Fiat Lux: The Origins Of Modern Money

Heavily Armed Clown explores the commonly misunderstood term “fiat” alongside in-depth historical economic background.

This post contains compilations of work previously written by the author and published separately.

The word “fiat” is growing more aggrandized in the modern lexicon, however, despite its increasing popularity it is often ill-defined or misused. I regularly observe people falsely call bitcoin a fiat currency. This is thanks, not least of all, to the layman’s poor grasp of history and money. Fiat is of Latin origin, meaning authoritative sanction; a decree, command or order. Fiat does not mean “backed by nothing” or “redeemable for nothing” or “pegged to nothing.”

The phrase “fiat lux” is a Latin reference to some of the most prolific words ever written; from the book of Genesis in the Bible, “Let there be light.” We can see here how the word is used authoritatively, there was no light, God commanded that there should be light, and there was light.

Unfortunately for us (or perhaps to our great fortune), man’s emulation of the spoken word of God carries with it far less divine authority, and thus decrees of sapien origin must be enforced by coercion, which today usually comes in the form of complex legal and judicial systems. As long as men have ruled over one another with force, there have been decrees in this manner. A decree can be as simple as making a particular day an observed holiday, likewise it can be as foolish and convoluted as saying the sky must be green on a Tuesday. Here is the insufferable nature of humanity laid bare, man can make a decree, but he cannot necessarily make it so. Mankind does not manifest ends through his words but rather via his action.

Certainly, a ruler could devote vast amounts of his kingdom’s resources toward advancing the ends of his decrees, but his means may make it no more achievable than if he had nothing at all. In fact, a very charismatic and narcissistic leader might succeed in assuaging resistance against absurd and impossible schemes of a great variety. History is full of egocentric, megalomaniacs proclaiming “fiat lux” into the darkness.

However, for our purposes, it is necessary to focus on a more particular topic, and that is the more recent, modern history of money, particularly in the United States. The word fiat is, perhaps, so widely misunderstood because the history of money is correspondingly misunderstood. In fact, by uncovering why the word “fiat” is so commonly ill-defined, we might just uncover truths of supreme importance.

Despite what you may believe, the first fiat currency of the United States, following the birth of the nation, was not in 1971, 1933 or 1913 but instead in 1792. The Coinage Act of 1792, proposed by Alexander Hamilton, established a pegged exchange rate of 15:1 silver to gold. When viewed through the modern lens, it is not at first obvious how this would be considered a fiat currency. After all, monies made from metal are not worthless paper! This simply must mean that it is impossible that a gold or silver money could be fiat! However, this is untrue; remember what the term “fiat” actually means—“by decree.”

It was by decree that the exchange rate between gold and silver coinage was decided by the United States government rather than by a free, open and voluntary marketplace. This act of price fixing places a face value premium on one coinage or the other, relative to the underlying cost of the bullion struck into coins. In this particular case, it was a premium placed on the face value of silver coins over the value of the silver bullion required to mint them. This is inherently inflationary. This premium had ultimately dilutive effects on the circulating face value of silver, as you will see.

To understand how layers of decree abstracted away our understanding of money, we must review just a sliver of the history underlying the process of transition from bimetallism to a gold standard to a pseudo-gold standard and, ultimately, to irredeemable paper notes. Our primary source for this history will be Rothbard’s “History of Money and Banking in the United States.”

Tokugawa Coinage

At a cursory glance, it’s not a simple matter to parse how soft and expansionary commodity money policy achieved through bimetallic pegs can be severely detrimental. Nor is it necessarily a simple matter to grasp how coinage exchange rates set by decree were a rudimentary form of the fiat money in wide use today. To sort this matter out, it is helpful for us to look for an extreme historical example.

In 1860, the empire of Japan opened up its borders for the first time to free and unregulated global trade in the modern world. Traditionally, Japan had set its exchange rate on gold to silver coinage at 1:5, while international rates at the time were set to 1:15. Consider, for a moment, the implications of this decree when exposed to market forces.

The artificially cheap gold Koban coins could be exchanged for the artificially soft, silver Tenpō coins at a 200% profit. Effectively, one could take five parts silver and exchange it for gold carrying an arbitrage trade against the rest of the world’s 1:15 gold-to-silver peg. In fact, this is exactly what happened, in 1860, 4 million gold ryos (a Japanese unit of weight) left the country, equivalent to approximately 70 tons of gold.

In response, the Bakufu (the Japanese Shogunate ruling class) chose to debase the gold contents of the Koban by two-thirds, bringing it in line with the foreign (and more realistically market adjusted) gold and silver exchange rates. At this point, however, the damage had been done.

Final settlement occurred in the form of the harder money moving out of the country by the shipload. Keep this story in mind as we make our way through the various shifts in American monetary policies throughout the 19th and 20th century.

