Fed Seen Holding Rates Steady, but Policy Statement and Press Conference Will Be Key for Bitcoin

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

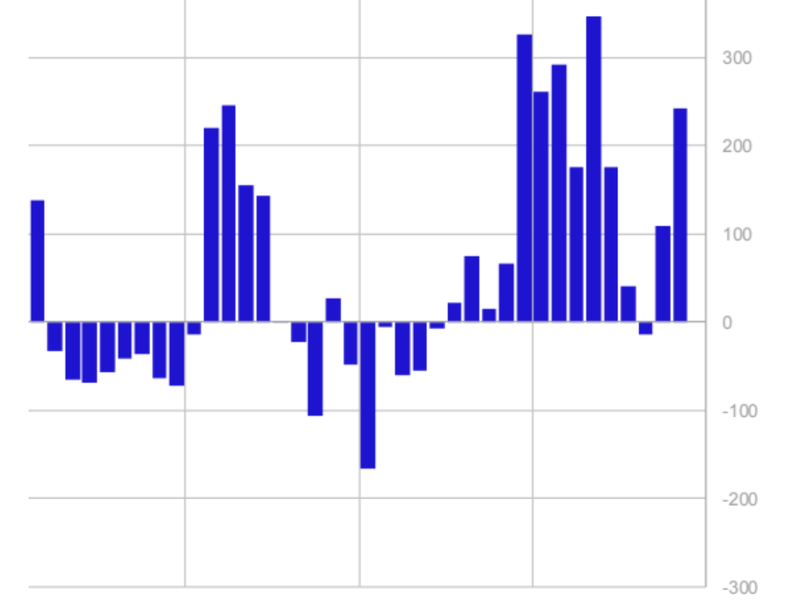

The Federal Reserve’s Federal Open Market Committee (FOMC) is universally expected to hold its benchmark fed funds rate steady at 5.25%-5.50% at the conclusion of its two-day policy meeting on Wednesday afternoon.

Traders in both traditional and crypto markets will be focused on the rate decision’s accompanying policy statement and Fed Chair Jerome Powell’s post-meeting press conference for clues about the future direction of monetary policy.

Fed speakers over the past few weeks have suggested the central bank is likely to hike interest rates one more time (timing undecided) before concluding what’s been a historic rate hike cycle that’s taken the fed funds rate from 0% in March 2022 to the current 5.25%-5.50%. Recent wobbles in financial markets, some softening economic indicators and a new leg higher in geopolitical tensions, however, could give the Fed an opening to back away from the idea of any more rate hikes.

Bitcoin’s strong October breakout from the $27,000 area has been stalled in the $34,000-$35,000 area for the past week, perhaps awaiting fresh fuel. While any dovish signal from the Fed could provide a push out of that range, few are expecting it. “We still see another U.S. rate increase as unlikely in the current cycle,” Matthew Ryan, head of market strategy at Ebury, told CNBC. “As a compromise, we think that the Fed will stress that rate cuts are not on the cards anytime soon, with easing to begin no sooner than the second half of 2024.”