Fed’s Rate Hike Cycle Has Peaked, Investment Banks Say

-

Per investment banks, Federal Reserve policy is now sufficiently restrictive to put inflation back on track to the central bank’s 2% target and does not warrant additional rate hikes.

-

The end of the tightening cycle does not imply a quick return to zero interest rate policy, meaning the heady crypto bull market days of 2021-21 may remain elusive for some time.

The U.S. Federal Reserve’s (Fed) aggressive interest rate hike cycle, which kicked off in March last year and was partly responsible for roiling the crypto market, has ended, according to several investment banks.

The Fed in July raised its benchmark fed funs rate by 25 basis points to the 5.25%-5.5% range – bringing cumulative tightening since March 2022 to 525 basis points. The bank retained a data-dependent stance, indirectly leaving the door open for further tightening in the coming months.

However, ING’s Chief International Economist James Knightley doesn’t expect the Fed to walk the talk.

“On balance, this [Friday’s nonfarm payrolls] report doesn’t suggest any need for the renewed impetus for the Fed hiking interest rates again in September. The Fed has signaled a desire to tighten policy more slowly and the report appears consistent with the gradual cooling of the labor market,” Knightley, said in a note to clients after Friday’s payrolls report.

Knightley added that a couple more 0.2% month-on-month consumer price index (CPI) prints will “dampen the talk of a rate hike in September.” July’s CPI data, due later this week, is likely to show the inflation rate held steady at 0.2% month-on-month in July, and August inflation numbers will also be available prior to the Fed’s upcoming rate-setting meeting next month.

Markets doing the Fed’s job

There has been a notable tightening of financial conditions of late thanks in part to the dollar index’s 2.6% rise over the past three weeks. There’s also been the 10-year Treasury yield’s 40 basis points rise to 4.10%. That, argues Knightley, should allow the Fed to hold steady.

“The move higher in Treasury yields and the dollar in the wake of the Fitch downgrade and the US Treasury funding announcement only adds to our conviction that the Fed won’t need to hike interest rates further. These market moves in combination with higher volatility are tightening monetary conditions and will also put up mortgage rates and corporate borrowing costs,” Knightley said.

The Federal Reserve Senior Loan Officer Opinion survey released last week showed that 50% of banks tightened credit standards for commercial and industrial loans in the June quarter, up from 46% in the prior survey. It also said 40% of banks would likely tighten lending standards further.

“The fact that banks anticipate tightening lending standards further in the second half of the year increases the likelihood of an additional drag on economic growth. This is something to be mindful of as the economy navigates the coming quarters,” Wells Fargo’s economic research team said in a note to clients on Friday.

Policy sufficiently restrictive

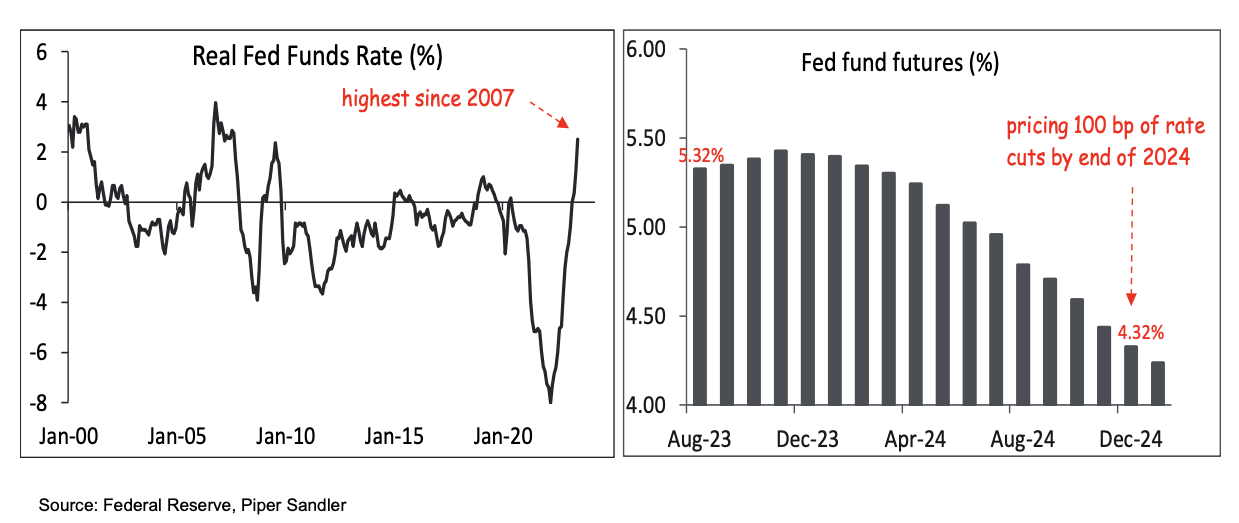

With the July rate hike to the 5.25%-5.5% range, the real or inflation-adjusted benchmark interest rate has climbed to over 2%, the highest since 2007, according to data tracked by Piper Sandler.

That weakens the case for continued rate hikes. Positive real interest rates are a widely accepted measure of a restrictive policy or measures that put inflation back on track to the Fed’s target of 2%.

“Our base case is that this was the Fed’s final rate hike for this tightening cycle, as the real Fed funds rate has climbed to its highest level since 2007 (right chart), suggesting economic conditions have turned notably restrictive,” Piper Sandler’s research note dated July 28 said.

Return of animal spirits?

A potential end of the tightening cycle does not necessarily mean a quick pivot to liquidity-boosting rate cuts and a return to the 2020-21 like bull market.

Back then, most central banks, including the Fed, were pumping record amounts of money into the system through zero interest rate policy and unlimited bond buying to help the global economy absorb the shock from the coronavirus pandemic. They are unlikely to revert to the ultra-easy policy in the near term. Recently, the Bank of Japan, the last heavyweight running a loose monetary policy, has begun turning hawkish.

“We see central banks being forced to keep policy tight to lean against inflationary pressures. This is not a friendly backdrop for broad asset class returns, marking a break from the four decades of steady growth and inflation known as the Great Moderation,” BlackRock said in a weekly market note on July 31.

Edited by Stephen Alpher.