The Panic of 1792 and 1796

The First National Bank of the United States was signed into Charter by Washington (under the direction of Alexander Hamilton) which set in motion a massive inflationary speculative boom. Private investors were allowed to purchase stock in the national bank, however only a quarter of the cost had to be paid in specie (gold and silver), the other three-quarters of the cost was to be paid in government debt securities. Rampant speculation surrounding National Bank stock ensued, and it was unsustainable. The speculation would’ve liquidated itself had it been allowed to run its course.

Alexander Hamilton worked closely with a New York financier (William Seton) to authorize the purchase of $150,000 of public debt with government revenue. A first great step in the marriage of government and private enterprise. By 1792, the expansion of credit made available to speculators by the Bank of the United States (in excess of $2.17 million) nearly bankrupted the Bank of New York, and from December 29 to March 9, cash reserves for the Bank of the United States decreased by 34%, prompting the bank to not renew nearly 25% of its outstanding debt.

Speculators were then forced to sell off securities in order to satisfy outstanding debts and the deflationary contraction began. In March, Hamilton then authorized an additional $100,000 in open-market purchases of securities and heavily encouraged the bank of New York to continue offering loans, collateralized with US debt. Hamilton also promised the treasury would buy up to $500,000 of securities from the Bank of New York thus staving off the liquidation for a short time.

The following few years were characterized by even more rampant speculation and malinvestment in the bank’s stock, government debt securities and paper land claims (corresponding to the ongoing westward expansion). As is typical, new credit and capital dried up, as a war-torn Europe grew weary of American speculative instruments, and paper land claims began to depreciate in value rapidly.

In 1797, British Parliament suspended redemption of specie (which lasted until 1821) and the complete undoing of the speculative credit expansion and paper financial instrument bubble followed.

The Panic of 1819

The panic of 1819 was caused by a massive monetary expansion created by banks during the Napoleonic Wars, particularly the United States’ involvement in the War of 1812.

The War of 1812 was essentially a trade war, the far less often discussed second war with Britain who was blockading French–American trade routes in the greater context of the Napoleonic Wars. In order to procure the necessary goods required for the war, huge quantities of new bank notes were created in order to purchase government bonds.

To quote Rothbard:

“[F]rom 1811 to 1815 the number of banks in the country increased from 117 to 212; in addition, there had sprung up 35 private unincorporated banks, which were illegal in most states but were allowed to function under war conditions. Specie in the 30 reporting banks, 26 percent of the total number of banks of 1811, amounted to $2.57 million in 1811; this figure had risen to $5.40 million in the 98 reporting banks in 1815, or 40 percent of the total. Notes and deposits, on the other hand, were $10.95 million in 1811 and had increased to $31.6 million in 1815 among the reporting banks.”

Essentially, the US government was financing its war operations with massive amounts of inflated bank notes which, when called due for final settlement in specie, sparked a near nationwide bank insolvency. In 1814, the US government gave the go ahead for all banks to temporarily suspend redemption of specie, but to remain open and continue their expansion of debt unabated.

Rothbard explains:

“Reporting banks increased their pyramid ratios from 3.17-to-1 in 1814 to 5.85-to-1 the following year, a drop of reserve ratios from 0.32 to 0.17. Thus, if we measure bank expansion by pyramiding and reserve ratios, we see that a major inflationary impetus during the War of 1812 came during the year 1815 after specie payments had been suspended throughout the country by government action.”

Rothbard expounds that although, during this particular point in time, there was no central bank in the United States (the National bank charter had lapsed under Jefferson) and misinformed historians often point to this as the cause of unchecked credit expansion, this monetary policy was similar to other expansionary periods which happened under the First and Second National Bank and, later, under the Federal Reserve System.

Coercion by the federal government, to secure wartime funding, drove the massive expansion of bank notes and credit, despite the lack of a central bank overseeing the process in this particular instance.

The federal government also issued large amounts of treasury notes which were “quasi-legal tender” and redeemable in specie one year after issuance. These notes took on a monetary role and were widely circulated and drove specie out of circulation (see Gresham’s Law).

Rothbard:

“Wholesale price increases from 1811 to 1815 averaged 35 percent, with different cities experiencing a price inflation ranging from 28 percent to 55 percent. Since foreign trade was cut off by the war, prices of imported commodities rose far more, averaging 70 percent. But more important than this inflation, and at least as important as the wreckage of the monetary system during and after the war, was the precedent that the two-and-a-half-year-long suspension of specie payment set for the banking system for the future. From then on, every time there was a banking crisis brought on by inflationary expansion and demands for redemption in specie, state and federal governments looked the other way and permitted general suspension of specie payments while bank operations continued to flourish.”

