Fed Chair Minneapolis: Crypto is 95% Fraud, Hype, Noise, and Confusion, But Is It Really?

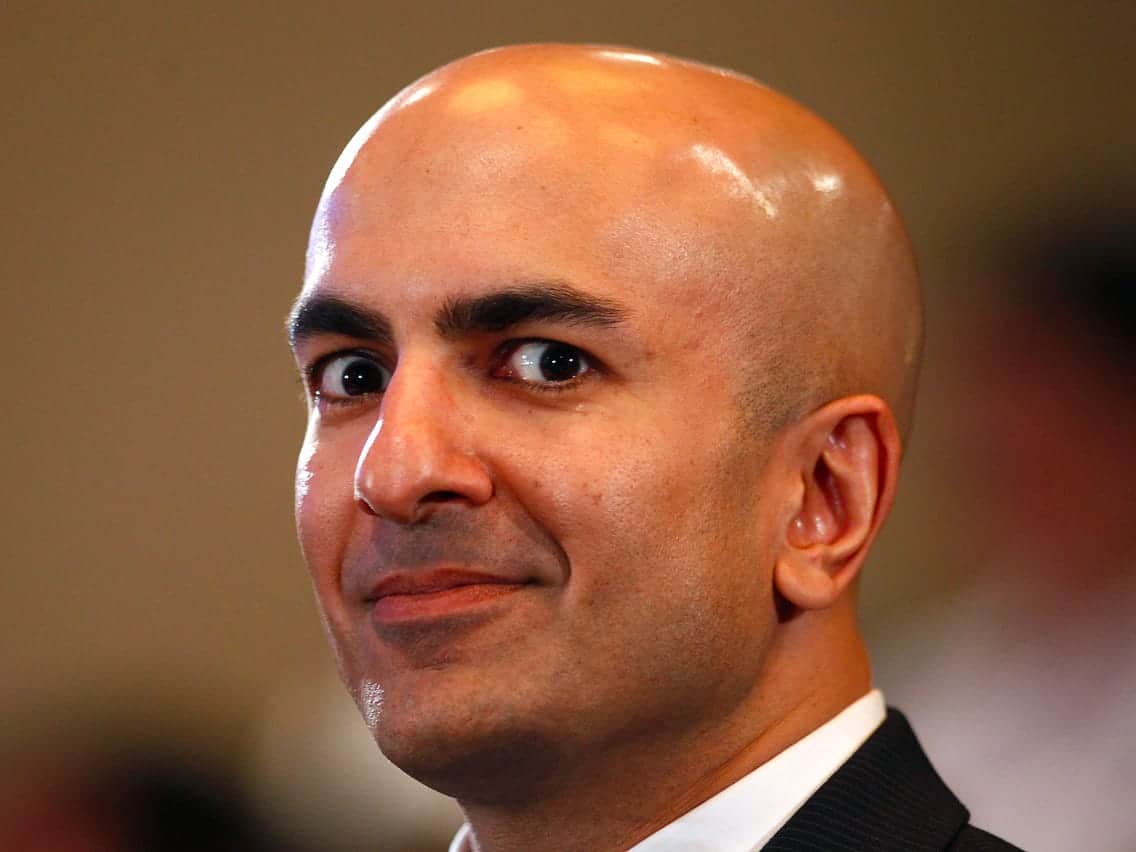

The President of the Federal Reserve Bank of Minneapolis – Neel Kashkari – opined quite negatively on the crypto industry and especially bitcoin. He referred to many digital assets as “garbage” and claimed they are “complete Ponzi schemes.”

Kashkari’s Hostile Stance on Crypto

During an appearance at the Pacific NorthWest Economic Region annual summit in Big Sky, Mont., the President of the Federal Reserve Bank of Minneapolis – Neel Kashkari – heavily criticized bitcoin and the cryptocurrency industry in general.

The central banker admitted that he had more faith in digital assets’ merits a few years ago. Now he sees them as “95% fraud, hype, noise, and confusion.”

It is worth noting that 5 or 6 years back, the cryptocurrency industry was not that settled, and the whole space was much more unpredictable. What’s more, many watchdogs put virtual assets under their scope and incorporated rules in the space, which could significantly reduce the risks of scams.

This is further supported by Bitmain’s former CEO – Jihan Wu. The founder of the crypto mining company opined that regulations are necessary and beneficial for the industry as they could isolate it from bad actors and fraudulent activities.

Kashkari continued with his bashing comments as he claimed that most of the cryptocurrencies are “garbage” and “Ponzi schemes” that trick people into allocating funds but, in the end, leave investors broke. Furthermore, he opined that their use case is mainly related to illegal operations such as drug trafficking and prostitution.

While this is true for many altcoins that have turned out to be a scam, it’s questionable, to say the least, to put all of them under the same roof. Bitcoin, for instance, is being accepted as a digital store of value by many prominent investors and institutions.

This became even more so throughout the period of a global pandemic. Putting it in the same basket as other cryptocurrencies is inappropriate. Many others, such as Ethereum, Polkadot, Binance Coin, and so forth, have also proven their worth as legitimate digital currencies that people use on a daily basis for various purposes.

Cryptocurrency adoption on a higher level could improve the lives of poor minorities and people in need around the globe. For example, Kenya – a country with deep financial problems – contemplated replacing its devaluating national currency with bitcoin. Officials of the country’s central bank noted that the primary digital asset could put an end to the monetary issues.

The Coin Always Has Two Sides

While Neel Kashkari criticized bitcoin and the entire cryptocurrency industry, many other prominent investors opined completely differently.

One of Apple’s inventors, for example, believes in the future of BTC and described it as a “mathematical miracle.” Steve Wozniak argued that the primary virtual asset would even replace gold as a store of value.

Speaking of bitcoin supporters, Michael Saylor is a name that typically stands out. MicroStrategy’s CEO recently referred to the cryptocurrency as the most appropriate investment tool in times of increasing inflation. He further opined that BTC outperforms gold by “a factor of 50.” Moreover, Saylor said that Ethereum and stablecoins have a spot in the ecosystem as well.

In his turn, the co-founder of Andreessen Horowitz – Marc Andreessen – highlighted cryptocurrencies and blockchain technology as a financial revolution. He praised bitcoin as a “fundamental technological transformation,” which network provides numerous options to investors.

Some of the crypto proponents include rock stars and singers, too. Gene Simmons – the bassist of the iconic rock band KISS – recently revealed he is a bitcoin hodler. Apart from his investment in the primary digital asset, “The Demon” also bought Cardano (ADA) at the beginning of 2021.

Featured Image Courtesy of NYTimes