Financial Vampirism And Bitcoin

2020 was an unprecedented year in financial engineering. Unprecedented and yet… totally predictable if you pay attention to the right metrics.

Market trajectories which have been set in motion, and remain in motion until acted on by an outside force, are being brought to bear on the world stage. No matter how many pundits regurgitate the notion that “nobody could’ve possibly seen this coming,” the truth is that the underpinnings of societal structure have been beset by a very predictable and destructive curse.

As markets become unstable following a period of monetary expansion and contraction, investors will demand either a premium on longer-term lending rates or will drive down yield (due to increased demand) on shorter-term lending rates. Historically, this yield curve inversion is a clear indicator of upcoming recessions because it signals uncertainty regarding the future. Couple this with historically-low unemployment rates (another signal that the market is oversaturated) and you’re left with a clear picture of the downturns to come. In fact, the only truly surprising thing about the market malaise of 2020 is how it leaves supposed experts scratching their heads in befuddlement.

The Rise Of The Vampire

The story certainly isn’t new (aggry beads are a sobering example of the economic and societal impacts of monetary debasement); in fact, American economist Murray Rothbard chronicled over a century’s worth of financial engineering and capital market manipulation in his book “A History of Money And Banking In The United States: The Colonial Era To World War II.” An endless boom and bust cycle exacerbated by fiat currencies and Keynesian economic theory have put us on a trajectory of ever-accelerating debasement.

The history is nuanced and complex, but the mechanics are quite simple. Sovereigns expand the money and credit supply to retain a disproportionate level of expenditure relative to tax receipts. A trick, colloquialized by the name of “coin clipping” in a time prior to the fiat monetary monopolies that plague the modern day, involved gathering tribute in the form of taxes, clipping or shaving a small value of the precious metal from the coins, and then recirculating them at face value.

Market boom cycles (bubbles) occur in response to the expansion of money and credit in the system. The less affluent individuals, who can only afford to save in the form of cash, experience a reduction in their purchasing power as their slice of the economic pie becomes steadily smaller. Scarce assets are bid up at market, as a greater supply of currency competes for a limited supply of resources. Crack up-asset booms are followed by deflationary busts and credit contractions.

Under monetary metal standards, suspension of redemption of specie was used to disrupt the liquidation of malinvestment. Legislation such as Executive Order 6102 in 1933 and the suspension of Bretton Woods in 1971 were indefinite forms of suspension of redemption of specie. This ultimately placed the world on a fiat standard, where expansion of the monetary base and allowable credit could continue unabated without the bothersome settlement to the base layer.

Disruption of the liquidation process that naturally occurs in the market, however, does not free the vampire from the economic consequences of bleeding its prey dry.

There is a great deal of misunderstanding in modern analysis of financial markets in the 21st century. Events seem haphazard and at odds with the natural order when not viewed through the lens of Austrian economics. But in reality, these events are perfect representations of the logical basis upon which all human action occurs.

Man acts to satisfy his most immediate needs first, utilizing whatever resources are available to him to prioritize satisfaction of his most urgent wants in descending order. Rothbard called this the “marginal utility of value.”

While human action is subjective and no one can predict how any one man will act under the various circumstances he finds himself in, a natural order of operations can be gleaned from societies and economic activities as a whole.

Obviously, Maslow’s hierarchy of needs naturally drives man to satisfy his physiological and safety needs first. This can be observed across the sociological spectrum of societies and traced back throughout history. We can see societies begin to flourish when enough capital goods and information are accumulated to the degree where focus can shift from the satisfaction of the most pressing and basic wants (survival) to those of a higher order.

Man learned through voluntary and profitable trade with his counterparts that in a free and flourishing society, his capital could be preserved and could grant him a degree of certainty in satisfying his basic needs into the future via savings.

The dominant medium through which man determined he would save his capital emerged in the form of a monetary medium, that is, the most liquid salable good in a society that served to preserve value across time and space. A single, most important asset which enjoys its value premium separate from its function as a capital or consumption good. In terms of historical significance, this medium, with unprecedented success, was gold.

Fast forward to 2020 and the world looks much different. The bastardization of the natural economic order through policies influenced by the likes of Keynesian economics has distorted the ways in which man can plan for and save his capital for the satisfaction of his most basic needs in the future.

The melting ice cube that is fiat currency functions not as a chosen dominant market leader in capital savings and transactions, but rather as a lynchpin in a vampiric legal monopoly which extracts the wealth from every productive aspect of profitable and voluntary cooperation among men. Whether consciously or not, acting man fears for his ability to preserve wealth into the future and provide for his grandchildren, or even satisfy his most basic needs in the immediate future.

This drives him to seek out alternative media in which he can preserve his monetary energy into the future, giving birth to a wide range of inefficient and arcane financial instruments through which he can find refuge in the storm of monetary debasement.

Real estate, equities, bonds, precious metals, fine art, luxury vehicles…you probably know the list. Tune in to any average joe financial planning YouTube channel and you’ll find a laundry list of strategies employed to preserve capital into the future. Capturing asset inflation has become an entrepreneurial activity in and of itself. Entire industries are built around advising, planning, trading and arbitraging the effects of monetary expansion on the market as a whole. The more unstable the system, and the more estranged its inhabitants, the more it takes the form of degenerative gambling, like a drowning swimmer desperate to get his head up for another breath of air.

Homes, built to fulfill a specific utility (the need for shelter and security) are bought and sold like collector’s items, with a high level of monetary premium. Equities are traded at a spot value decades beyond projected earnings and fair valuations according to cash flows. Tax incentives are built around protecting the liquidity in these instruments and allowing the vampire to siphon off a continuous stream of fresh sustenance for itself.