All of this new money and credit, in conjunction with rising commodity prices, set off an inflationary boom in 1817, which led to the deflationary bust in 1819 as the economy was snapped back to reality.

“Contraction of money and credit by the Bank of the United States was almost unbelievable, total notes and deposits falling from $21.9 million in June 1818 to $11.5 million only a year later. The money supply contributed by the Bank of the United States was thereby contracted by no less than 47.2 percent in one year. The number of incorporated banks at first remained the same, and then fell rapidly from 1819 to 1822, falling from 341 in mid-1819 to 267 three years later. Total notes and deposits of state banks fell from an estimated $72 million in mid-1818 to $62.7 million a year later, a drop of 14 percent in one year. If we add in the fact that the U.S. Treasury contracted total Treasury notes from $8.81 million to zero during this period, we get the following estimated total money supply: in 1818, $103.5 million; in 1819, $74.2 million, a contraction in one year of 28.3 percent.”

The Panic of 1857

As is the inevitable case with all fiat currency schemes, monetary expansion was the natural outcome. Large outflows of gold and silver from Mexico, due to the favorable premium on coinage in America, led to an exchange rate debasement of 16:1 in 1834 and, by the Coinage Act of 1853, all silver denominations were diluted further again.

By the 1850s, nearly half of the states in the Union had transitioned to what was called “free banking.” An important distinction here is that “free banking,” in the context of its political rhetoric sources, was not what economists traditionally considered free banking at the time.

The system of free banking that existed during this time period allowed the government to afford banks the “general suspension of specie payments whenever the banks over expanded and got into trouble,” as pointed out by Rothbard.

This means that, during times of crisis, banks were no longer liable to redeem their outstanding paper money certificates for the underlying metals. Free banking brought “a myriad of regulations, including edicts by state banking commissioners and high minimum capital requirements that greatly restricted entry into the banking business,” explains Rothbard.

In this way, competition in banking was heavily stifled by government intervention and normally, where overextended banks would fail during a time of liquidation, this liquidation was halted. But even more concerning;

“The expansion of bank notes and deposits was directly tied to the amount of state government securities that the bank had invested in and posted as bond with the state. In effect, then, state government bonds became the reserve base upon which banks were allowed to pyramid a multiple expansion of bank notes and deposits. Not only did this system provide explicitly or implicitly fractional reserve banking, but the pyramid was tied rigidly to the amount of government bonds purchased by the banks.”

Effectively, a bank’s ability to expand its credit and monetary base was directly tied to public debt. The more debt it purchased from the government, the more new money it could create and, in tandem, the more banks made use of this financial trickery, the more governments could expand their debt as well. This ability to expand credit and essentially soft default on that debt when it came due, through the suspension of specie redemption, is very important for what came next.

Starting in 1848, the American Gold rush was in full swing. A huge supply of new gold was introduced to the market creating strong inflationary signals. Seemingly, economic conditions were good. Investors and speculators engaged in rampant overleveraging.

By the mid 1850s, the supply of new gold began to dry up and, additionally, a large shipment of gold aboard the SS Central America was lost in the midst of a heavy storm. She was carrying approximately 30,000 pounds of gold to the shores of Eastern America at the time!

In the midst of these two deflationary events, the railroad companies booming around the growing westward expansion experienced a speculative stock bubble. Thanks to the abundance of cheap credit (and latent malinvestment), many of these companies were worth considerable amounts of money on paper but had no physical assets with which to run their business. Railroad stock values peaked in July 1857 and a slow market sell off began.

The Gold Standard

The subsequent fall out from these events lasted up until the Civil War at which point virtually all specie redemption stopped. The National Bank Act of 1863 forbade the issuance of any new state bank notes, finally giving a full monopoly of monetary expansion to the federal government.

With the groundwork having already been laid for paper money experiments in the colonial area, the United States switched from bimetallism to a paper currency backed by silver specie in order to fund the Civil War effort. This was colloquially known as the “green back system.”

Following the end of the war, the United States resumed redemption of specie but ended what was known as “free silver.” By 1873, the silver value of coins had dropped so low relative to their fiat face value that the United States soft abandoned bimetallism by ceasing the free and unlimited minting of silver coins with the Coinage Act of 1873. This was largely politically unpopular and led to 20 years of political strife over the alleged prosperity caused by monetary expansion under free silver.

The Sherman Silver Act of 1890 ushered in a period of inflation by decreeing an increase in the amount of silver purchased by the US government—to the tune of 4.5 million ounces of bullion a month. This caused a sharp increase in the paper money supply of the United States and encouraged rampant speculation.

The US treasury purchased the silver bullion using a special issue treasury note which could then be redeemed for either gold or silver, and a run on the gold reserves of the United States began. Artificially overvalued silver drove gold out of circulation and into hoards.

