Eye-Popping Projection for $3T Crypto Market Underpins Bakkt Deal

Eye-Popping Projection for $3T Crypto Market Underpins Bakkt Deal

Cryptocurrencies could grow fivefold by 2025 into a $3 trillion market, under new projections from Bakkt Holdings, the digital-asset financial firm.

Bakkt published the estimate as part of an investor presentation released Monday in connection with its new plan to go public via a merger with Victory Park Capital, a special-purpose acquisition company. Bakkt is majority-owned by Intercontinental Exchange Inc., which also owns the New York Stock Exchange. The deal would give Bakkt an enterprise value of about $2.1 billion, according to a press release.

The underlying assumptions behind the transaction show just how bullish investors, entrepreneurs and financial executives have become over the past year on the fast-paced digital-asset industry, especially after prices for bitcoin, the largest cryptocurrency, quadrupled in 2020.

Just last week, the industry’s total market capitalization surpassed $1 trillion for the first time, though a swoon over the past few days in prices for bitcoin and other digital assets has since trimmed the total value to about $931 billion, according to the website CoinGecko.

Bakkt currently runs a market for cryptocurrency derivatives including bitcoin futures, but in March the company plans to release a new consumer application that could allow users to manage digital assets and use them for spending and peer-to-peer payments alongside cash and rewards miles.

“It’s these shifts that we are leveraging for the benefit of both customer and merchants, truly unlocking a massive market by empowering the monetization of digital assets,” Gavin Michael, former head of technology for Citigroup’s global consumer bank, told investors Monday on a conference call, according to a transcript.

In the investor presentation, Bakkt estimated that its revenue, net of transaction-related expenses, could grow by an average 75% per year to $515 million by 2025. The company is expected to turn cash-flow positive by 2023.

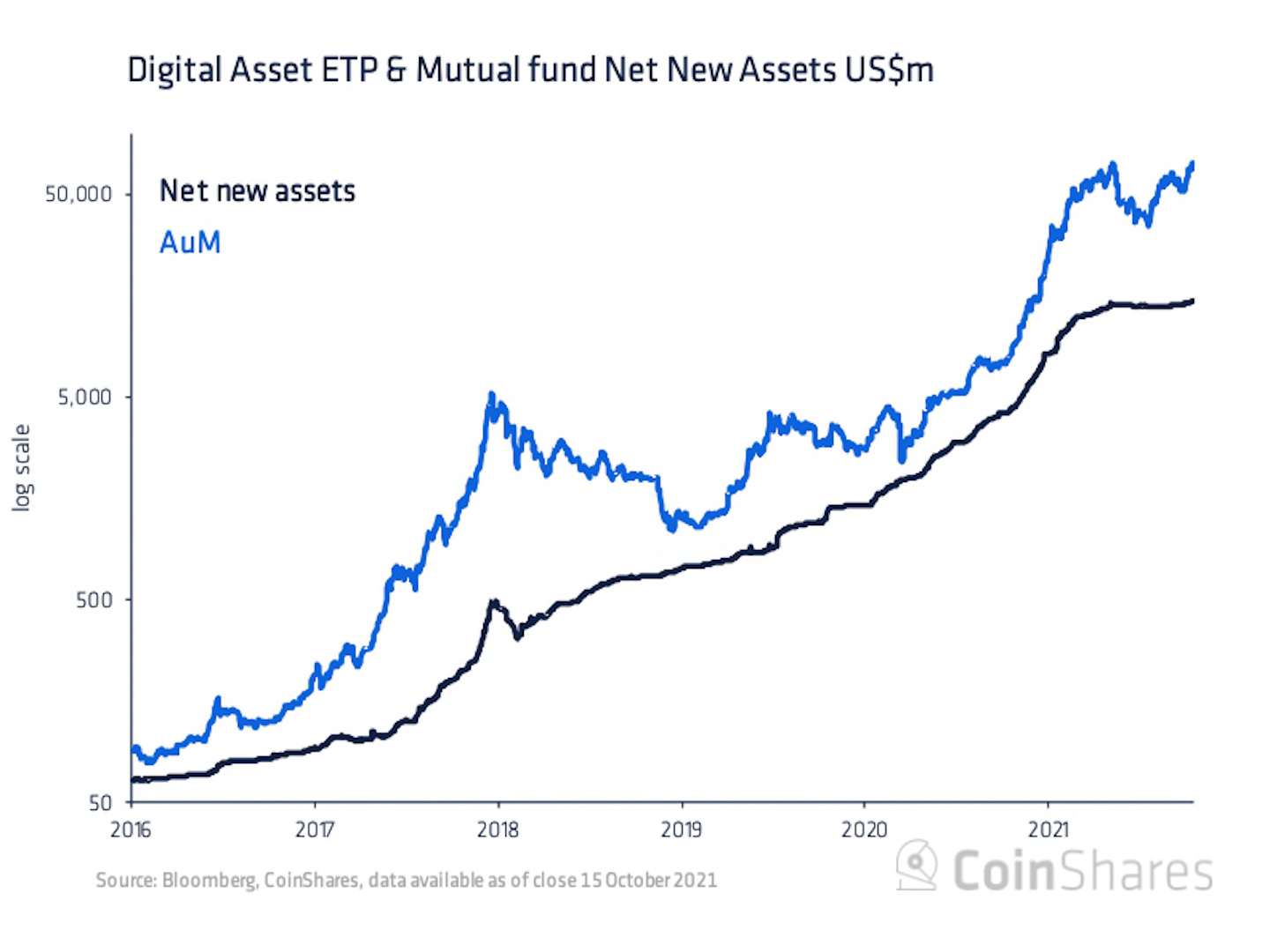

According to one slide in the investor presentation, Bakkt operates in a “massive serviceable addressable market” that was worth about $1.6 trillion in 2020, including $564 billion for the “notional value” of cryptocurrency.

By 2025, the presentation estimates, the company’s overall target market would increase to $5.1 trillion, including $3 trillion of cryptocurrency.

Here’s the diagram from the presentation: