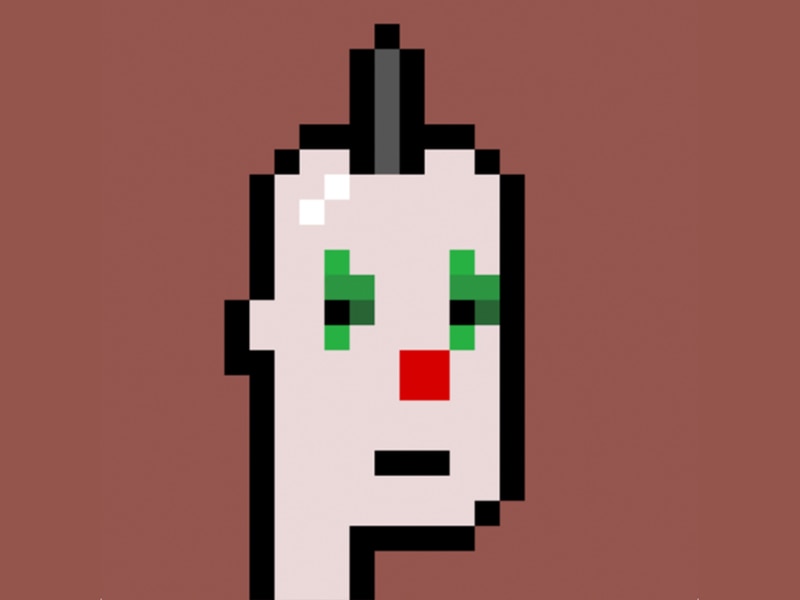

Beeple Goes Punk With $208K NFT Purchase

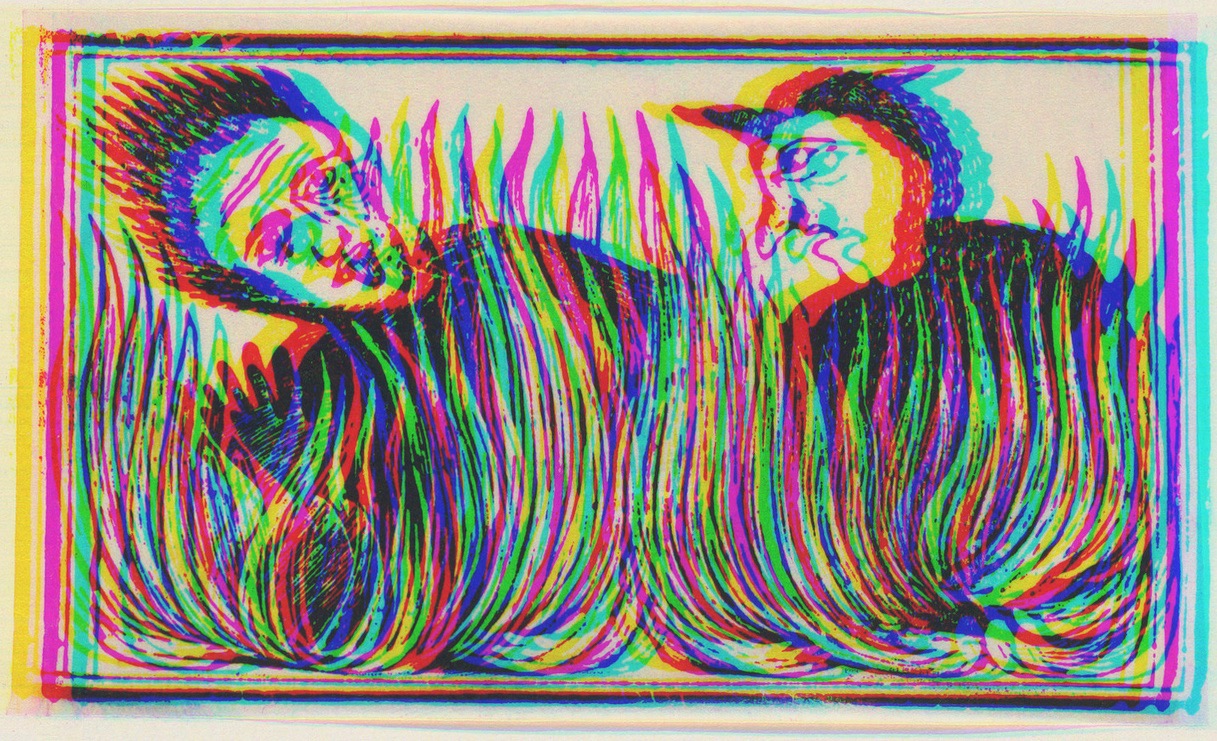

The artist who created the most expensive non-fungible token (NFT) ever sold has finally made his first profile-picture (PFP) NFT purchase.On Tuesday afternoon, Mike Winkelmann, better known as Beeple, bought CryptoPunk #4953 for 113.7 ETH, which cost him $208,000, according to data from Etherscan.Last week, Beeple posted a tweet sharing he was “in the market…