In the metals markets, silver was now worth less than the fiat exchange rate of silver to gold. Investors would buy silver from the booming mining economy, exchange it for gold with the treasury, and then sell the gold claims for a profit. These profits were then reinvested in more silver and on the cycle went.

This continued until the treasury nearly ran out of gold. President Grover Cleveland repealed the Sherman Act to prevent further loss of federal gold reserves.

By the end of 1890, the price of silver had dropped from $1.16 an ounce to $0.69 per ounce. By early 1894, the price had dropped to $0.60. By November of 1895, US mints entirely halted all production of silver coins and outright discouraged the use of silver dollars.

Runs were made on the US treasury gold reserves—not just by silver speculators but by European financiers as well—in anticipation of a spreading global financial turmoil. Concern over the weakening financial state of the United States led to bank runs and a nationwide liquidity squeeze as the malinvestment wrought by monetary expansion began to purge.

In the midst of this man-made regulatory fiscal crisis, global commodities prices (particularly that of wheat) tanked due to a cascade of liquidations in emerging markets. In 1894, the rate for a bushel of wheat dropped from its 14.7¢ 1893 price to 12.88¢ per bushel, continuing to fall all the way to 9.92¢ in 1901. Overleveraged US farming operations dependent on high international commodity prices went belly up.

By 1900, the United States established for the first time, a gold standard.

The Panic of 1907

The panic of 1907 was a period of monetary contraction leading to a financial/banking crisis which set the tone for the creation of a central bank in the United States (The Federal Reserve, with the previous National Bank having been abolished under the Jackson Presidency).

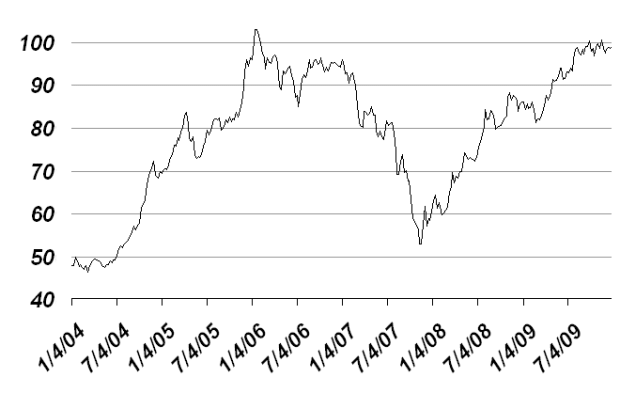

The panic coincided with the annual harvest season where money would flow out of the cities as harvests were purchased. To compensate for this, banks would raise interest rates. Taking advantage of these new interest rates, foreign investment became increasingly attracted to the New York markets. During this time and as well across the first half of the decade, the United States saw a massive run-up of the DOW Jones (seen below).

In April 1906, San Francisco had a 7.9 magnitude earthquake, prompting a large amount of money to make its way to the west coast. In late 1906, the Bank of England also raised its interest rates, slowing foreign investment in New York City.

That same year, the Interstate Commerce Commission passed the Hepburn Act which allowed for a ceiling to be placed on railroad rates. The result was a devastating blow to the railroad securities valuations and so began the market cascade. This was followed by a collapse in the price of copper, a failure in the New York City Bond offering (June 1906), and major antitrust fines against the Standard Oil Co.

At the time, the national banking system had no ability to inject artificial liquidity into the system and, naturally, the liquidation was painful. This was much to the chagrin of many of the bankers throughout the country.

Rothbard writes:

“In each of the banking panics after the Civil War, 1873, 1884, 1893, and 1907, there was a general suspension of specie payments. The panic of 1907 proved to be the most financially acute of them all. The bankers, almost to a man, had long agitated for going further than the national banking system, to go forward frankly and openly, surmounting the inner contradictions of the quasi-centralized system, to a system of central banking.”

“The Bankers found that the helpful cartelization of the national banking system was not sufficient. A central bank, they believed, was needed to provide a lender of last resort, a federal governmental Santa Clause who would always stand ready to bail out banks in trouble. Furthermore, a central bank was needed to provide elasticity of the money supply. A common complaint by bankers and by economists in the latter parts of the national banking era was that the money supply was inelastic. In plain English, this meant that there was no governmental mechanism to assure a greater expansion of the money supply—especially during panics and depressions, when banks particularly wished to be bailed out and avoid contraction. The national banking system was particularly inelastic, since its issue of notes was dependent on the banks’ deposits of government bonds at the treasury. Furthermore, by the end of the nineteenth century, government bonds generally sold on the market at 40 percent over par. This meant that every $1,400 worth of gold reserves would have to be sold by the banks to purchase every $1,000 worth of bonds—preventing the banks from expanding their note issues during a recession.”

