First Mover Americas: Binance.US Suspends Dollar Deposits

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Binance.US says it’s temporarily transitioning to an all-crypto exchange as of June 13, citing pressures from the U.S. Securities and Exchange Commission (SEC), which targeted the company with a major enforcement action this week. In a tweet, the U.S. arm of Binance said USD and deposits will be suspended as of June 9, and USD-based trading pairs will be de-listed shortly after. Trading, staking and deposits and withdrawals in crypto will remain fully operational.

Cryptocurrency custody firm BitGo has reached a preliminary agreement to buy Prime Trust, another crypto custody specialist regulated in the state of Nevada. In a blog post, BitGo confirmed an earlier story from CoinDesk that a tentative deal had been agreed upon. In a statement, Prime Trust Interim CEO Jor Law called the move “a significant enhancement for the industry.” BitGo President Mike Belshe described the deal as a “landmark transaction … With the expected acquisition of Prime Trust, BitGo is well positioned to enhance its best-in-class, trusted solutions and to service the combined customer base.”

Coinbase (COIN) shares are “uninvestable” in the near term, investment bank Berenberg said in a research report Thursday. The company was already expected to report weak second-quarter 2023 trading volumes before the SEC filed a lawsuit against it on Tuesday, said analyst Mark Palmer. This weakness may now persist and intensify thanks to the overhang from the SEC action, he added. “The upshot is that we view COIN shares as uninvestable in the near term.” Palmer maintained his hold rating on the stock, but slashed his price target to $39 from $55, suggesting nearly 30% downside from last night’s close of $54.90.

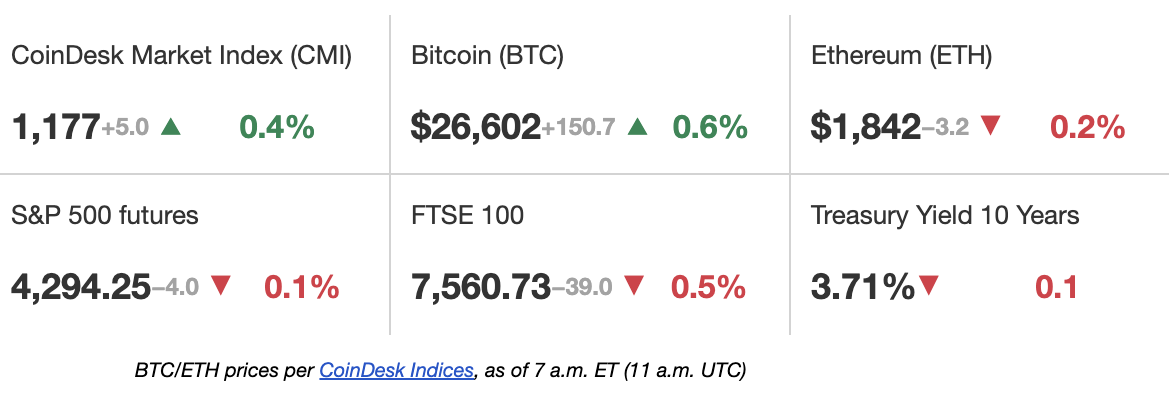

-

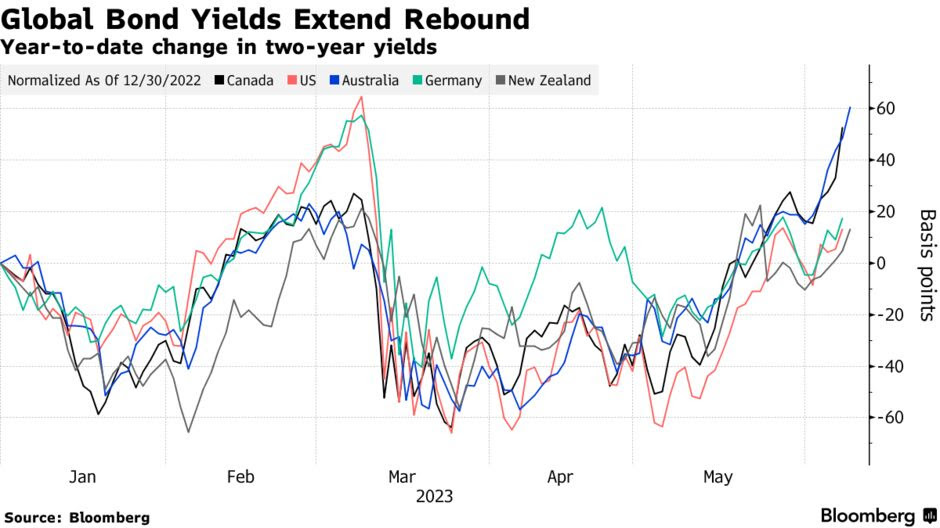

The chart shows year-to-date gains in the two-year government bond yields across the advanced world.

-

Yields have bounced back sharply from lows reached in April/May, denting the appeal of risk assets, including cryptocurrencies.

Edited by Stephen Alpher.