Fiat-to-Crypto Partnerships Expand Abra’s Footprint to 150+ Countries

Fiat-to-Crypto Partnerships Expand Abra’s Footprint to 150+ Countries

Abra is expanding its cryptocurrency marketplace to dozens more countries through partnerships with four fiat-to-crypto gateways.

The Silicon Valley-based crypto banking services firm is now available in over 150 countries (previously it only served about 40) stemming from deals with Simplex, Moonpay, Banxa and Transak.

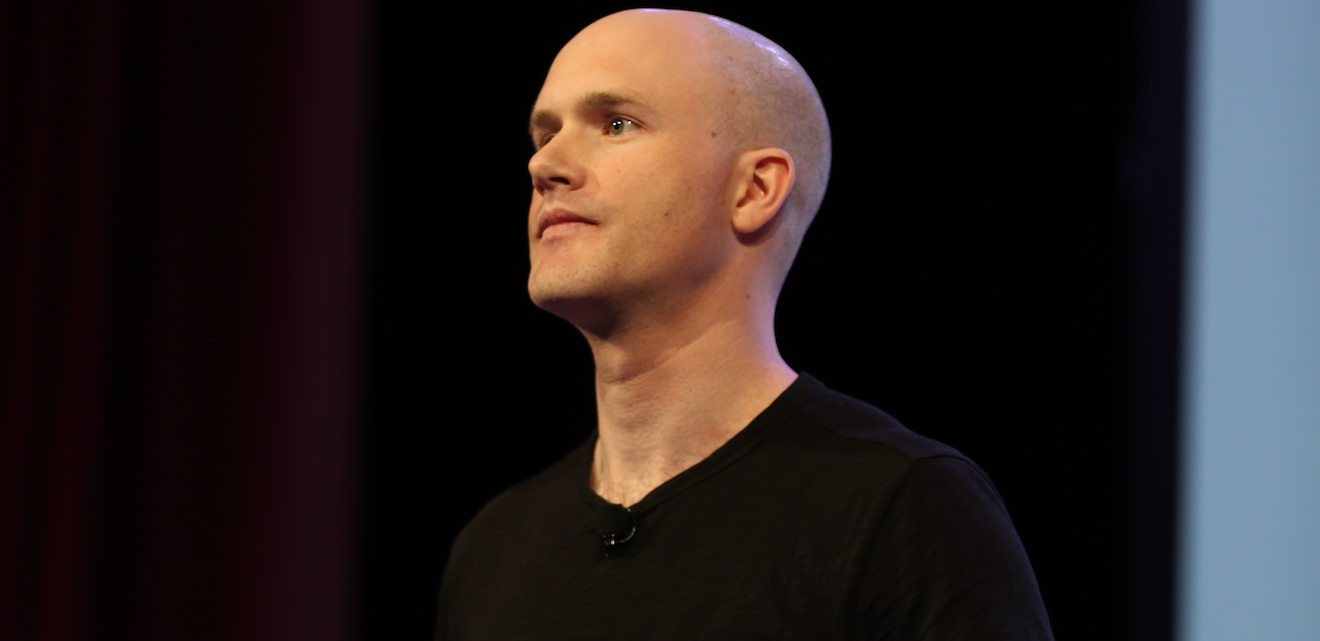

In an email to CoinDesk, Abra CEO Bill Barhydt said the service is akin to a “Kayak for buying crypto.”

The international partnerships mean Abra now has access to additional payment methods including Visa, Mastercard, Apple Pay, Google Pay, Samsung Pay, SEPA, FasterPay, Australia Post and more.

Over the next year, Abra plans to add 10 to 15 additional fiat-to-crypto gateways to cover more geographies.

“We may have a few that operate in a small part of the world, but they go very deep in that part of the world,” said Barhydt.

The move comes amid an uptick in international interest in cryptocurrency investing and a corresponding surge in activity from global regulators.

“The blockchain industry has been evolving so fast that we no longer need to wait for the banking industry to adopt crypto,” Simplex CEO Nimrod Lehavi told CoinDesk. “We are building the entire banking functionality into our own products and platforms at any jurisdiction, and for any type of user.”