Finding Signal In A Noisy World

In a new and developing space, there is bound to be a lot of noise.

A version of this article was originally published here.

In any new and developing space, there is bound to be a lot of noise. New solutions both compete for a new market against existing monopolies — which currently own the market, and against other technologies trying to displace them.

Hard To Understand

This is especially true in those breakthrough innovations/discoveries that change our world and force us to use a new lens to understand it. Prior biases make us less likely to investigate the new innovations on a first principles basis. Data is a legacy of our existing models — not these new ones. New ones need to be intuited to predict what will happen instead of forecasted using historical data. We simplify the models in our brains to save time and as a result, most people fall into the trap of predicting their future behavior by looking back at their past.

It is the same reason that when using a Blackberry phone when the iPhone was released, we couldn’t predict how our minds would change — and our minds changing because of new value created, would change an industry. We move instantly when given something of greater value, and it’s impossible to predict that move before we’ve “seen” it.

It is the same reason why Kodak was destroyed by the very digital camera that Kodak created, and Blockbuster failed to see the threat of Netflix until it was too late.

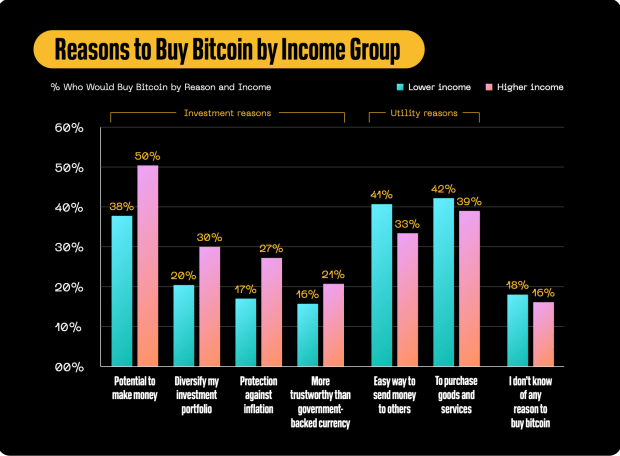

And it is the same reason why all monopolies fail when misunderstanding the value creation delivered to society by a new technology. Technology adoption is most often bottom up versus top down. Why? Simply because the people furthest away from monopoly power have the most to gain, and the people closest to the monopoly have the most to lose.

Add to this that there are always far larger numbers of people farther away from the monopoly than close to it, and it becomes easy to see how fast something that creates more value for those people can take hold and get stronger — rendering a monopoly impotent in fighting it.

Note: This framework is important to consider regardless of whether the monopoly is within an industry, or whether it applies to money itself.

Harder To Understand

It is even harder to understand general purpose technologies like artificial intelligence that affect all industries or predict their rate of progress. Because these general purpose technologies apply to most value creation over time, we can easily underestimate the corresponding impact on every business and, in turn, our lives. For example, pretending that a narrow or general artificial intelligence won’t negatively impact our job one day is something we want to believe, which ensures narratives that support that line of thinking are popular — even if untrue.

Hardest To Understand

But the innovations that are hardest of all to understand are open, decentralized, protocol-level technologies. These protocols create value in the form of a new foundation that emerges slowly and methodically. Protocols are built in layers, which means we can’t generally see what is possible on the next layer until it is already built. The base layer technology protocol (Layer 1) that allowed computers to be networked together is called the transmission control protocol, and the internet protocol (TCP-IP) and was developed by the Defense Advanced Research Projects Agency (DARPA) in the late 1960s. It wasn’t until 1989 that Tim Berners-Lee invented the hypertext transfer protocol (HTTP) on Layer 4, which would link those computers and webpages and would form the world wide web.

Which is why if you tried to explain the TCP-IP open protocol layer that allowed previously isolated computers to talk to each other or even HTTP to someone in the early 1990s, or tried to tell them that one day that same technology (largely unchanged) would give rise to the iPhone, Google, Zoom, Amazon, and everything else we take for granted today, their eyes would roll over in disbelief.

We experience value through products and services that give us value instead of trying to understand the intricate details of the plumbing that gives rise to those products and services.

I am going to attempt to use a framework for considering how this applies to Bitcoin, and the predictable rise of altcoins, decentralized finance (DeFi) Web3, Metaverse and the entire blockchain space.

But before we go there, we must start at a higher level because the higher-level abstraction effects and amplifies everything else.

We must start at money. We must start there for the same reason stated above.

Namely:

- We experience value through products and services that give us value, instead of trying to understand the intricate details of the plumbing that gives rise to those products and services, and

- Money is the foundation layer that gives rise to everything else.

Therefore, when money breaks down, standing your ground when the ground gives way will provide little in the way of safety.

