Ferrari to Extend Cryptocurrency Payments to Europe: Reuters

-

Ferrari wants “to support dealers in better addressing the evolving needs of its clients.”

-

Despite crypto’s popularity as an investment tool, it remains relatively rare for major companies to accept it as a means of payment.

05:58

BitPay Co-Founder on Launching Bitcoin Lightning Network Payment Services

08:42

What OnlyFans Stopping Sex Acts and Politicizing Payments Means for Crypto

03:51

Republican House Campaign Arm to Accept Donations in Crypto

03:13

Republican House Campaign Arm to Accept Donations in Crypto

Ferrari (RACE) will extend its provision for cryptocurrency payments to Europe by the end of July, Reuters reported on Wednesday.

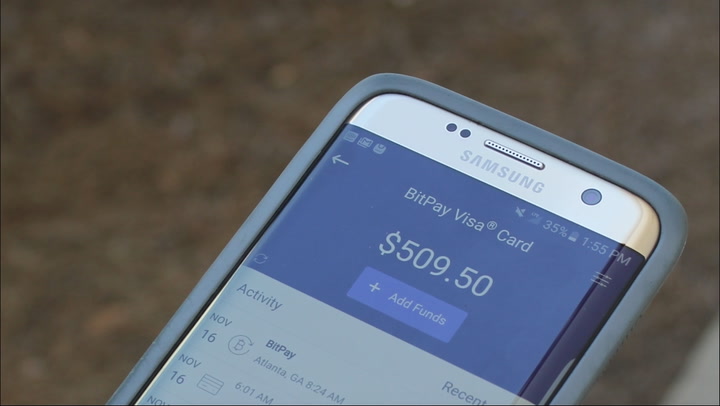

The Maranello, Italy-based luxury sports car manufacturer began accepting crypto in the U.S. last October, in partnership with BitPay. Bitcoin {{BTC}}, ether {{ETH}} and USD coin {{USDC}} were the tokens accepted.

Ferrari is now extending the program to Europe “to support dealers in better addressing the evolving needs of its clients,” Reuters said, citing a company statement.

The company plans to extend the service to other markets by the end of 2024.

Despite crypto’s popularity as an investment, it remains relatively rare for major companies to accept it as a means of payment, possibly due to lack of demand from customers. Crypto holders might not wish to spend their coins on everyday purchases out of concerns they’ll be worse off if the crypto’s value increases.

This may not be an issue with luxury items like cars, which also hold long-term value.

Neither Ferrari nor BitPay responded to CoinDesk’s request for comment.

Edited by Sheldon Reback.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a

strict set of editorial policies.

In November 2023

, CoinDesk was acquired

by the Bullish group, owner of

Bullish,

a regulated, digital assets exchange. The Bullish group is majority-owned by

Block.one; both companies have

interests

in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin.

CoinDesk operates as an independent subsidiary with an editorial committee to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/008ae87f-5c6e-412b-816b-ded600ac5054.png)