Exactly 4 Years Since The $152 Capitulation Candle Which Ended The 2014 Bear Market

TL; DR

The 2014 bear market ended with a capitulation candle that reached low of $150 per Bitcoin on January 14th, 2015. Many see the 2014 bear market as similar to 2018 one and are wondering if capitulation of the current bear market has already been seen.

Patterns in the price of Bitcoin emerge very often and usually provide nothing more than an educated guess about what direction the crypto markets might move next. On a smaller time scale, these patterns are highly unpredictable, but on a larger time scale, there tends to be more consistency and the educated guesses derived from previous key moments in Bitcoins price history can give traders a high probability of success in predicting the future.

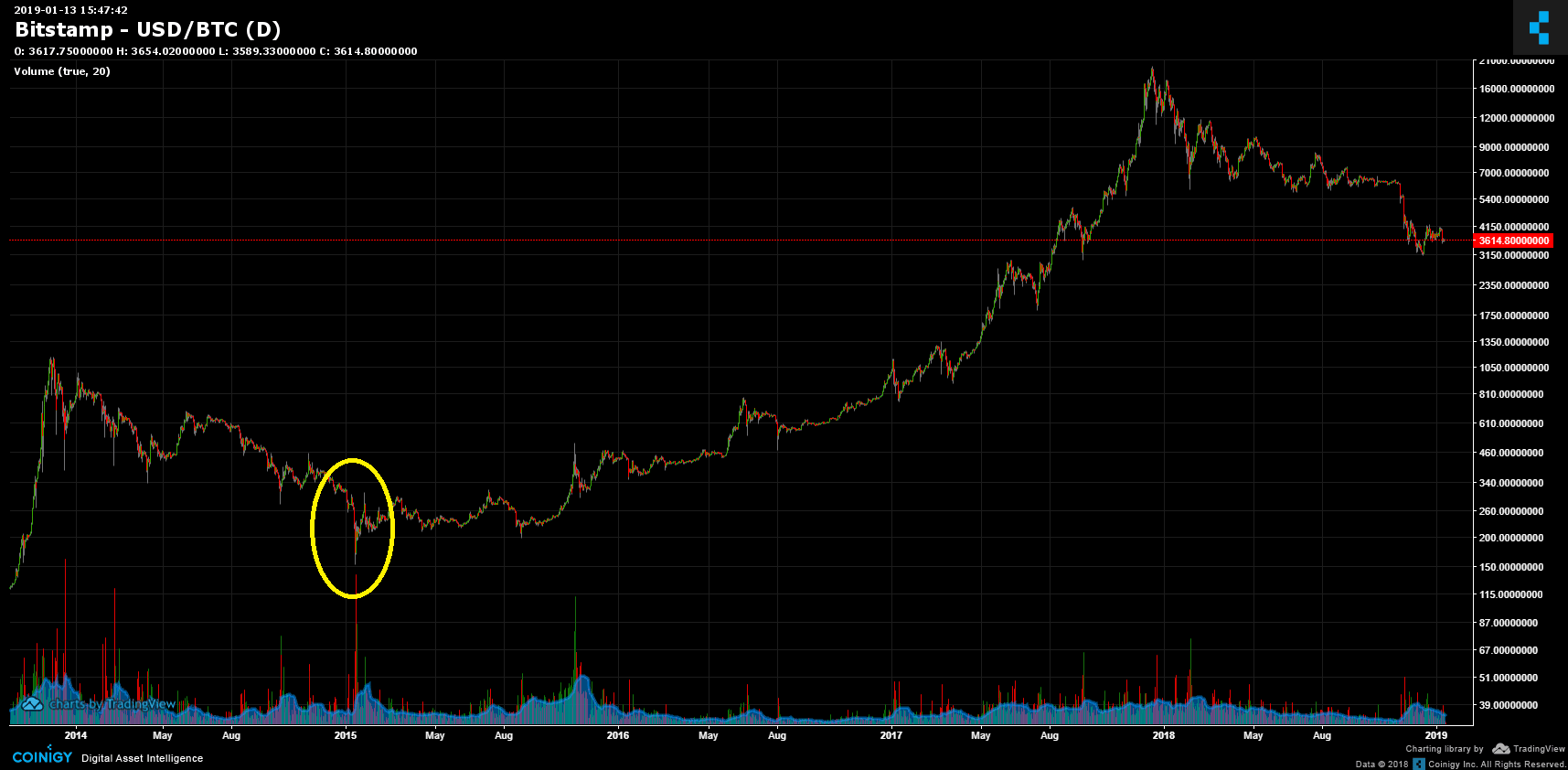

Many crypto traders see the high similarity between the Bitcoin chart of 2014 to the chart of 2018. With that said, looking at the price movements of Bitcoin in January 14th, 2015 and comparing it to today, we’ve discovered a pattern that may indicate that we’ve already experienced the bear market ending capitulation candle.

