Exchange Inflows Spike As LFG Moves Bitcoin Reserves

The Luna Foundation Guard was forced to send a majority of its holdings to exchanges as it tried to hold the dollar peg for its Terra stablecoin.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

LFG Exchange Inflows

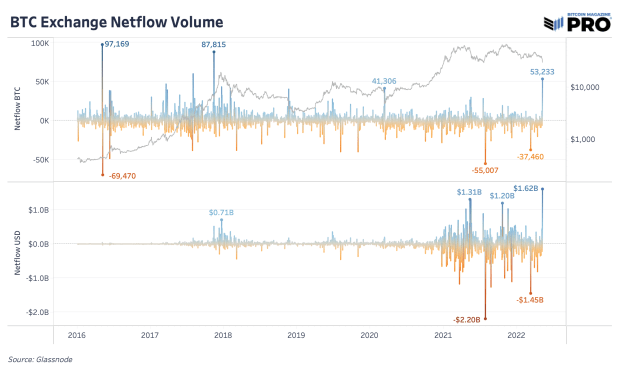

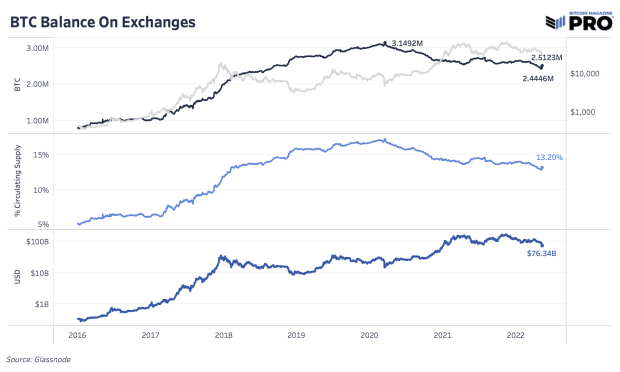

As a result of this week’s chaos, exchanges had an estimated 52,333 of bitcoin inflows largely driven by the depletion of the Luna Foundation Guard (LFG) reserve balance. This doesn’t change the larger macro trend of exchange outflows over the last two years, but it is the largest daily inflow of bitcoin to exchanges since November 2017 and the all-time highest USD value of bitcoin moved.

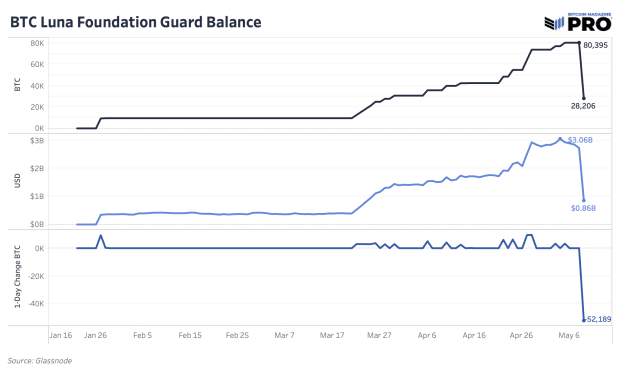

From what we know so far, without a clear LFG statement yet on the latest status of reserves, 52,189 bitcoin has left known addresses dropping the reserve balance from 80,395 BTC to 28,206. At peak, that was nearly $3 billion in reserves (with a $10 billion goal) to support Terra’s previous $18 billion market cap. A large chunk of 37,836 BTC (approximately $1.13B) looks to have been sent to Gemini.

Total reserves fell after LFG announced that $750 million in bitcoin was deployed as a loan to market makers with efforts to defend the UST peg. It’s not as clear as to the exact percent of reserves that were completely sold on to the market versus what’s been loaned to market makers. The question now is how much bitcoin will make its way back to LFG’s reserves, or back to the market amid another potential wave of sell pressure if the recovery efforts fail and trust in this stablecoin experiment doesn’t return?

Although this was a historic inflow day, it’s a relatively small total monthly inflow as a percentage of market cap so far. Similarly, on a 30-day rolling basis, exchange outflows are still dominant with 15,012 BTC outflows from exchanges up from nearly 100k BTC in outflows at the recent peak.

April 2022 was the third-highest exchange balance outflow month of all time. Across both March and April, nearly 161,000 BTC left exchanges while so far, May has an estimated inflow of nearly 51,000 BTC nine days into the month.

With markets becoming more sophisticated over time, balances on exchanges alone don’t tell the whole story — with fairly noisy, insignificant correlations to short-term price action when looking at rolling 90-day correlations using 30-day flows. Exchange balances are still useful at understanding flows, monitoring economic activity and analyzing longer-term trends, but they are certainly nuanced.

Subscribe to access the full Bitcoin Magazine Pro newsletter.