Fake PayPal USD Tokens Pop up on Several Blockchains

Scammers are trying to defraud unsuspecting users, capitalizing on PayPal’s (PYPL) recently launched dollar-pegged PayPal USD (PYUSD) stablecoin, by issuing fake tokens on various networks.

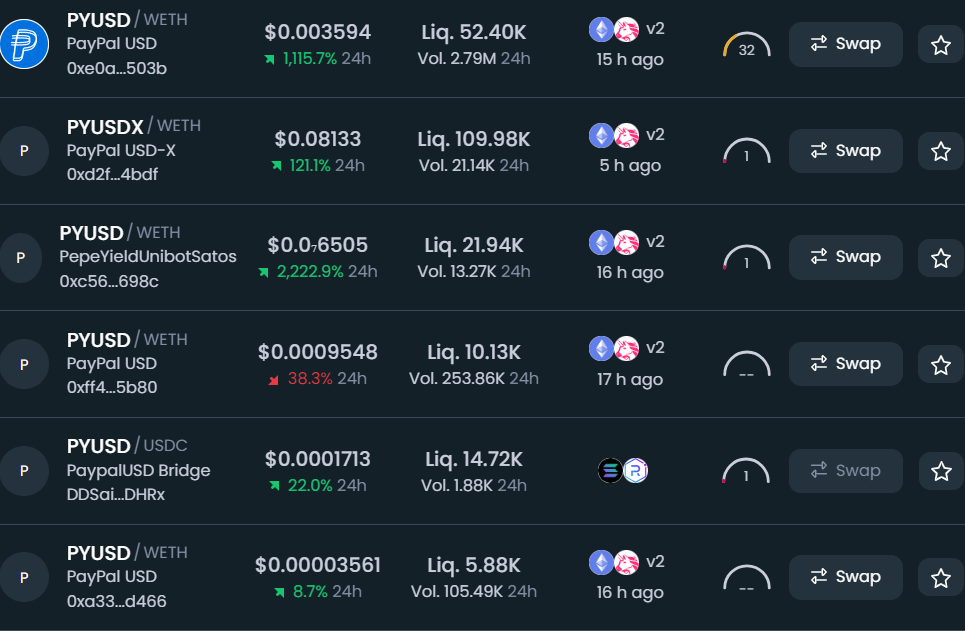

Over 66 fake tokens have propped up on networks, such as Ethereum, BNB Chain, Base, and others as of Asian noon hours on Tuesday, DEXTools data shows. The majority of these have been floated on Ethereum, where the original PYUSD exists.

New York-based payments giant PayPal said on Monday that it will soon make its PayPal USD (PYUSD) stablecoin available to users, marking the first time a major financial company is issuing its own stablecoin.

Users can transfer PYUSD between PayPal and supported external digital wallets, use the tokens to pay for goods and services or convert any of PayPal’s supported cryptocurrencies to and from PYUSD.

While the tokens are yet to come, some scammers are already trying to trap unsuspecting users. The modus operandi is to issue a token, name it “PYUSD,” add liquidity with ether or another token and offer it to users on a decentralized exchange.

This is possible as anyone can call a smart contract and issue tokens on Ethereum (or other blockchains) for a few cents, and the presence of decentralized exchanges means tokens can instantly be issued, supplied with liquidity and traded soon after.

Most of the supply of these tokens are likely purchased by their creators after issuance, giving the illusion of a trendy token while being a honeypot in reality. The hustle may yield a few thousand dollars in a few hours for such developers – making it a profitable, albeit wholly unethical, venture.

Some developers may, however, pull all liquidity from the fake tokens hours after issuance, causing prices to drop 100% and leaving speculators holding digital dust.

Edited by Parikshit Mishra.