Announced Thursday, Fireblocks is partnering with staking infrastructure providers Staked and Blockdaemon to offer hosted proof-of-stake (PoS) services for Ethereum 2.0 and the popular Polkadot (DOT) and Tezos (XTZ) tokens.

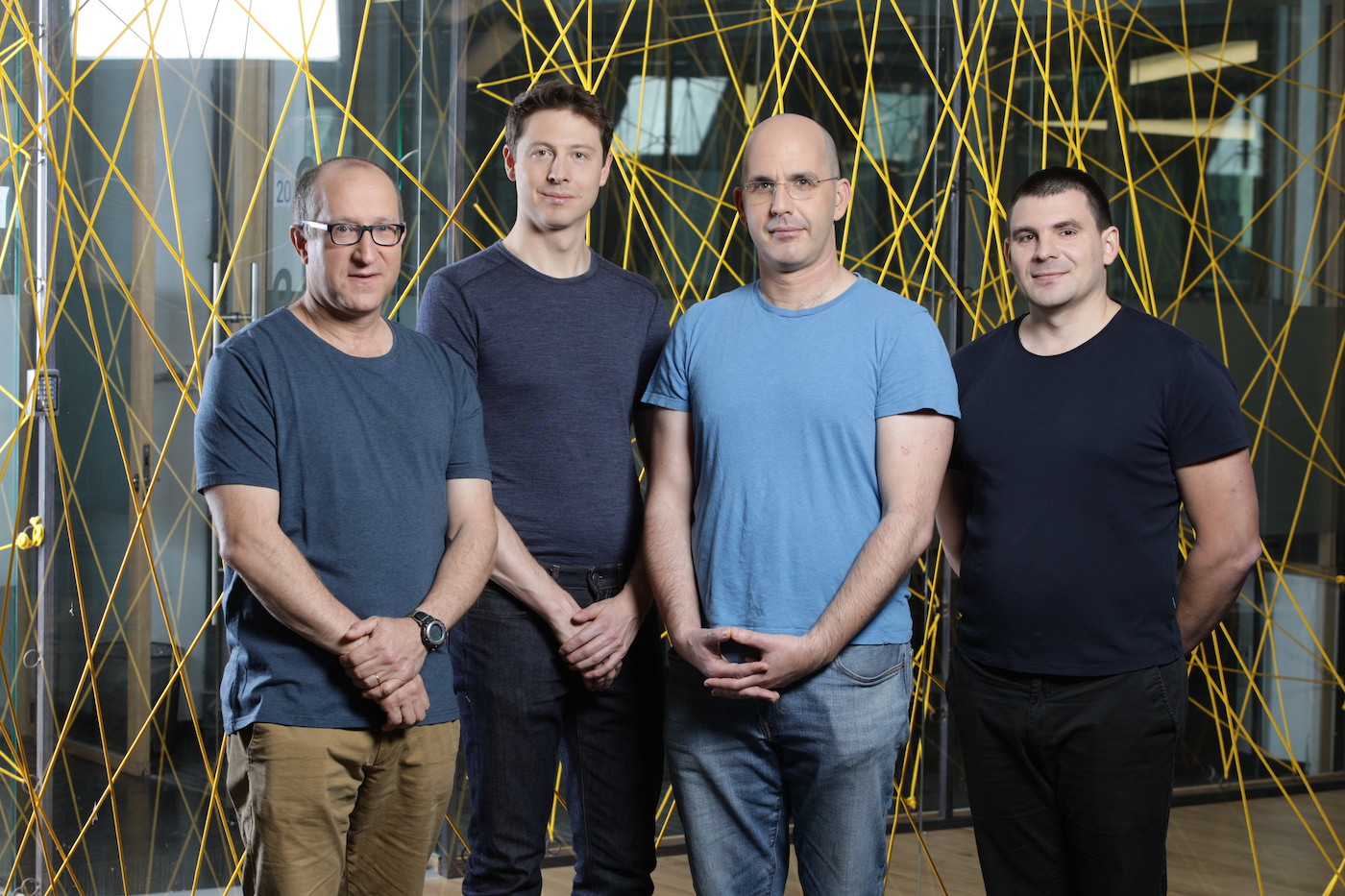

Fireblocks, which raised $30 million in funding in November last year, uses a technique called multi-party computation (MPC) that protects cryptographic keys by splitting them into pieces, and which the company says is well suited to the dynamic business of blockchain token staking.

“We are launching staking wallets to Fireblocks customers who collectively hold a significant balance of crypto assets,” Fireblocks CEO Michael Shaulov said in an interview. He said that while the majority of Fireblocks clients have bitcoin, “between DOT, XTZ and ETH we have over $1 billion of assets that are stakeable.”

The custodian’s clients include some of the large crypto lenders like Celsius, BlockFi, Salt and Nexo. Fireblocks also provides custody to U.K.-based firms like Revolut and B2C2, as well as Coinflex, Galaxy and a lot of smaller crypto hedge funds, Shaulov said.

By participating in blockchain staking, token holders are required to have skin in the game by committing some of their assets on the network to verify transactions. Network validators can earn between 10%-15% yield on those assets, a tempting proposition for financial institutions in the current no-interest climate.

More broadly, participants are betting on the next generation of finance; backing a given economic system is analogous, in some respects, to the way banks are required to post capital reserves in the traditional financial world today.

Generating and managing various sets of validation and withdrawal keys is not for the layman, but the biggest pain about staking is maintaining constantly available infrastructure to verify transactions. Failure to do so results in a slashing of the validator’s stake.

“For our clients, from an operational or technical standpoint, it’s actually transparent,” said Shaulov. “They don’t need to do anything special. When they sign the delegation message, we select the infrastructure and switch into the optimized nodes.”

In return for maintaining the service, Fireblocks takes a 10% slice of the yield the staker earns.

Shaulov sees the new service as a way of inviting retail investors to get more involved in staking. Celsius and others are retail gateways, he pointed out. “Our customers that are retail-facing are planning to basically act as a gateway and roll out Eth 2 staking to generate the market for retail investors that are long on ETH,” Shaulov said.

Such an invitation to retail involvement could be a step towards a fintech app approach to crypto staking. So, is this a conversation Fireblocks is having with customers like Revolut, for instance, which allows users to buy and hold crypto?

“I think they [Revolut] have a roadmap of things set out ahead that are perhaps less advanced, but they are interested in looking at it,” Shaulov said. “Part of the reason we are releasing it is because of how compelling it is to fintech companies like Revolurt and others.”