It was following this crisis that a man named Nelson Aldrich (father-in-law of John D. Rockefeller) formed a commission to investigate and propose solutions to fix this “problem” of liquidation and money expansion.

The Federal Reserve

Nelson Aldrich proposed “The Aldrich Plan.” Congressman Vreeland (one of the bill’s coauthors) had the following to say on the proposal:

“The bank I propose…is an ideal method of fighting monopoly. It could not possibly itself become a monopoly and it would prevent other banks combining into monopolies. With earnings limited to four and one half percent, there could not be monopoly.”

It is important to remember that antitrust legislation was center stage around this time. Popularized, in particular, by the likes of the “Progressive Bull Moose’’ Theodore Roosevelt with his Sherman Antitrust Act of 1890. This framing of a central bank in the United States being necessary to prevent banking monopolies was crucial to its public acceptance. The reality of how central bank policy affected change could not be further from these claims.

Firstly, we know with absolute certainty that the measly “four and a half percent” Vreeland spoke about would fly out the window at the earliest opportunity, but the real wealth concentrating monopolization of the Federal Reserve would come in the form of monetary and credit expansion.

Secondly, artificial protections from the liquidations of malinvestment is, in effect, a legal monopoly for all beneficiaries, shielding banks from the consequences of market forces which, ordinarily, naturally direct capital allocation.

Cleverly, the Federal Reserve was set to be a private institution, and unelected bureaucrats would reside over its policy making. This was a convenient loophole to skirt the unconstitutionality of unchecked monetary expansion. Frankly, this relationship is the opposite of antitrust, as private government partnerships both create and sustain cartels via judicial and legislative capture.

The most important difference between the Federal Reserve and the national banks of the United States, which had existed in years prior, was the Fed’s ability to create the official money of the United States. Paper bank notes issued by the Fed became legal tender for both public and private debts. Notice the Constitution didn’t specifically prohibit a private institution from issuing bills of credit and the government then deeming it legal tender. For all intents and purposes, this was a deliberate obfuscation of US constitutional law.

One should note, there is very little presence of a “private institution” on these illegitimate bills of credit, they take on every role and appearance of being a government issue.

All of this was a carefully constructed facade to convince the public that the government was working to “break apart the money trust.” The public was thoroughly convinced that it was the centralization of financial power in Wall Street which caused the booms and busts actually created by government policy making. The Aldrich bill was the reform that promised to fix this problem for the American people.

As G. Edward Griffin put it in his brilliant expose, “The Creature from Jekyll Island: A Second Look at the Federal Reserve”:

“The public was, of course, outraged, and the pressure predictably mounted for Congress to do something. The monetary scientists were fully prepared to use this reaction to their own advantage. The strategy was simple: (1) set up a special congressional committee to investigate the money trust; (2) make sure the committee is staffed by friends of the trust itself; and (3) conceal the full scope of the trust’s operation while revealing just enough to intensify the public clamor for reform. Once the political climate was hot enough, the Aldrich bill could be put forward.”

Executive Order 6102 and the Emergency Banking Act

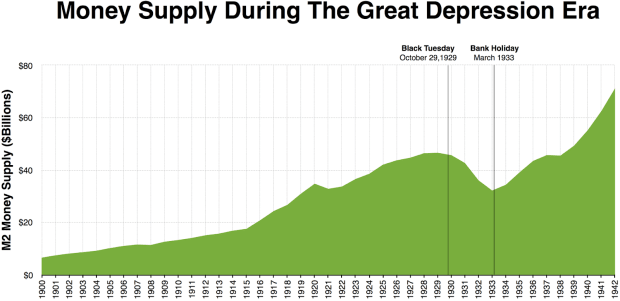

The restrictions on new money creation were eased by the FDR administration with the Federal Reserve turning over all of its gold to the treasury, under the Gold Reserve Act of 1934. One should note that monetary expansion began to increase in velocity particularly after the creation of the Federal Reserve in 1913 and into WWI.

The booming economy of the roaring twenties was a result of Mellon’s push to lower federal reserve interest rates in 1921 and 1924. The availability of cheap credit and cheap capital encouraged once again, rampant speculation.

In 1928, responding to the fear of a dangerous bubble in the stock market, the Federal Reserve began to raise interest rates. In 1929, the Fed raised the interest rates to 6% and yet still failed to stop rampant speculative activity in the markets.

Less than three months after this rate hike, came Black Tuesday. Historically, one of the worst financial crashes in the history of the United States. Mellon was a strange man. On one hand, he publicly proclaimed his disdain for economic intervention and yet, by 1930, he was already again calling for interest rate cuts (2% by mid-1930). The four-year devastation caused by the burst of this speculative bubble led to drastic reforms by the FDR administration.

