FDIC Chair: US Regulators Work on Rules How Banks Can Hold Cryptocurrencies

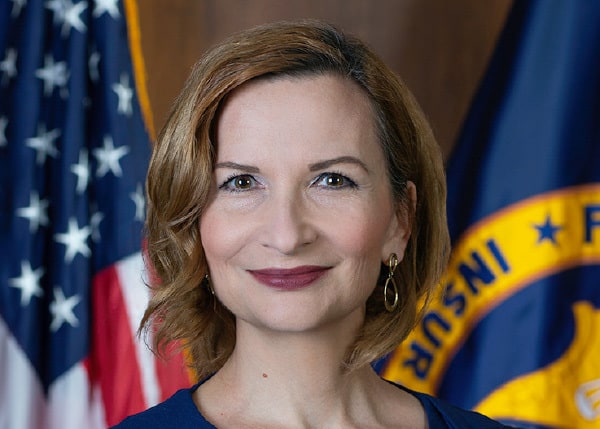

The United States will aim for clear regulatory rules to enable banks and their customers to hold and operate with cryptocurrencies, said the FDIC chair, Jelena McWilliams.

As such, the positive developments coming from the world’s largest economy continue as the nation recently had its first Bitcoin Futures ETF.

US Banks to Hold Crypto?

Up until a year ago, banks and cryptocurrencies were two mutually exclusive terms as the former refused to acknowledge even the mere existence of digital assets.

The landscape started to change in the US at the start of this year with BNY Mellon – the country’s oldest bank – which announced Bitcoin custodial services. Many others followed, and even former well-known critics such as JPMorgan and Goldman Sachs launched pro-digital asset initiatives.

US banks could take it a step further, according to Jelena Williams, the chair of the Federal Deposit Insurance Corporation (FDIC). During a recent speech, she said local regulators are working on a roadmap for banks to enhance their engagements with cryptocurrencies.

Those include clear rules on how banking institutions can hold digital assets in custody. She also feared that other organizations could take this role if banks were not allowed.

“If we don’t bring this activity inside the banks, it is going to develop outside of the banks. The federal regulators won’t be able to regulate it.” – she told Reuters.

McWilliams added that the FDIC has partnered with the Federal Reserve and the Office of the Comptroller of the Currency in this initiative.

The Latest US-Crypto News

With some world governments separated into two main camps lately – pro-crypto such as El Salvador and anti-crypto like China – all eyes were on the United States to determine its approach.

The country was somewhat indecisive, with many digital asset proponents blaming the authorities for the lack of actions while other nations were launching ETFs and adopting cryptocurrencies.

However, the US has become significantly more active in the past few months. It began with Fed Chair Jerome Powell saying the country has no plans to follow China’s path and ban digital assets, which was later echoed by SEC boss Gary Genser.

Even more positive news came last week when the first-ever Bitcoin Futures ETF launched in the States after years of waiting. Shortly after, another one reached Wall Street. Nevertheless, the community still anticipates the release of the first spot-based BTC ETF.