Money Is Just Information

This might be hard to see because it is important information, but we don’t desire more pieces of paper (or the digital units it represents). We desire the feeling we get from having those pieces of paper and what it can buy us. Regardless of whether that “buy” is a feeling of safety, a legacy in the form of giving to your children, a vacation, status, a home or freedom. Money is just the information (a ledger) that allows us to measure what we have, and what it will take (in our own minds) to achieve our desired result. Fear, greed and the human desire to want more comes on top of that ledger and comparison to other people.

It makes logical sense then, that one, if money is just information and two, money is being manipulated by central banks at an unprecedented rate to avoid a credit collapse of the system, then misinformation must be growing throughout the system. (A second order derivative of that misinformation is that trust must be declining throughout the system.)

But that is the unfortunate system we live in, and it has vastly negative consequences. Because we measure a system from within the system, for most of the population, it would make the truth virtually impossible to see. Similarly, every company, organization and political party are made up of similar people measuring the system from the system, while every member of our society writ large each believes that they can see through this misinformation better than others.

(Caveat emptor: Although I do my personal best to go deeper on issues to understand both sides and where I might be wrong, this includes me, and the words on this page.)

By consequence, it is completely logical to see conspiracy theories, confusion, polarization, in-group, out-group bias and social chaos reign.

That misinformation in the form of money wouldn’t just create polarization. Because money connects value between people and nations, it would drive a tremendous misallocation of capital and resources as individual actors in the system all made the system worse with their actions to make enough money to escape the system. Chasing ever higher returns, it wouldn’t only be the general public. Even pension plans, which need certain growth returns to stay solvent to pay liabilities in the form of retirement benefits would search for higher “real” returns — all of them, and us too, searching for ways to solve a growth problem to escape the very system creating the problem.

In a world that looked like this, it would be easy to fall into a trap of pyramid and get-rich-quick schemes to escape. In fact, the very structure of manipulating money (information) and corresponding incentive structure would ensure a market grew to abuse it — both in crypto and the overall market. Everyone measuring and trying to create value from this system would unknowingly contribute to greater insecurity. No one would be exempt. All, searching for a higher return to escape the existing debasement of currencies, crowded into markets that in turn, hurt others.

With this one, misinformation as a backdrop, and two, a new protocol layer technology emerging, (remember that open protocols provide the most value to society and are the hardest to understand) it would be extraordinarily difficult to see why Bitcoin alone stands out as a breakthrough technology and where it is heading. By extension, it would be relatively easy in this environment for ill-informed or bad actors to conflate Bitcoin with crypto, Web3, DeFi, blockchains, Metaverse and other naming conventions to gain an advantage for their offering. A public market that one, believed these were similar and watching a meteoritic rise in Bitcoin over the last 13 years (while they were concurrently losing purchasing power in their own currencies) and two, lacked the time to do deep research, would be easy targets for copycats, fraudsters and even well-intentioned actors who might be misinformed, promoting the next big thing.

This would act to amplify the cycles of highs and lows in Bitcoin and obfuscate its true nature. Firstly, by bringing more leverage, hypothecation and rehypothecation into the overall space by leveraging bitcoin (which has no counterparty risk) as a pristine bearer asset and amplifying the price of bitcoin on the way up. And secondly, as each of the altcoins and DeFii schemes tied to them, then fell due to that same leverage, creating “bank runs” that would amplify bitcoin’s fall in price (in USD terms) as the pristine bearer asset (BTC) was sold into a failing market to cover losses.

As the vastly bigger market of money broke down, (the world balance sheet is approximately four orders of magnitude larger than bitcoin market cap today) and the Federal Reserve and other central banks eased or tightened in fiat terms, it would only amplify the entire process described here and create additional confusion.

With that as a backdrop, I will provide a simple framework to explain why Bitcoin is without equal in its design so others can use that framework to decide for themselves. My hope is that by understanding the necessary trade offs required in the design of any blockchain, a general public, and/or policy makers can more accurately understand the trade offs and see the signal through the noise. In doing so, I’ll also show why the rise of competing blockchains and altcoins are predictable, the advantages and disadvantages of them and why, in my opinion, each will fail in the end.

