FATF Recommends Heightened Restrictions On Virtual Assets And Service Providers

In its updated guidance on virtual assets and virtual asset service providers, the FATF recommends requiring more strict KYC/AML measures.

The Financial Action Task Force (FATF) has updated its “Guidance for a risk-based approach to virtual assets and VASPs.” Previous FATF guidance, released in 2015 and updated in 2019, has recommended regulating virtual assets in a similar way to traditional finance, mandating customary KYC/AML laws that affect most financial entities.

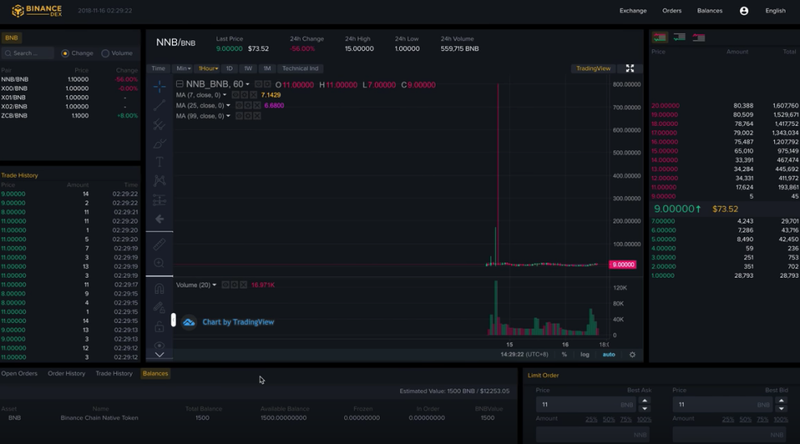

The new updates would alter this dramatically, encouraging heightened restrictions and surveillance on virtual asset service providers, or VASPs. The latest guidance includes expansion on what constitutes VASPS, and could potentially be interpreted as including Lightning Network node operators. This type of categorization would require participants to collect vast amounts of information on the activities of others, and could essentially prohibit KYC-free use of decentralized networks.

FATF is an intergovernmental organization tasked with developing policies that combat money laundering and financial crimes. Although FATF guidance is not legislative, it establishes the practices to which its member financial entities are expected to subscribe. The updated guidance places emphasis on transactions with non-obliged entities, i.e., private bitcoin wallets.

The guidance includes “denying licensing of VASPs if they allow transactions to/from non-obliged entities,” indicating a serious intention to place surveillance regulation around the transaction flow of virtual assets.

It goes on to recommend, “placing additional AML/CFT requirements on VASPs that allow transactions to/from non-obliged entities.”

The document also suggests that VASPs be regulated under The Travel Rule for all transactions. The Travel Rule, which only applies to regulated entities in the United States, would force custodians and exchanges to survey and report any transactions done by their customers. This could be extremely problematic for non-custodial liquidity providers like node operators.

It is increasingly clear that regulatory entities want greater control and transparency over the inherently decentralized world of virtual assets. By releasing updates which focus on centralization, the FATF fails to address the gap between regulation and reality, as the decentralized nature of the virtual asset industry naturally circumvents many of the described regulatory guidances. The FATF is accepting public comments until April 20, and the current document remains a draft.