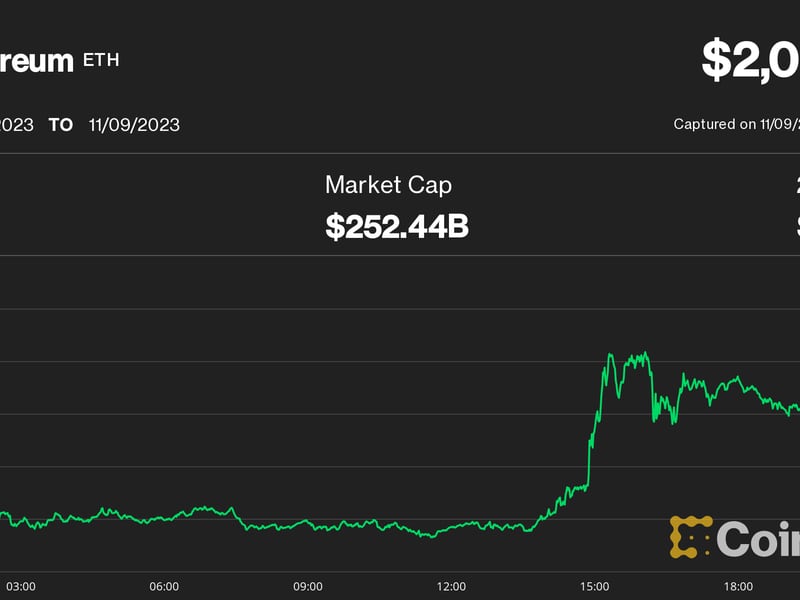

Chart of the Day

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/NZPEJBUATZFI5IQH2XPNXY7BSY.png)

-

The chart shows LINK’s funding rate or cost of holding tether or USD-margined long (buy)/short (sell) positions in the perpetual futures market.

-

The funding rate has surged to its highest since at least June, indicating a bias for long positions. The token has more than doubled to $16.3 since mid-October.

-

Deeply negative or positive funding rates often act as a precursor to trend reversals.

-

Source CoinGlass

Trending Posts

Edited by Sheldon Reback.