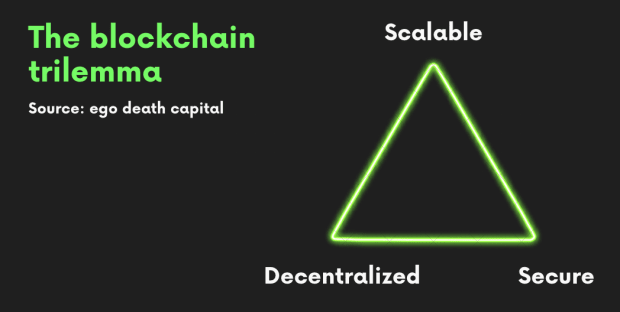

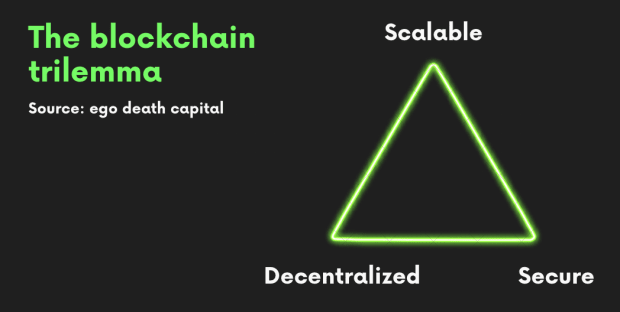

Decentralization, Security, Scalability

Bitcoin (on Layer 1) solved decentralization and security. Never in history has society had decentralization and security together. Thirteen years after its discovery/invention by the pseudonymous Satoshi Nakamoto and no matter the amount of nation state, economic challenge, or fear, uncertainty and doubt (FUD) thrown at it, it remains decentralized and completely secure. This is a bigger deal than it seems at first glance. Because society throughout time could never rely on decentralization and security together, it needed to rely on trust in institutions and the rule of law (to keep those institutions in check) for protection, the Magna Carta, Declaration Of Independence and many other such frameworks over time enshrining rights to citizens from unchecked power over them by their rulers. The problem is that over a longer time horizon, money surpasses laws, so laws alone cannot solve trust. Laws change over time ensuring those with access to money either re-write the laws or prevail in court. A reflection of the world we live in shows this unfortunate truth, i.e., where money is most broken, rule of law breaks down!

The rule of law doesn’t protect citizens from the manipulation of money. It protects those closest to the manipulation.

