Fidelity Joins Rush For Bitcoin ETFs With New Filing

Fidelity has joined the wave of financial firms filing for regulatory approval to offer a bitcoin exchange-traded fund in the U.S.

Fidelity is the latest financial institution to file for regulatory approval to offer a bitcoin exchange-traded fund, or ETF, with the U.S. Securities and Exchange Commission (SEC). This comes among a wave of bitcoin ETF filings by various entities, all vying to enter the U.S. market simultaneously.

The proposed fund, to be called The Wise Origin Bitcoin ETF will be sponsored by FD Funds Management LLC, and the Fidelity Service Company, Inc. will serve as administrator, according to the filing.

“The Trust’s investment objective is to seek to track the performance of bitcoin, as measured by the performance of the Fidelity Bitcoin Index PR (the ‘Index’), adjusted for the Trust’s expenses and other liabilities,” states the filing.

Although the ETF awaits approval, the filing itself is a major hint at an incoming mountain of financial interest in bitcoin. Not only is the ETF entirely focused on bitcoin, but the name itself suggests a deeper understand and interest in bitcoin from the company, as described here by Alex Thorn:

All of this comes after VanEck, Skybridge Capital, NYDIG, and Valkyrie Digital Assets filed for their own ETFs, alongside Goldman Sachs announcing a note offering tied to the ARKK Innovation ETF, a fund capable of investing in bitcoin.

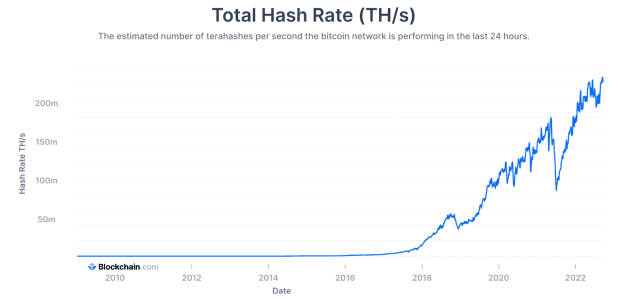

If all of these ETFs are approved, it wouldn’t be unreasonable to expect a considerable increase in the investment of bitcoin. Regardless of the outcome, it is exposing the traditional finance world to bitcoin while being backed by well-trusted names. And the fact that this is all occurring at once suggests there has been, for some time, a building interest in bitcoin.