Financial Crisis Fears? Russians Withdrew More Cash in March 2020 Than The Entire 2019 (Over Trillion Rubles)

Amid lockdowns prompted by the spread of the novel coronavirus, Russian citizens have withdrawn more cash from banks and ATMs since the start of March, than they did in the whole of 2019. A report reasoned that people are afraid that banks may not function during the quarantine.

For Russians, Cash Is Still King

According to a recent report, Russians withdrew about 1 trillion rubles ($13.6b) from cash machines and bank branches since the start of March. This is more than the total amount withdrawn in 2019.

Denis Poryvay, an analyst at Raiffeisenbank in Moscow, believes that “people were afraid that banks will be unavailable during the quarantine. They withdrew money for the same reason as people hoarded food.”

Interestingly enough, residents attempted most withdrawals when President Putin carried his regular briefings regarding the COVID-19 situation.

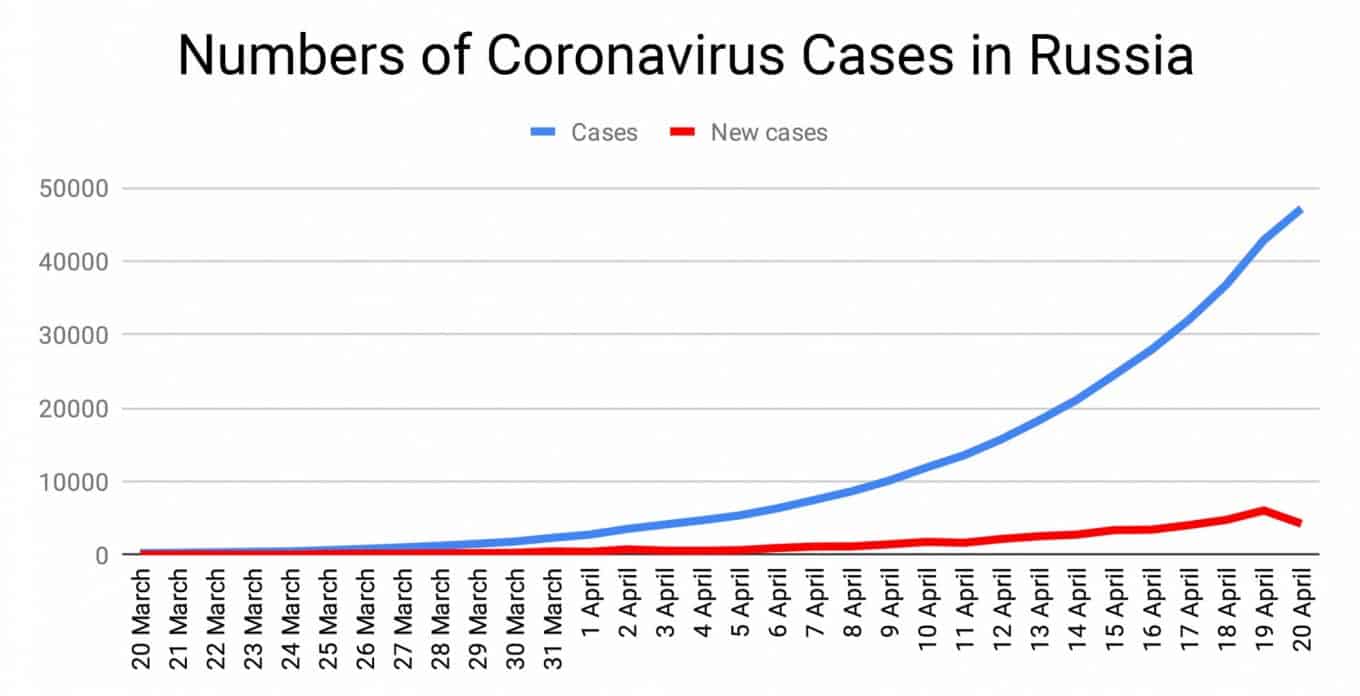

Russia managed to lay low in terms of confirmed COVID-19 cases for a while when countries like Spain and Italy were registering a severe death toll. In the past few weeks, though, the official numbers are rising notably. At the time of this writing, the largest country by landmass has over 47,000 confirmed cases.

Per another report, however, “Russia’s testing capacity is hampered by bureaucracy, while officials warn that the real number of cases is likely much higher.”

The majority of affected patients are in the nation’s capital Moscow. As of March 30th, the city of 12 million people is under lockdown until at least May 1st.

Is This An Opportunity For Bitcoin?

Russians may not be the only ones fearful of potential bank issues. Lebanon citizens, for instance, have to endure the pandemic while having a stressful cap on daily withdrawals from their personal bank accounts.

Even after the recent central bank “ease,” only people with accounts containing $3,000 or less would be able to withdraw their money in Lebanese pounds at the market rate. That rate, however, is substantially higher than the official one.

Similar developments reveal a classic “this can’t happen with Bitcoin” scenario. The primary cryptocurrency was created amid the last financial crisis in 2008 to serve as an electronic peer-to-peer cash system. No central authority exists to halt transferring or withdrawing funds. Moreover, it’s digital – national-wide lockdown can’t harm distribution.

As long as users have access to the internet, they can receive or send funds in a matter of minutes. A recent transaction proved it could be quite cheap to use as well – $633 million worth of Bitcoin was transferred for a fee of just $0.26.

The post Financial Crisis Fears? Russians Withdrew More Cash in March 2020 Than The Entire 2019 (Over Trillion Rubles) appeared first on CryptoPotato.