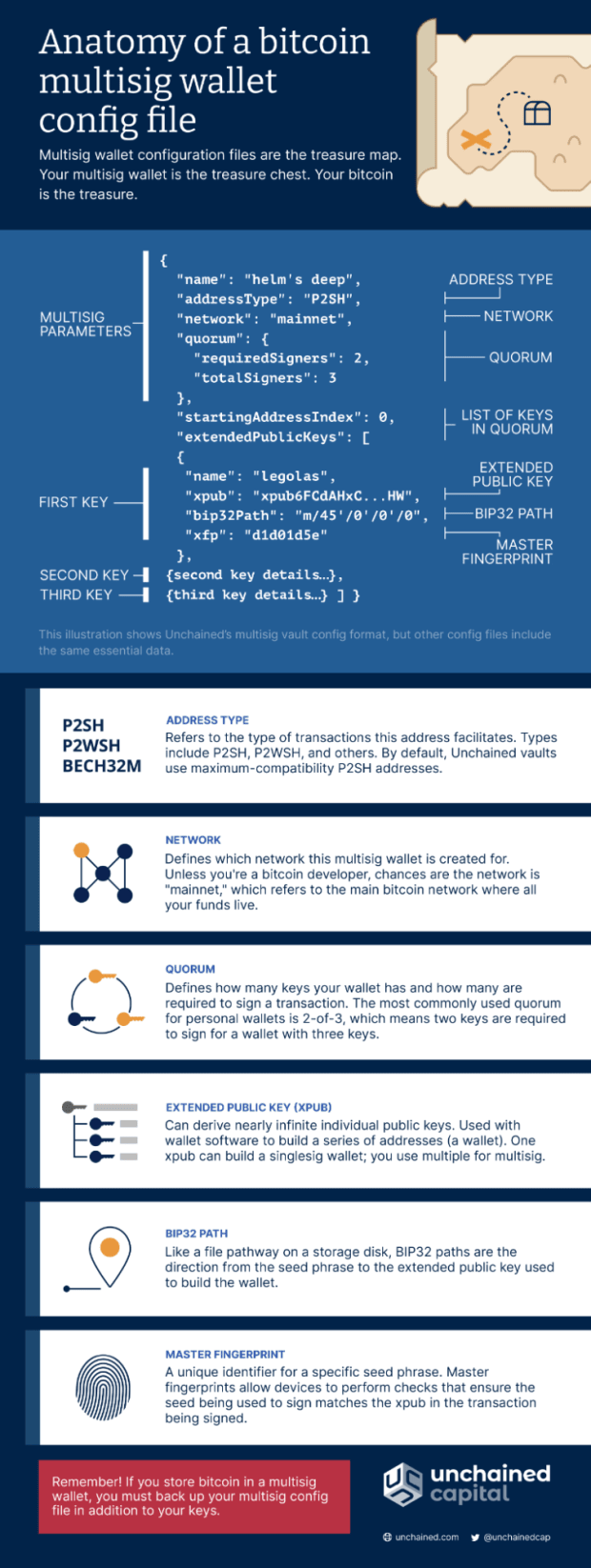

Bitcoin remains decentralized and secure because of its design. Two critical design elements led to this outcome: One, a limited block size and two, using energy to secure the network through proof of work. (Additional elements of design connected to these two design elements remain critical to the security and decentralization of the network. For the reader who wants to go deeper, these will be explored later in this post with links to some great thought leaders and content.) It is important to remember, Bitcoin is open source which means it is open to everyone (to audit or use freely), controlled by no one and freely available for anyone to change through a fork to try to design in a different way that creates more value for users.

By designing in such a way, Bitcoin over the last 13 years became an excellent store of value, but also remained largely unviable to be used as a currency or broader technology stack due to its lack of transaction speed at five to seven transactions per second (on the first layer). The transaction speed wasn’t the only limitation. By keeping block size small to ensure continued decentralization, Bitcoin left an opening for competing blockchains/altcoins to do more on Layer 1. Venture capital, entrepreneurs and developers raced into this ecosystem because one, inventing a new coin that could compete with bitcoin would achieve massive short-term profits for its founders and venture capital backers, and two, with a larger block size and more permissive blockchain, more could be done. These competing blockchains would give rise to smart contracts, non-fungible tokens (NFTs) and “decentralized” finance.

It would be easy to show Bitcoin as old technology, instead of a protocol layer to an audience looking for scalability and other use cases. That same choice though, either transaction speed or providing more capability through smart contracts on Layer 1, required those blockchains to sacrifice either decentralization or security, to achieve their objectives.

You will see from a long history of competing blockchains that they all either become centralized (through a council or small number of people/nodes who make decisions for everyone) or become vulnerable to hacks/outages as they scale.

Bitcoin stands alone in decentralization and security.

Why? Because there is simply no way around the two-of-three choice for a blockchain on Layer 1.

The logical conclusion though, is that if one sacrifices security for scalability, the blockchain fails because it’s insecure, or If one sacrifices decentralization for scalability, a blockchain must eventually become useless for economic reasons. And while you may argue that point of view from an ecosystem that seems to provide value for a window of time, the economic trade offs of running a blockchain that is centralized ensure it can’t work in the long term. Stated simply, if centralization is a requirement of the design, a database is a much less costly solution — in terms of economics and energy usage. That economic reason alone negates any long-term benefit (apart from initial holders of tokens) of a centralized blockchain for the participants of the system because someone needs to pay for it.

Which ensures that all projects built on top of these alternative blockchains (Web3, Metaverse, NFTs, etc.) regardless of the intent of the founders of these projects, must suffer the same fate as the underlying blockchain.

Building on top of quicksand is not a good long-term strategy.

Some quick questions to bring clarity:

- How could decentralized finance occur on a centrally-controlled blockchain?

- How would Web3’s promise be any different than today’s monopoly power in technology if it was built on a base layer that was more costly, and controlled by very few?

- What is the long-term value of a digital copy (NFT) of something connected to a blockchain that fails?

- If a lower cost (through Layers 2 and 3) and decentralized alternative existed that enabled gaming and virtual reality companies to control their own destiny rather than risk their future on a centrally-controlled blockchain, what would these entrepreneurs choose? Wouldn’t it be more likely that this new protocol, instead of a centrally-controlled one, forms the foundation of the “metaverse”?

All the while, entrepreneurs building to those blockchains, the general public and regulators

may be unaware of the long-term nature of the vulnerability. Worse still, capital, and large holders of the various altcoins schemes could become willing or unwilling participants in a perverse incentive scheme where they get rich or get out just in time, at the unknowing public’s expense. Charlie Munger’s famous quote “show me an incentive and I will show you the outcome” applies well here. If invested capital (by venture capitalists) and time (by an entrepreneur or team) has gone into designing one of these blockchains or building a company on top of one, human nature tells us that it is much easier to obfuscate the truth to sell to a higher bidder before it collapses than to admit a wrong strategy.

As always, follow the money.

The line becomes particularly skewed by exchanges who offer these coins to an unknowing public. By offering a multitude of securities (altcoins, 20,000 and counting) that all eventually suffer a similar fate, they create enormous wealth at society’s expense, making transaction fees on the way in and out, every time someone trades any one of these 20,000-plus coins. It’s a very low-risk business enabled by a highly susceptible public. That same wealth is then used to advocate/lobby governments for favorable policies to allow them to operate. Seeing opportunities for investment and jobs from the largest exchanges, while believing that bitcoin and altcoins are similar in nature, ensures policy makers are easily swayed. Much of this adds to the public and media being completely misinformed about Bitcoin and proof of work.

