Financial Advisors, Bitcoin Is the Next Amazon

This is what skeptical investors are saying:

1. “It’s a bubble.”

Andy Edstrom, CFA, CFP, is the author of the book Why Buy Bitcoin, a financial advisor, and Head of Institutional at Swan Bitcoin. He is a speaker at CoinDesk’s Bitcoin for Advisors event, November 9 and 10, 2020.

2. “It’s just one competitor among many in the field.”

3. “It only has a few million users.”

4. “It’s used for crime.”

5. “It won’t be able to scale up enough to grow into its valuation.”

6. “It doesn’t generate cash flow and probably never will.”

The year is 2005, and they are talking about Amazon, which:

1. has recently suffered a bubble and bust in which its stock lost over 90% of its value,

2. still has plenty of online retail competitors,

3. has only a few million monthly active users,

4. is regularly used to evade sales tax,

5. seems unlikely to grow into its valuation, and

6. generates no cash flow.

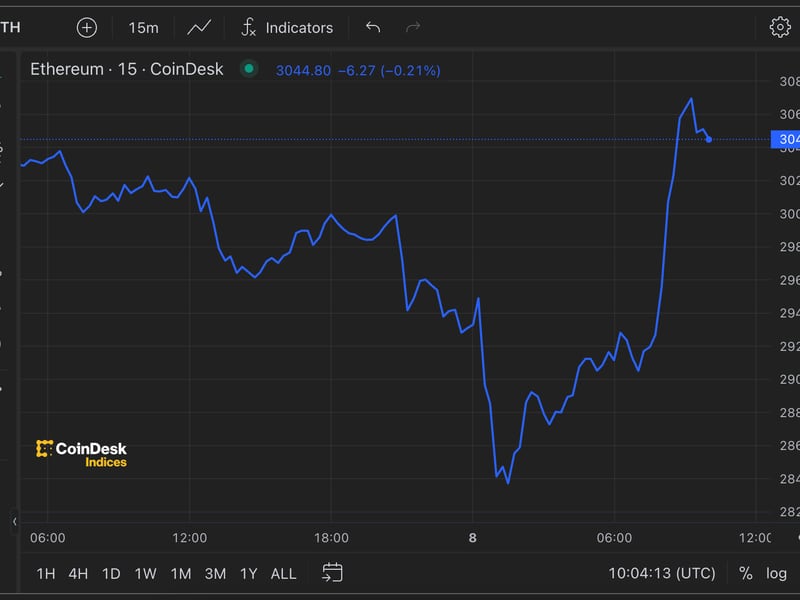

Having recovered somewhat from its lows after the dotcom bubble burst, the stock at the time is trading at $35 per share, and there is a lively debate about how overvalued it is.

Fast forward to 2020. Amazon stock trades around $3,300 per share (over 90x its 2005 price), and it has single-handedly driven a significant portion of the total return of the S&P 500 in recent years.

Now wind back the clock again and imagine you are a wealth manager back in 2005. If you have zero investment allocation to Amazon, you are probably in the majority.

Now fast forward again and imagine you are a wealth manager in 2020. If you have zero investment allocation to Amazon, you are probably out of business.

I am a wealth manager, and in 2005 a lot of people (myself included) underestimated Amazon’s total addressable market. At first we thought it was online book sales. Then it was global book sales. Then it was online purchases of stuff. Then it was global online purchases of stuff. Then it was the cloud infrastructure required to support this e-commerce edifice, then…

Wealth managers who didn’t buy bitcoin for their clients will be like those wealth managers who never bought Amazon: out of business.

Amazon’s success is partly due to great management. But it also comes from the creation of a well-functioning internet-native (and therefore network-native) market for online commerce that is open to all suppliers. Amazon couldn’t have become the “everything store” without opening up the marketplace to third-party sellers. This increased the available inventory of items for sale and cemented Amazon’s position as the place that everyone visits to buy just about anything.

Thus Amazon became a major internet platform whose market capitalization exceeds $1.5 trillion, even while continuing to munch away at a total addressable market that is multiples larger. Even today, Amazon only has 7% share of the retail market – it still has ample room to grow.

These days my wealth management peers are still making the same mistake with Bitcoin that they did with Amazon in 2005. (See the list above of criticisms of Amazon stock 15 years ago – bubble, competition, low usage, criminality, inability to scale and no cashflow.) But now, more than a decade after 10,000 bitcoins were exchanged for two pizzas (analogous to the first successful completion of a book order via Amazon), Bitcoin has pretty clearly “won” the market for digital hard money. Just like Amazon became the obvious winner of the e-commerce market years ago, and yet still continues to gobble up share of this enormous potential market, Bitcoin still has very far to run.

Gold, which is the world’s preferred hard money, is roughly a $10 trillion asset. At $275 billion today, Bitcoin’s share of the hard money market is therefore less than 3%. But Bitcoin’s total potential includes the overall market for money and safe value storage. This overall market is multiples larger than the market for gold. This suggests that Bitcoin has captured less than 1% of its total addressable market.

Skeptics retort that Bitcoin will never be able to innovate or launch new products as effectively as Bezos & Co. Really, the opposite is true. Instead of a CEO-driven management team with a limited number of employees, Bitcoin is an open platform with thousands of brilliant, diligent software developers and entrepreneurs building on-ramps, applications, and additional useful products on top of Bitcoin. Like the third-party merchants who provide the additional inventory that made Amazon the automatic destination to buy stuff on the internet, these thousands of talented people are turning Bitcoin into the automatic place to put your internet-based wealth.

So as an investment, Bitcoin today is roughly where Amazon was 15 years ago. And Bitcoin’s value is likely to grow as dramatically in the next 15 years as Amazon’s did in the previous 15. As a result, there will be two kinds of investment portfolios: those of people who were wise enough to own some Bitcoin, and those who weren’t. But there will only be one kind of wealth manager. Wealth managers who didn’t buy Bitcoin for their clients will be like those wealth managers who never bought Amazon: out of business.