Filecoin Price Drops After SEC Asks Grayscale to Withdraw FIL Trust Application

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.

The U.S. Securities and Exchange Commission (SEC) asked Grayscale to withdraw its application to launch a Filecoin (FIL) Trust product, the asset manager revealed Wednesday.

Grayscale said in a press release that it had received a comment letter from the federal securities regulator saying FIL “meets the definition of a security.”

“The SEC staff requested that Grayscale seek withdrawal of the registration statement promptly,” Grayscale said. “Grayscale does not believe that FIL is a security under the federal securities laws and intends to respond promptly to the SEC staff with an explanation of the legal basis for Grayscale’s position. Grayscale cannot predict whether the SEC staff will be persuaded that Grayscale’s position is correct, and if not, whether it may become necessary for Grayscale to seek accommodations that would enable the Trust to register under the Investment Company Act of 1940 or, alternatively, seek dissolution of the Trust.”

Grayscale is a subsidiary of Digital Currency Group, CoinDesk’s parent company.

An SEC spokesperson declined to comment when asked if the agency could comment on FIL last month.

Grayscale said in a public filing in April that the SEC Divisions of Corporation Finance and Enforcement had reached out at the time “concerning [Grayscale’s] securities law analysis of FIL.

Grayscale “acknowledges that FIL may currently be a security, based on the facts as they exist today, or may in the future be found by the SEC or a federal court to be a security under the federal securities laws, notwithstanding [Grayscale’s] prior conclusion,” the company said at the time.

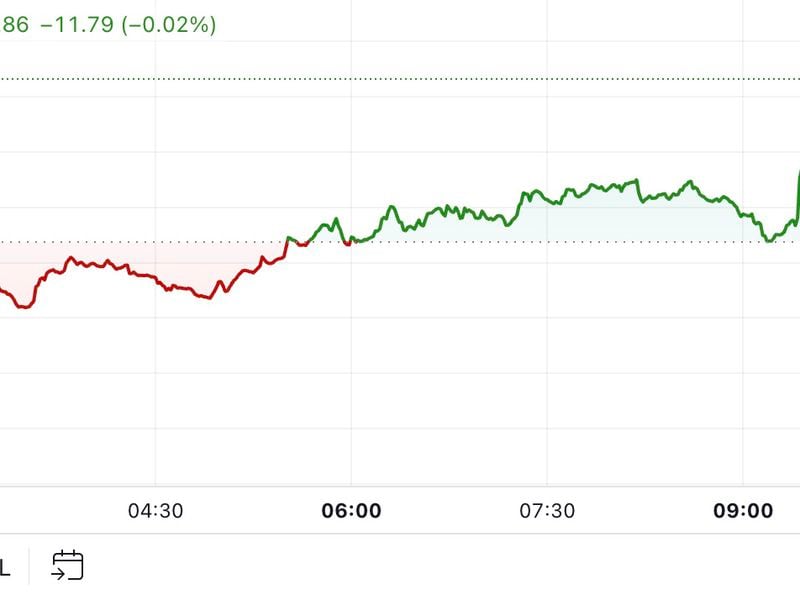

FIL’s price dropped nearly 3% (15 cents) on the news of the filing, before rebounding slightly and trading at $4.51 at press time.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.