Why? Because conflating Bitcoin, blockchains and altcoins is key to operating profits.

A Deeper Dive On The Three Sides Of The Pyramid

1. Security

Through proof of work, Bitcoin offers miners a way to compete to solve cryptographic hash puzzles to verify new transactions on the blockchain. Miners purchase the latest hardware, to compete for Bitcoin in the form of block rewards. The reward follows a halving schedule where the reward for solving the hash puzzle is programmatically reduced every 210,000 blocks. Starting in 2009 at 50 bitcoin per verified new transaction on the blockchain (approximately once every 10 minutes) to 25 bitcoin in 2013, to 12.5 in 2016, to 6.25 BTC today, and to be reduced by half every 210,000 blocks until the year 2140. In the natural competition that arises in the free market with other economic actors trying to “win” bitcoin, an incentive is created where miners win bitcoin by securing the network. Because the primary costs of mining are one, the hardware (required to solve the cryptographic hash puzzles) and two, the intensive energy costs to run the hardware, miners are incentivized through competition to gain advantage over other miners which adds hash rate to the network (hash rate is the total computational power securing the network).

Nakamoto developed a novel way to protect the network and take advantage of game theory as the network ebbed and flowed with the latest hardware improvements allowing faster computing, and new nodes being added or removed from the network. Called the difficulty adjustment, the network automatically adjusts the difficulty every 2,016 blocks, based on the time it took to mine the last 2,016 blocks, to keep the average time for finding the next block at 10 minutes. This takes advantage of greed and fear in a free market of economic actors working in their own best interests for gain, to constantly balance and protect the network. As more compute power is added to the network, the difficulty adjustment automatically makes it harder to find the next 2,016 blocks and conversely, as compute power is removed, the difficulty automatically adjusts to make it easier to find the next 2,016 blocks. This process creates more and less profitable mining operations which take advantage of the free market. For example, when China instituted a ban on all bitcoin mining in May 2021, Bitcoin hash rate fell over a two-month period from approximately 185 million terahashes per second to 58 million terahashes per second. Every two weeks, the difficulty adjusted downwards to keep the average block time at 10 minutes. With fewer miners competing for rewards, and a glut of newly-available mining equipment hitting the market, creating downwards pricing pressure on the equipment, mining became much more profitable. In turn, many U.S. companies rushed in to fill the void (and the economic opportunity) that China created. A “gold rush” for mining ensued. As more economic actors rushed in to take advantage of easy profits, and the difficulty adjustment clocked higher, profits rationalized once again.

And so, regardless of a nation state attack, or a boom bust cycle driven by greed and fear, the

network, globally, is always protected through the difficulty adjustment in creating a natural incentive to win a larger share of an economic prize. As more market entrances race in to take advantage of the higher profit opportunity created by an easier difficulty rate, they add additional security to the network — in turn taking the difficulty rate higher and their profits lower. (Bitcoin hash rate is currently 212 million terahashes)

Additionally, the process of paying for additional equipment which is then obsoleted over time as new equipment becomes superior, is costly. This has the effect of supporting new entrants/ideas in the market. In other words, its very nature reduces the monopolistic tendencies of a market to consolidate around a few large miners and price others out.

The boom and bust cycles of bitcoin mining should be looked at as the free market competition for an advantage in a perfectly transparent market with each rational actor, in their own minds trying to find an advantage (which leads to energy innovation, see below). All the while, securing the network as a byproduct of this natural competition.

Energy (As A Part Of Security)

While many people falsely believe that Bitcoin and the way it uses proof of work to validate blocks is bad for the planet because of the energy used to secure the network, the truth is that Bitcoin is the only thing that I have found that will allow a transition to a system of planetary alignment and abundance. As I’ve often stated: Abundance in money creates scarcity everywhere else, and scarcity in money creates abundance.

At the highest level, this is because our current economic system for the planet is incongruent with where technology is taking us and life on a finite planet.

As explained in “The Price Of Tomorrow: Why Deflation Is Key To An Abundant Future” and in “The Greatest Game.”

A conflict needs to be resolved at a system level:

- Exponentially increasing efficiency driven by technological progress requires a currency that allows for deflation (bitcoin). We get more for less work.

- The existing fiat monetary system requires inflation and consequently, it needs manipulation to remain viable. We get less for more work.

Because the existing system is credit based, it cannot allow ongoing deflation without complete collapse (because the credit would be wiped out and the credit is the system). Society would never vote to have its entire way of living collapse. Which means a paradox exists where society will always eventually insist on manipulated “growth” for fear of the consequences of collapse, and that manipulated growth is the primary source of the problems that society is dealing with — including environmental damage.