The Emergency Banking Act of 1933 (EBA) was a series of reforms made by the federal government (driven by the FDR administration) to stabilize the banking system.

The act came directly on the heels of a nationwide banking holiday declared by FDR. These holidays were intended to halt the widespread bank runs. FDR made a great number of reforms during just the first year of his presidency.

The EBA was an amendment to the Trading with the Enemy Act of 1917 (TWEA) which originally gave the president power to restrict trade between the United States and foreign nations during a time of war (in particular, WWI), however, the TWEA was changed to also be usable in times of peace via a congressional amendment.

The EBA amendment was passed in a single night of chaos on the Congress floor with such haste that only a single copy was available to the House and was voted on after being read aloud. The act had two significant goals:

1. To reaffirm the Federal Reserve’s commitment to supply “unlimited currency” to banks which reopened after the end of the banking holiday

2. To establish a 100% deposit insurance for banks

All of these were temporary measures until the much more cohesive 1933 Banking Act.

The 1933 Banking Act was wide in scope, and it had many significant goals:

- Creation of the FDIC

- Separation of Commercial and Investment Banking

- Creation of the Federal Open Market Committee (FOMC)

- Reduction in competition between commercial banks

- Restriction in “speculative” uses of bank credit and removal of limits on total amount of loans that could be made by member banks

- Elimination of personal liability for new shareholders of national banks

- Tightly regulate national banks to the Federal Reserve, requiring member banks and holding companies to make three annual reports, given to the Fed

- Give national banks the same ability to establish branches in their home state as state chartered banks

Executive Order 6102 (EO 6102) was signed on April 5, 1933 (one month after the Emergency Banking Act), by President Franklin D. Roosevelt, “forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” This power was made possible by the Emergency Banking Act of 1933.

Many are aware of EO 6102 and its implications on the US markets at the time, but few realize that gold ownership actually remained illegal throughout the entirety of the Bretton Woods agreement which ran from 1944 to 1971.

“The private ownership of gold certificates was legalized in 1964, and they can be openly owned by collectors but are not redeemable in gold. The limitation on gold ownership in the U.S. was repealed after President Gerald Ford signed a bill to “permit United States citizens to purchase, hold, sell, or otherwise deal with gold in the United States or abroad” with an act of Congress…which went into effect December 31, 1974.”

Following this legislation to its logical conclusions, this means that it was actually illegal for US citizens to redeem their USD for gold held by the US Treasury under the Bretton Woods system!

EO 6102 was a direct and indefinite suspension of the redemption of specie, echoing over a century of similar policy making surrounding government-induced financial depressions. In other words, paper notes could no longer be redeemed for the gold by which it was supposedly backed. In fact, from 1933 to 1971, this settlement to the base layer of money was a right reserved only for sovereigns.