Of course, the more leveraged the system becomes, the more it defies the natural economic order of liquidation, the more it pushes off risk into the future, the more unstable it becomes.

A growing chorus of populism on both sides of the political theater (and yes, I use the term “theater” literally here) demands state intervention in the markets to protect what is deemed most urgent. That is, assets must continue to inflate because assets are the store of value medium through which man preserves himself into the future.

Gone are the days of trepidation and debate over public fiscal conservatism. Monetary policy is three sheets to the wind and legislators drool over the next allocation of pork to their aisle of special interests. As the risk increases by orders of magnitude, “troubled assets” are bought up in droves by the legal vampire which is drunk on the blood of its host.

The store of value proposition of assets must be upheld by the legal monopoly or else it might face certain destruction at the hands of a disenfranchised constituency.

And here we find ourselves in a most curious and unusual place.

The Vampire’s Curse

Entrepreneurs (whether they know it or not) now find themselves in a crossroads of great societal importance. They no longer merely provide goods and services to the consumer at a profitable rate, but rather have taken on a role of a much greater import.

They control the levers of financial engineering of money-like assets. They satisfy the market demand for instruments in which man can preserve his capital — his lifeblood — into the future.

Only in a world where incentives have been so painfully and obviously distorted, because of the nature of the vampire’s grasp, do you see events like this:

And this:

As Rana Foroohar asks in her book “Makers And Takers”:

“How did finance, a sector that makes up 7 percent of the economy and creates only 4 percent of all jobs, come to generate a third of all corporate profits in America, at the height of the housing boom, up from some 10 percent it was taking 25 years ago?”

Because, you see, Apple no longer just provides fun and interesting electronic devices to its consumers and, likewise, the airlines no longer just provide transportation across land and sea. These businesses have mutated into mercurial public financial instruments which the whole of society depends upon to preserve its lifeblood into the future.

Corporate executives who can satisfy this most urgent market demand for a sound store of value are lauded as demigods. Gone are the days of the Henry Fords, whose entrepreneurial activities were grounded in building an empire of value for the consumer through sound business practices.

Soft money and artificially cheap credit (i.e., that which is redistributed by the state and its legal monopoly) promote financialization at the cannibalization of the entrepreneurial process. The vampire has taken complete dominion over the capital markets. By pulling his levers of interest manipulation, reserve ratios and asset purchases, he feeds himself at the expense of the productive capacities across society.

No other explanation can be used to justify a technology company like Apple borrowing billions of dollars to pump the price of its public financial instrument when it sits on more than $200 billion in cash.

No other explanation can be used to justify a transportation industry which allocates nearly every dime of its free cash flow for over a decade to protect the value of its equity.

Killing A Vampire

There is only one way to kill a vampire. Just as technology disrupts and revolutionizes countless industries across generations of men, human ingenuity for finding ways to solve complex problems seemingly knows no limit.

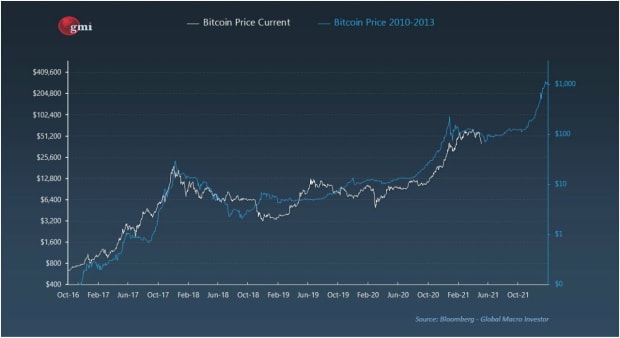

A new monetary medium that satisfies the most pressing demand for preserving lifeblood into the future is making its way onto the world stage. Over-engineered financial assets that have been used as stores of value and contain a great deal of monetary premium are like hyper-saturated solutions in desperate search for equilibrium.

The emergence of a global, self-clearing digital monetary network which emulates and improves upon the monetary properties of history’s best money (gold) will function like a vacuum that sucks up this premium like a black hole.

A deluge of ink has been spilled on the history of money, as well as the emergence and merits of this new technology known as Bitcoin, but the critical eye can discern that the paradigm shift is already in motion. While the mainstream parrots conventional wisdom and stands stunned in disbelief as the universe returns to a state of natural equilibrium (that is to say, a monetary premium in money, rather than in money-like assets), rest assured that the benefits to society will be immense.

A diffusion of the monetary premium away from hyper-saturated money alternatives like real estate, commodities and equities and into an accessible, digital hypo-saturated sound money will allow for a more productive satisfaction of the marginal utility of value of these goods and services. Instead of needing a money spigot of capital to artificially inflate assets and preserve wealth through space and time via complex and over-engineered financial instruments, entrepreneurs can return to solving less pressing issues. Homes can return to a more reasonable price in line with their utility value. Gold and other commodities can be made more cheaply available in industrial applications.

Entrepreneurial capital will free itself from its tether to malinvestment in the form of artificial inflation via financial instruments, and will be put to use in the profitable and productive satisfaction of man’s desire.

This curse can be lifted.

For the first time in history, the world will know monetary security without the drawbacks of a commodity-based money. We have a scalable, base layer bearer asset set upon a distributed and global peer-to-peer network that settles in real time.

Bitcoin is the stake through the heart of a most terrible beast.

Author’s note: A big thank you to Robert Breedlove, Parker Lewis, Ben Prentice, Ben Kaufman and Rollo Mcfloogle, who helped me sort through and proof read these thoughts.

This is a guest post by Heavily Armed Clown. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post Financial Vampirism And Bitcoin appeared first on Bitcoin Magazine.