Ultimately, this is because instead of allowing prices to fall (and society to gain time and freedom) with increasing productivity, it presupposes that we can “grow” forever. And the growth itself presupposes that money can be created out of thin air to achieve it. This “growth” for more jobs to be able to pay the bills, to pay for higher prices, which are manipulated higher in the first place keeps society on a hamster wheel unable to see that it is the system itself with its embedded growth obligation to service unpayable debt that is responsible for all the pain. It gets worse — from the existing system every innovation lowering price or saving time in the future must be offset with more manipulation of currency to keep the existing monetary scheme going. Energy itself provides a good example. It is not like there hasn’t been an abundance of technology deployed into the exploration, production, transportation and development of new energy sources. When you realize that the primary reason (increasing demand is important, too) energy prices have risen against new energy coming online and efficiency gains of existing energy sources, is that they must rise to support the existing credit system, you also realize there is no way out from the system.

Beyond the environmental problem being unsolvable from the existing system, Bitcoin provides a path to a Kardashev type 1 planet where we harness all the energy that can reach earth from the sun.

It does so because it provides a positive economic incentive in a transition to abundant energy. From the perspective of supply and demand, Bitcoin’s high energy cost to secure the network is a feature because an economic incentive is created that is both natural and positive to build out energy abundance. Energy is the number one driver of profitability in Bitcoin mining, meaning that low-cost energy is required for profits. A bitcoin miner cannot remain profitable by paying for energy at rates that a retail customer will, so it doesn’t compete with that energy.

Instead, it unleashes the same free market behavior in energy production and utilization. Namely searching for lower cost or stranded energy. By doing so, it provides a floor price for energy and a way to allocate capital to investments that would otherwise not be made. Those new energy investments, along with renewables, allow regions that were once cut off from the world due to a lack of reliable energy to build wealth and energy independence. The constant competition to find lower costs in energy and/or to use the heat provided from Bitcoin mining for other commercial uses such as heating greenhouses or commercial buildings unleashes a wave of entrepreneurial talent onto the challenge of energy utilization. All by way of free market competition to ensure a reliable abundance of energy and utilization.

It should be obvious to most observers by now that energy is more important in our lives than the amount of printed paper notes or digital representations of those notes. Printing more paper or digital units only creates additional energy scarcity. Energy supersedes dollars because without energy, there is no economy.

Bitcoin’s tie to energy for security and its corresponding positive effect on real growth and energy abundance is then perhaps its most under-appreciated feature (and one that the mainstream press has completely backwards).

This excerpt from Gigi (@dergigi) provides a novel way of understanding how energy protects the network:

“Anything that doesn’t have any real cost—cost that is immediately obvious and can be verified by anyone at a glance—can be trivially forged or simply made up. In the words of Hugo Nguyen: ‘By attaching energy to a block, we give it ‘form’, allowing it to have real weight & consequences in the physical world.’

“If we remove this energy, let’s say by moving from miners to signers, we reintroduce trusted third parties into the equation, which removes the tie to physical reality that makes the past self-evident.

“It is this energy, this weight, that protects the public ledger. By bringing this unlikely information into existence, miners create a transparent force-field around past transactions, securing everyone’s value in the process—including their own—without any use of private information.

“It is this energy, this weight, that protects the public ledger. By bringing this unlikely information into existence, miners create a transparent force-field around past transactions, securing everyone’s value in the process—including their own—without any use of private information.

“Here comes the part that is tricky to understand: the value that is protected is not only value in the monetary sense, but the very moral value of the integrity of the system. By extending the honest chain with the most work, miners choose to act honestly, protecting the very rules that everyone agrees to. In turn, they are rewarded monetarily by the collective that is the network.”

2. Decentralization

There are two major design choices that lead to the ongoing decentralization of Bitcoin:

1. First is the nature of proof of work in solving the Byzantine generals problem. Importantly, it is a discovery that cannot be solved again. It can be copied which sets up its own challenges, or it can be changed to try to solve it in a different manner. But, because of general relativity, changing it cannot solve the problem without introducing an oracle and centralization. Let’s dive into each of these:

a. A copy by necessity isn’t the longest chain because it must start later than Bitcoin which has the most proof of work protecting its history. The longest blockchain, by definition, is the one with the most trust. Therefore, a copy cannot have the same security or trust. Which begs the question, what utility would the new copy of Bitcoin provide that wouldn’t be better achieved through utilizing the most trusted and secure chain? Or how would a new chain without utility gain enough traction to compete with Bitcoin, while at the same time Bitcoin was exponentially increasing its security and hash rate because of its trust?