Bretton Woods and the London Gold Pool

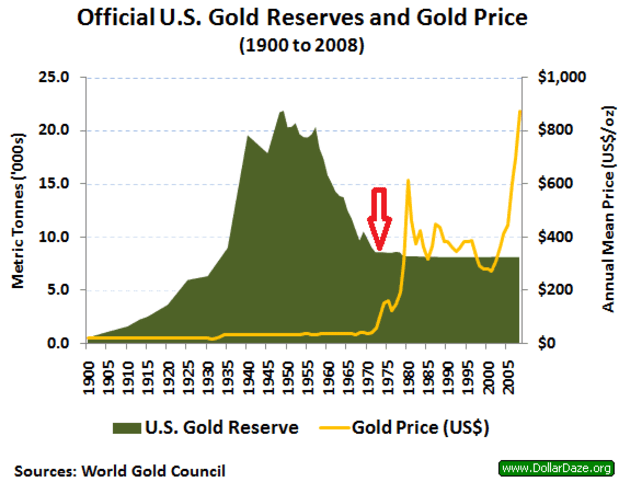

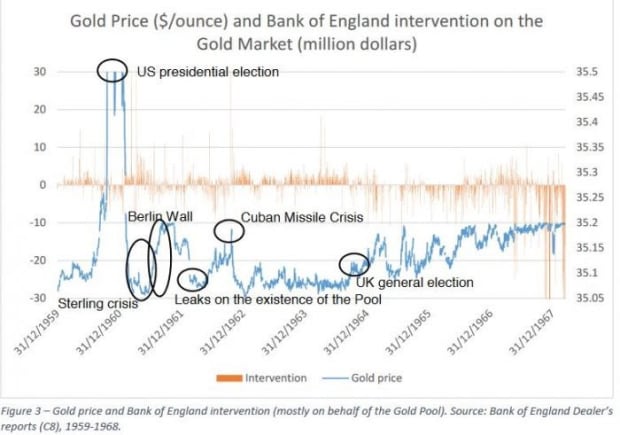

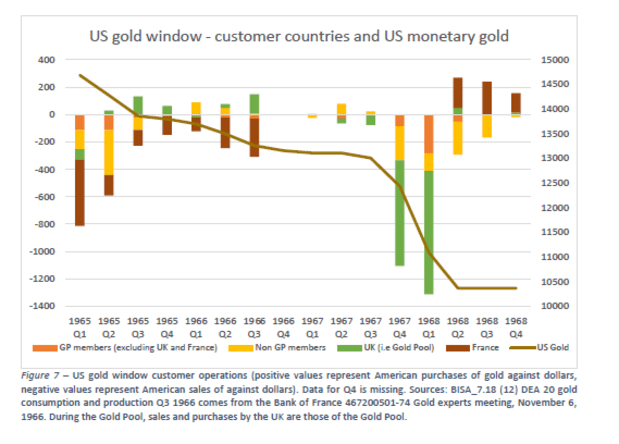

From 1961 to 1968, Western Banks corroborated in what was known as the London Gold Pool. The United States and a handful of European nations pooled their gold resources into the London gold exchange in an attempt to stabilize the price of gold around the fixed redemption rate of $35 per troy ounce.

This monetary experiment, just like every other attempt at market intervention and stabilization (attempt to subvert free market action), failed horribly and ultimately led to the closing of the gold window by Richard Nixon in 1971.

Perhaps its best to establish a timeline of events here. In 1933, EO 6102 not only made it illegal for US citizens to hold physical gold but also effectively prohibited them from redeeming treasury notes for gold. With the outbreak of war in Europe, the London Gold Pool closed its operations in 1939, effectively stinting international gold redemption under Bretton Woods (est. 1944) until the London Gold Pool reopened in 1954.

Notice here, that during this time period (roughly 1933–1954), US gold reserves were at their all-time high. Starting in 1961, central banks began cooperating in an attempt to stabilize gold prices via the London Gold Pool by providing excess gold if demand increased and providing buy pressure if demand started to drop.

In the first half of the 1960s, the pound sterling was under significant stress from various European geopolitical crises (seen below). As a result, increasing amounts of intervention were needed from central banks to maintain the desired gold exchange rates.

It was well known by sovereign financial ministries that the United States was benefiting disproportionately via the dollar peg by exporting inflation and running deficits to benefit from the seigniorage of dollar creation. In 1965, the De Gaulle administration of France (at direction of the finance minister, Jaques Rueff) announced intentions to begin exchanging dollars for gold in an attempt to close this deficit gap and force a return to an international gold standard.

These events had significant and expected impacts on the demand and price of the gold markets, starting around 1960, a dramatic decrease in US gold reserves occurred, all the way up until the collapse of the London Gold Pool in 1968. In effect, this financial loss can be viewed as the central banks’ (both the United States and The Bank of England) attempt to stabilize the London Gold Pool.

Here we see the United States fighting the same battle previously fought by the Japanese Shogunate, caused by their artificially soft and expansionary money policy under bimetallism. Despite the suspension of redemption of specie for all but the sovereign states, artificially soft gold notes were arbitraged for a profit which could be settled in finality on the base layer money (gold specie).

In 1969, the IMF passed legislation allowing the issuance of the SDR, technically the first fiat obligation not backed by a form of gold redemption under the Bretton Woods system, and the first step toward the establishment of floating global fiat reserve currencies.

As we know, Nixon ended the convertibility of the dollar for gold in 1971 (the backbone of the Bretton Woods system) and the adjustable peg disappeared entirely in 1973.

For a far more comprehensive look at these events, I would refer you to this research piece. Hopefully I have given you enough of an overview of these historical events to get a picture of how the incentives of the system disrupt its stability. This topic is complex, and despite the fact that the USD was the backbone of the Bretton Woods system, that isn’t to say they were the only nation to benefit from inflation and market intervention.

Bretton Woods was doomed to fail because of its misaligned incentives.

The events of 1971 were yet another form of soft default on obligations, except this time, rather than suspending redemption of specie to her constituency, the United States suspended redemption for every nation state under the Bretton Woods system.

And yet, despite this decree of irredeemability for paper to gold, the face value of dollars to gold was still fixed. Historically, this price was what gave the paper notes its value in the first place, specie was the base layer of money, but paper notes allowed gold to scale in an increasingly complex and global economy. In a case where paper notes can never be redeemed for the underlying specie, the exchange value is set by decree rather than by the market.

Hence the term “fiat.”

