First Mover Americas: Axie Infinity Rallies After Apple App Store Debut

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Blockchain-based play-to-earn project Axie Infinity’s native cryptocurrency AXS rallied after the company’s card-based strategy game debuted on the Apple app store. AXS surged over 12% from $7.16 to $8.04 on the news, becoming the top gainer on CoinDesk Indices’ leaderboard. The game will initially launch in the Apple store across Latin America and Asia. Bitcoin traded down on Wednesday, struggling to hold the $27,000 mark as investors keep a close eye on developments around raising of the debt ceiling in the U.S. The world’s largest cryptocurrency by market value has lost 9% over the past month.

Crypto companies fleeing U.S. regulatory uncertainty have been offered a welcome in France, by officials boasting a regulatory framework that offers relative predictability. The European Union member already boasts around 74 registered crypto companies. “In France, we are proud to be pioneers,” said Benoît de Juvigny, Secretary General of the Autorité des marchés financiers (AMF), noting his country’s crypto service asset provider regime – known as PSAN – was passed in 2019, “If American players want to benefit, in the very short term, from the French regime, and from the start of 2025 from European arrangements, clearly they are welcome,” he added. “We have good relations and discussions with our U.S. counterparts.”

Using distributed ledger technology (DLT) in securities markets could create savings north of $100 billion per year, a report produced by a major traditional-finance lobby group has said. In a paper published Tuesday evening, the Global Financial Markets Association (GFMA) called for regulators to allow the technology that underpins crypto to aid collateral management, asset tokenization and sovereign bond markets.“ Distributed ledger technology holds promise for driving growth and innovation,” said Adam Farkas, Chief Executive of GFMA, whose affiliates in the U.S., Europe and Asia count major players such as JPMorgan Chase, HSBC and Nomura among their members.

-

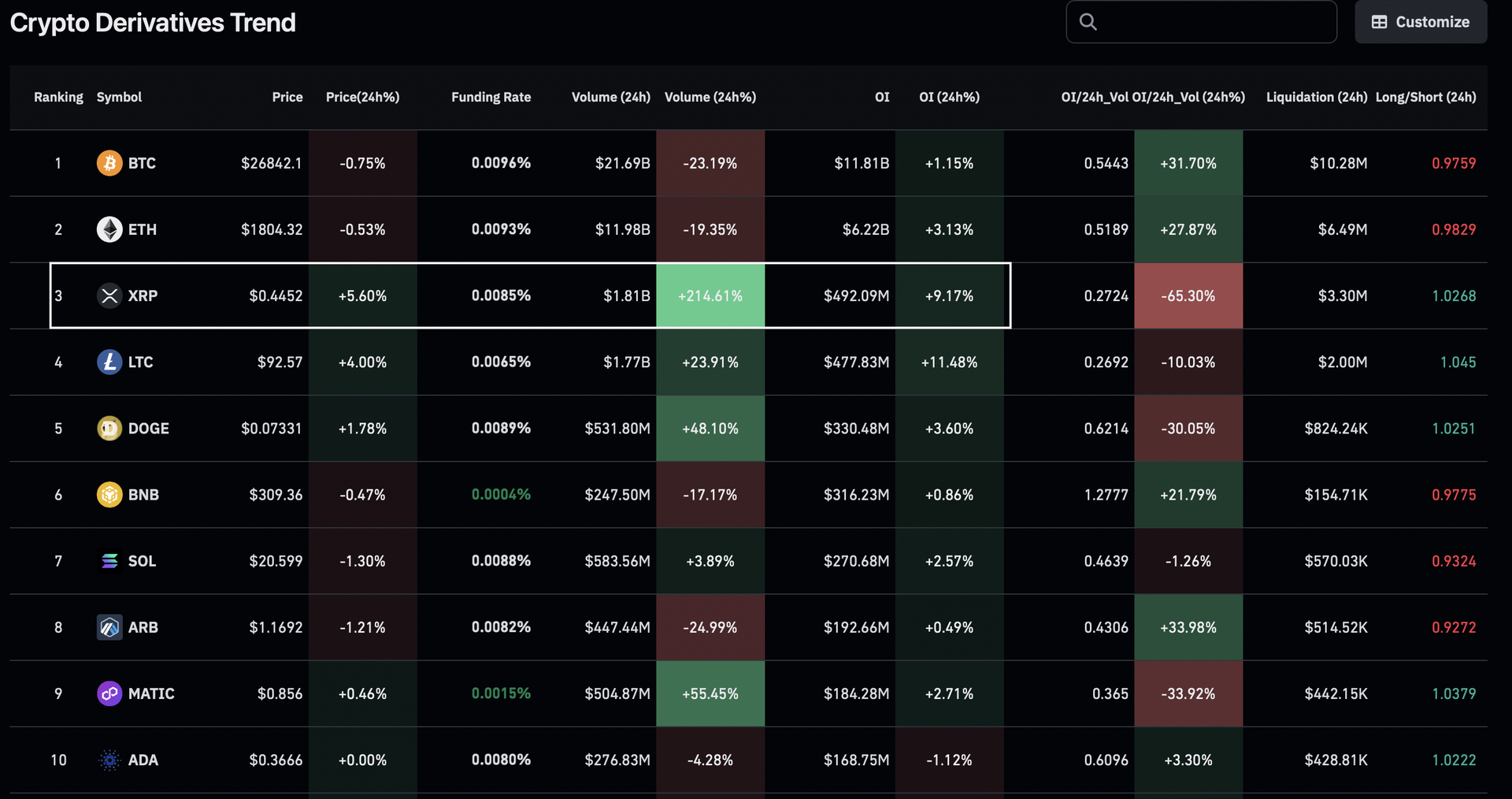

The chart shows the 24-hour change in volume and open interest in futures tied to the top 10 cryptocurrencies.

-

Payments-focused XRP has been the most active cryptocurrency of the past 24 hours, with volume growth of over 200%. The notional open interest, or the dollar value locked in open futures contracts, has increased by 9%, signaling an influx of new money into the market.

-

An uptick in volumes and open interest often brings increased price volatility.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/31d39a34-26a1-4e78-a5da-d5cf54a9d695.png)

Omkar Godbole is a Co-Managing Editor on CoinDesk’s Markets team.