b. There is no such thing as universal time. Einstein’s theory of general relativity says the way we experience time is from our point of view. Time is relative to us — where we are. Depending on orbits, this “time” difference from our point of view on earth to Mars is between four minutes and 24 minutes. This same time difference occurs on earth as well but in such small intervals that we don’t notice it in our daily lives. The fact that we do not notice them, doesn’t change the fact that these small time differences exist. When computer systems are searching for cryptographic keys to prove they found the next block and won the prize, these small differences in time between different regions become critically important. Two Bitcoin miners on different sides of the world could solve the cryptography at exactly the same “time” because of these small variations and both be correct. It is not just theoretical, it has happened numerous times on the Bitcoin protocol and the way it is solved is, again, the longest chain, or most trust wins. For a period of 10 minutes then, or until the next block is mined, these two chains can both be valid until the next block is mined and the nodes confirm the longest chain. Miners choose which block they believe is valid and as 51% of them choose the valid block, the other miners move to the longest chain. It is a waste of energy and resources to mine on top of an orphaned block. Again, the longest chain is the one with the most trust.

Because of this discovery that ties energy and proof of work together, there exists only one other way to solve the time problem. This involves introducing a “trusted” agent or oracle that defines the “rules” and then chooses which transactions are valid (what transaction came first). But once an oracle is introduced to solve the problem, trust is placed in the oracle, the rules can change and decentralization is lost.

Bitcoin, through proof of work, is the only way to solve the problem. As Neil Degrasse Tyson points out, “After the laws of physics, everything else is an opinion.”

2. The second design choice that keeps Bitcoin decentralized is the size of the block. Sacrificing additional block size on Layer 1 of Bitcoin meant a lower number of transactions per 10 minute block and/or less room for smart contracts in the underlying code. By keeping the block size small, the tens of thousands of full node operators around the world are the true rule enforcers of the network. (Tomer Strolight gives a great firsthand account of this power in the hands of the node operators here.)

Therefore, while miners compete as economic actors to secure the network, they are held in check by nodes (open to anyone to easily set up and run) who confirm the transactions. These full nodes each have an entire history of the blockchain and confirm each of its transactions. Because block size is kept small, it means that these nodes are very economical to run in hardware and energy costs, which in turn leads to more nodes or participants validating the system (decentralization).

By adding additional information or space to the blockchain on Layer 1, the cost in energy and compute power to secure the network explodes, and in turn leads to only the most powerful or wealthy having enough money to run nodes, which in turn controls the decisions, i.e., centralization. The Blocksize Wars starting in 2015 to 2019 were fought over this key issue with many of the most powerful Bitcoin proponents at the time favoring a rule change that would bring more functionality to Layer 1, but in turn would give them more control in the form of centralization. Bitcoin hard forked over this fight with new code representing the new rules. Unlike soft forks which are agreed to by the miners and nodes and are backwards compatible, hard forks create a new chain. For example, if you owned bitcoin prior to August 1, 2017, and a hard fork to Bitcoin Cash occured, you would own coins in both chains. You could then elect to sell one of them in favor of the other or keep both. Below is a snapshot of what the market determines as value in both coins:

Market capitalization of Bitcoin as of August 6, 2022: $443 billion

Market capitalization of Bitcoin Cash as of August 6, 2022: $2.7 billion

The price discrepancy of the fork demonstrates again that while anyone can change the rules to offer a different coin, the longest chain with the most proof of work has the most trust, and is valued higher by market participants as a result. Decentralization is a big part of this trust.

3. Scalability

As reinforced throughout this article, the design choices that led to decentralization and security which itself wasn’t possible before Bitcoin, also led to design choices that lacked scalability. It is here that much of the conflict and confusion in blockchains originate. From a human nature perspective, it is easy to see that there would be conflicts, some users that wanted to build more in terms of scaling or differentiation on top of Bitcoin and felt blocked by its slow and methodical consensus of nodes protecting the ecosystem. They then decided to create their own blockchains with differentiation and tried to convince others that the new blockchains were better in some way. While many were/are complete fraudsters looking to make a quick buck on the back of ignorance, some may not have even been aware of the long-term implications of their design decisions in creating blockchains that must fail — either due to one, centralization and lack of economic incentives, or two, security vulnerabilities. And once created, there was no way out but to admit failure, or to keep changing while promising to solve the paradox at some point in the future.

A Different Way To Scale

Protocols scale in layers. Scaling Bitcoin in layers provides a way to retain security and decentralization of Layer 1, but also gain scalability in the second or third layers instead of sacrificing the first, similar to the layers that form the building blocks of the internet and ultimately the products that you use every day. Each of the different protocols operate only at that layer. This abstraction ensures that each layer is self-contained, only needing to know how to interface with the layer above and below it, which simplifies design and flexibility without sacrificing what another layer provides. This short YouTube video provides a good overview of the network protocol layers of the TCP-IP layered model.

