FibSwap: Why Deflationary Token Models are Crucial to the Value of a Crypto Project

Any investor with a bit of experience in the market knows the importance of tokenomics when evaluating projects. Factors such as distribution, total supply, and circulating supply play a significant role in determining the potential value of a crypto project and its token and must be taken into serious consideration.

This is why it is essential to assess a project’s tokenomics to determine the future potential of a crypto asset. Everyone from the most basic crypto investor to more seasoned professionals uses these data points. There’s no way around it if they are serious about their capital and its short and long-term safety.

So, how can tokenomics be used to value crypto projects?

Using Tokenomics To Value Crypto Projects

First, it’s essential to understand what tokenomics means, which is a word that is thrown around a lot in the crypto market.

Tokenomics is more or less a representation of the supply characteristics of a token, as well as its distribution model and timing. Through evaluation, it can be used to determine factors such as potential price gains and market cap (using the current price and circulating supply).

The industry community is constantly talking about inflation fears. Governments print more fiat currency, thereby reducing the buying power of the money already in circulation. Inflation is something we all have to deal with — just take a look at the increase in prices of groceries over the years.

One of the main differences between cryptocurrencies and government fiat is the supply of cryptocurrencies works according to a predetermined schedule. The coding of this predetermined issuance in protocols lets you determine how much of a supply would be available at a particular date in the future. For example, the Bitcoin halving slashes the supply of new BTC in half, and it happens once a certain number of blocks are mined.

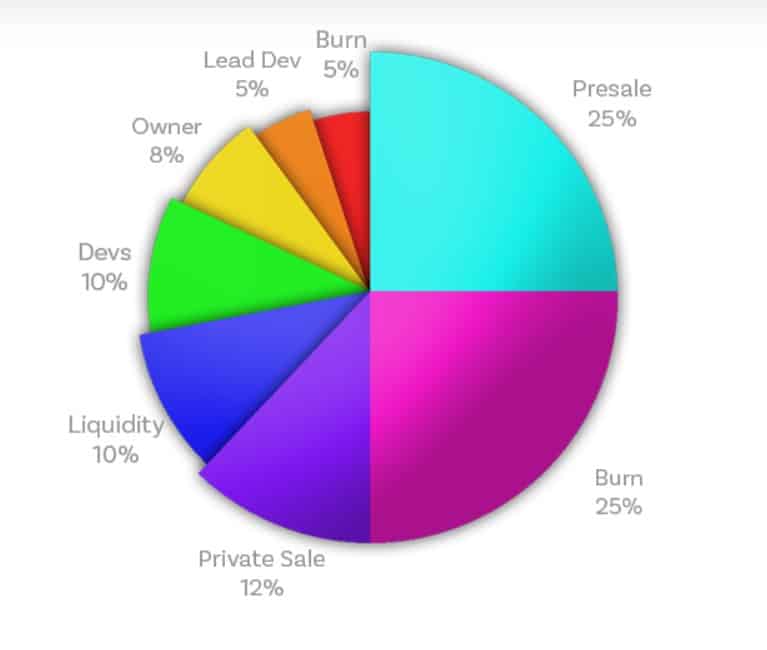

A project’s tokenomics gives the information users may need to better determine a potential valuation. For example, it reveals how many coins exist (through circulating supply), the issuance schedule, the distribution of the coins between the public, team, and project initiatives, and the potential burning of coins.

In this way, it can be somewhat similar to valuing a business through shares and the corresponding market cap. For example, if Bitcoin were to reach $500,000 with all of its 21 million Bitcoins issued, that would put its market cap at about $10.5 Trillion. In this way, users can determine the potential market cap by looking at the supply and its current price.

FIBO Tokens and Its Deflationary Model

Another important point to consider when looking at an asset is whether it is a deflationary or inflationary asset. The latter sees an increase in supply, while the former is a decrease in supply. Obviously, when the supply decreases, the individual value of an asset goes up, assuming the demand for it stays the same or increases. For this reason, it’s considered that deflationary assets are a better store of value.

FIBO is a deflationary asset, with a portion of the tokens burned every time users spend it to facilitate a swap between chains. Thus, the FIBO token supply reduces with each such transaction that takes place on FibSwap.

The token can also be staked on the recently released FibSwap Staking application, which provides users with another way of making use of their capital.