Fed Holds Policy Steady, but Sees Just One Rate Cut This Year

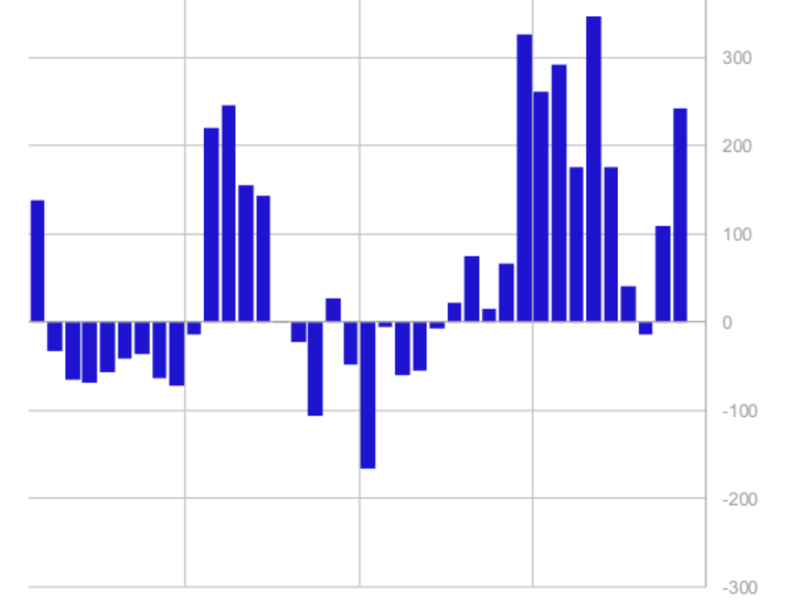

As expected, the Federal Open Market Committee of the U.S. Federal Reserve Wednesday held its benchmark fed funds rate range at 5.25%-5.50%, but its economic outlook now calls for just one 25 basis point rate cut this year.

“In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective,” said the FOMC in its policy statement. The “modest” wording is notable because the previous policy statement complained of a “lack of progress” towards lower inflation.

40:42

How Much Money Will Flow Into Bitcoin ETFs? Here’s One Projection

01:26

Bitcoin Investor Sentiment Shifting Towards the Negative: Glassnode

01:16

Bitcoin and U.S. Real Yield Notch Strongest Inverse Correlation in Four Months

04:18

Binance Receives License to Offer Bitcoin Services in El Salvador

Updating its economic projections, the Fed’s median expectation for the fed funds rate at year-end 2024 is now 5.1% versus 4.6% three months ago. This means the central bank is now anticipating just one 25 basis point rate cut this year versus 75 previously. The 2025 year-end fed funds expectation is now 4.1%, suggesting 100 basis points in rate cuts next year.

Earlier today, the U.S. Consumer Price Index report for May showed an unexpected slowdown in inflation last month. The news sent crypto, stock and bond markets sharply higher as traders ratcheted upward their expectations for the commencement of Fed rate cuts. The hawkish change to the 2024 rate outlook has taken some of the steam out of the bitcoin (BTC) rally, taking the price to $69,100, still up 3.5% over the past 24 hours.

U.S. stocks remain sharply higher, with the Nasdaq ahead 1.7% and the S&P 500 1%. The dollar index remains under pressure, but off session lows and down 0.5%. The 10-year Treasury yield has ticked higher, but remains lower by 12.5 basis points for the day at 4.28%.

Still ahead is Fed Chairman Jerome Powell’s post-meeting press conference to begin at 2:30 p.m. ET at which he’ll give more color on the central bank’s thinking with respect to today’s decision and monetary policy going forward.