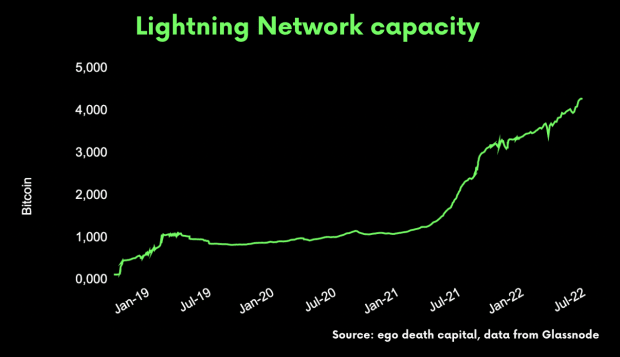

Because of the misunderstanding that protocols scale in layers, and the overall noise in the market, innovations like Lightning that allow Bitcoin to scale would be largely dismissed by an audience that saw Bitcoin as slow-moving, old technology, uncompromising in its security and decentralization.

This would provide an asymmetric opportunity for the nations, entrepreneurs, capital and public who took time to understand what was happening in the ecosystem versus those who dismissed it.

I believe that we are at that inflection point where technologies such as Lightning, Fedimint, Taro and others will usher in a wave of innovation in the space. I also believe although it is still in its infancy, Bitcoin and the protocol are unstoppable.

Below is a chart of Lightning adoption since inception:

From Lyn Alden’s recent masterpiece on The Lightning Network:

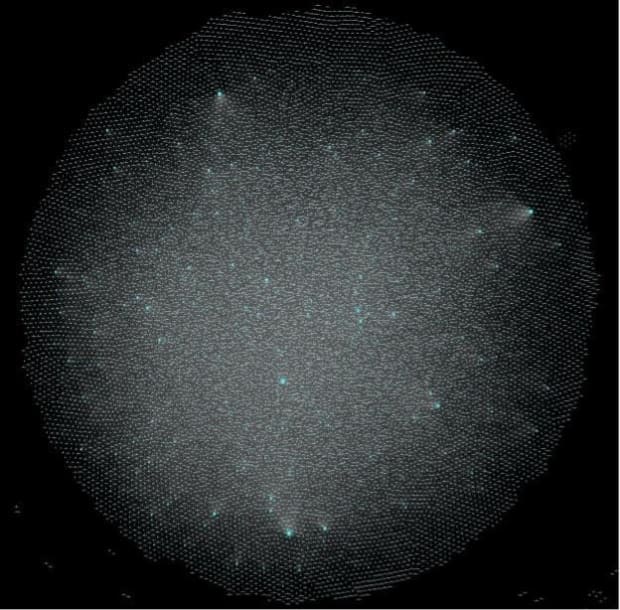

“Imagine a global system with a massive number of interconnected nodes. Anyone can enter the network with a new node and start creating channels. Alternatively, many custodial services also gives their account-holders access to the network through their nodes and channels.

“Here’s a visualization of the public Lightning network at the moment. It’s a growing network of interconnected nodes connected by payment channels, with those bigger dots representing particularly well-connected nodes:”

It is early, and not everything will work out as planned, but each success scaling in layers reinforces and brings more talent and capital to the ecosystem. Some of these pieces of the puzzle (like Lightning, Taro and Fedimint) will work together in ways not yet completely understood — accelerating adoption, all of them will build upon a Layer 1 foundation that is rock solid. In doing so, many of the long-term “use cases” of alternative coins will disappear and one by one, they will fail.

The Bitcoin protocol, scaling in layers, will provide a base layer that merges a new peer-to-peer internet and money natively within it. This will form a completely secure, open to anyone, integral foundation for technology more broadly. Like the dawn of the internet, but this time decentralized and secure, ensuring with its design a hopeful path for humanity where the natural abundance gained through technology is broadly distributed to society instead of being consolidated in the hands of a few. Regulators in certain nations could try to slow or stop it, but in doing so, they would be making a grave mistake, analogous to shutting down the internet from their citizens and blocking the innovation that came with it. It wouldn’t stop the innovation but would instead ensure that the innovation, and value derived from that innovation moved to other nations. Over time, people will realize that instead of pricing bitcoin “from the system” that they live in today, bitcoin will price everything in that system.

There will be incredible successes, failures, and learnings. Most importantly though, there will be enduring value to society that comes on top of a solid foundation that is incorruptible by a small group of people — decentralized and secure by its design. That emergent system, launched to the world by Nakamoto in 2009, changes everything.

Some leading thinkers in space and their work:

Lyn Alden

Dergigi

Troy Cross and Kyn Urso

This is a guest post by Jeff Booth. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.