But what’s most interesting is how so many great abstractions on top of the monetary system disrupted the common man’s ability to reason that paper notes were originally a layer above specie. Rather, he began to think of paper notes as the base layer itself. This was to the great benefit of the nation state, who found it could create for itself a great deal of funding for a whole manner of twisted machinations at the expense of its currency holders (which could be diluted en masse).

Mounting global geopolitical and local socioeconomic pressures put a tremendous amount of stress on the system to continuously debase circulating currency supply to fund the next crisis.

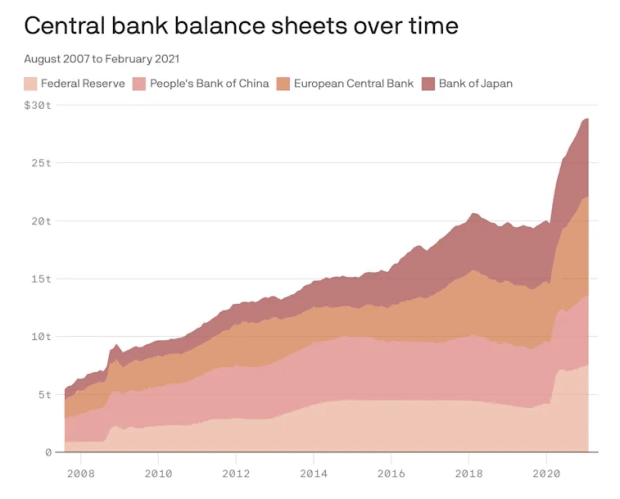

To better understand the consequences of indefinite suspension of settlement to the base layer, I suggest looking through my website called WTF Happened in 1971. Liquidation, which was once softened by temporary base layer settlement, has been supplanted by an indefinitely suspended expansionary system. The ripple effects continually grow in magnitude and severity as economic calculations are distorted on a global scale. Look no further than the dot com bust, the 2008 financial crisis, and the 2020 financial crisis for a glimpse at how unlimited credit expansion and expansionary monetary policy go hand in hand.

These are the inevitable results, increasing amounts of risk and leverage build up in the system, with no way to purge itself, beyond one final and total collapse.

A New Base Layer

Now that we have taken the time to properly understand the history of money, it should be obvious to us that bitcoin is not a fiat currency. In fact, it is not so tongue-in-cheek to call many aspects of modern society “fiat.” They are often, in fact, by decree rather than of an emergent and voluntary order.

It is disruption of settlement to the base layer of money, which has been co-opted so effectively over the last two centuries, that has abstracted away our ability to understand the monetary system. If you look at the markets today, the Federal Reserve’s expansion of the money supply, and the government’s ability to borrow and spend unabated, it seems to simply make no sense—that’s because it does not.

Credit expansion and the generational postponement of the liquidation of malinvestment is only possible under a system mired in numerous layers of decree over a co-opted monetary base layer. According to Ludwig von Mises, “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of the voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

The common argument against bitcoin proclaims it to be a fiat currency because it is “not backed by anything.” This abstraction assumes that all money must be redeemable for something, but this simply is not so. Gold bars are not redeemable for anything and yet they were once money. They were, in fact, the base layer of money.

Bitcoin has value because people are free and willing to exchange for it, at its spot price. It has no peg, no artificial face value, and the settlement stack cannot be given a mandatory holiday.

Bitcoin is a new base layer of money, one that, as Friedrich Hayek wrote, can “take the thing out of the hands of government.” he first global, self-clearing, real-time settled, bearer asset. One which solves the problems inherent in scaling precious metals for use at a global economic scale. Bitcoin is an economic social contract with distributed consensus surrounding the rules of play, noncompliant with co-option.

A money not prone to the pitfalls of centralized issuance and debasement. A money usable outside of the confines of centralized institutions which can rehypothecate and postpone the liquidation of notes to settlement on the base layer. A money which sidesteps the inevitable replay of events that would occur under a return to the gold standard.

Bitcoin is the first base layer money in which redemption of specie (or final settlement) cannot be suspended without consequence. The right to final settlement will not be afforded exclusively to the sovereign state, but rather, any individual may choose to become self-sovereign, by simply becoming a willing participant in the network.

Despite our storied history of shenanigans, humanity progressed forward in spite of the shaky foundations upon which our economic activity, or the means of making life worth living, was ensconced. Bitcoin is better than a return to the gold standard. Bitcoin is more than a silver squeeze..

Bitcoin is a new beginning. A new base layer. An opportunity to transition a new and better system, while the old one goes down in flames. A space for fair, open and voluntary cooperation outside the prescriptions of tyrants. A fresh start for what humanity could be instead of the unyielding fixations on what it should have been.

Bitcoin is not man commanding “Fiat Lux”, but rather a genius example of how he makes it so.

This post contains compilations of work previously written by the author and published separately.

This is a guest post by Heavily Armed Clown. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.