Capitulation means merely the action of surrendering or ceasing to resist an opponent or demand. In trading, the capitulation is the last stage of the typical market cycle when traders give up on the possibility of prices going back up and sell their positions out of fear of losing more money. Traders believe that this signals that the worst has come to pass and now it’s time for the pattern to reverse.

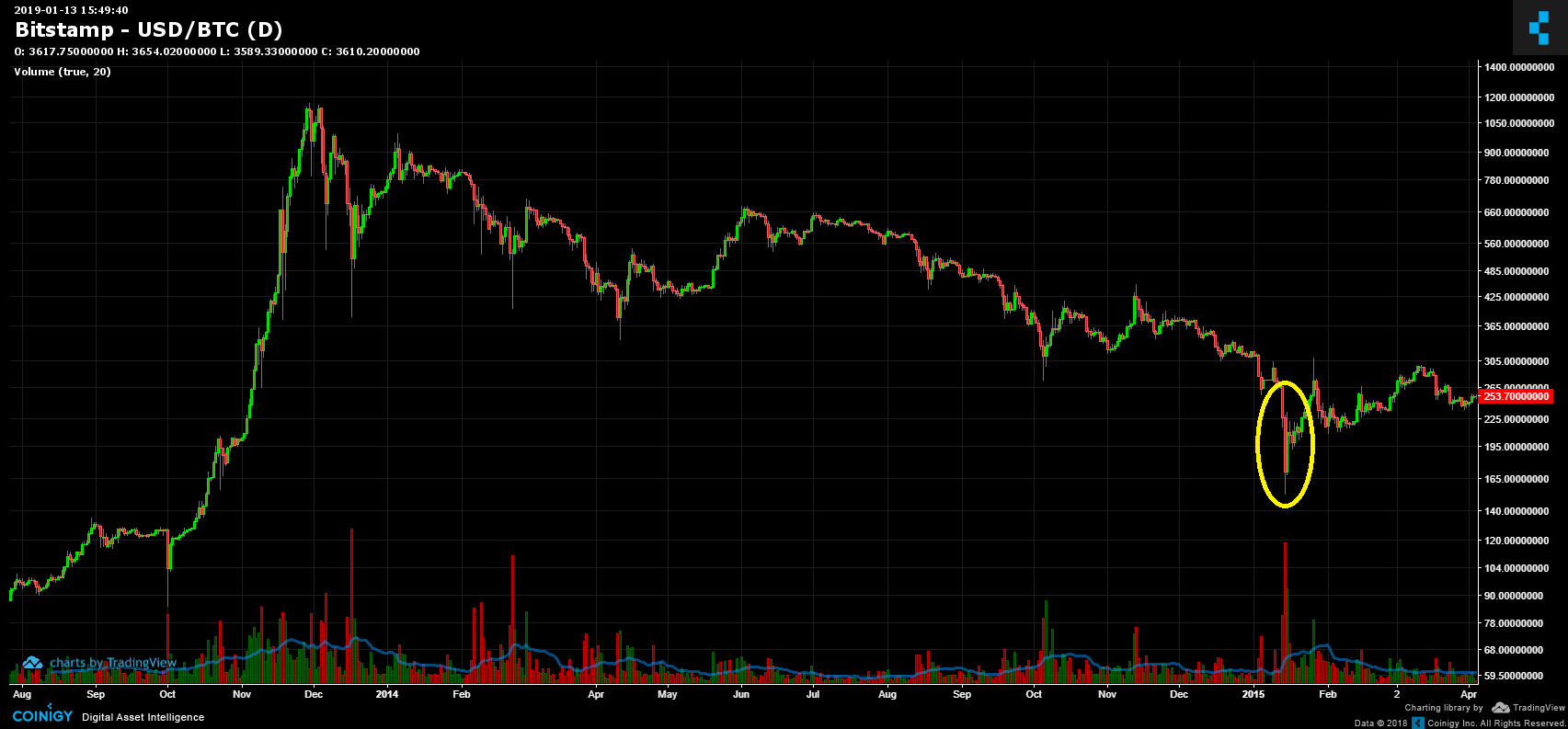

As illustrated below, the 2014 bear market saw its capitulation candle occur precisely four years ago, on January 14th, 2015.

BTC recorded a yearly low of $152 (Bitstamp). However, this was not the beginning of the bull market, as it was followed by eleven months of ranging between $200 and $320 before the price finally shot up to $500 in November 2015, then starting forming higher highs, which signaled the start of the bull market of 2016 and 2017. The bull market which recorded Bitcoin’s all-time high price of almost $20K per coin.

Have we seen the 2018 desirable market’s capitulation?

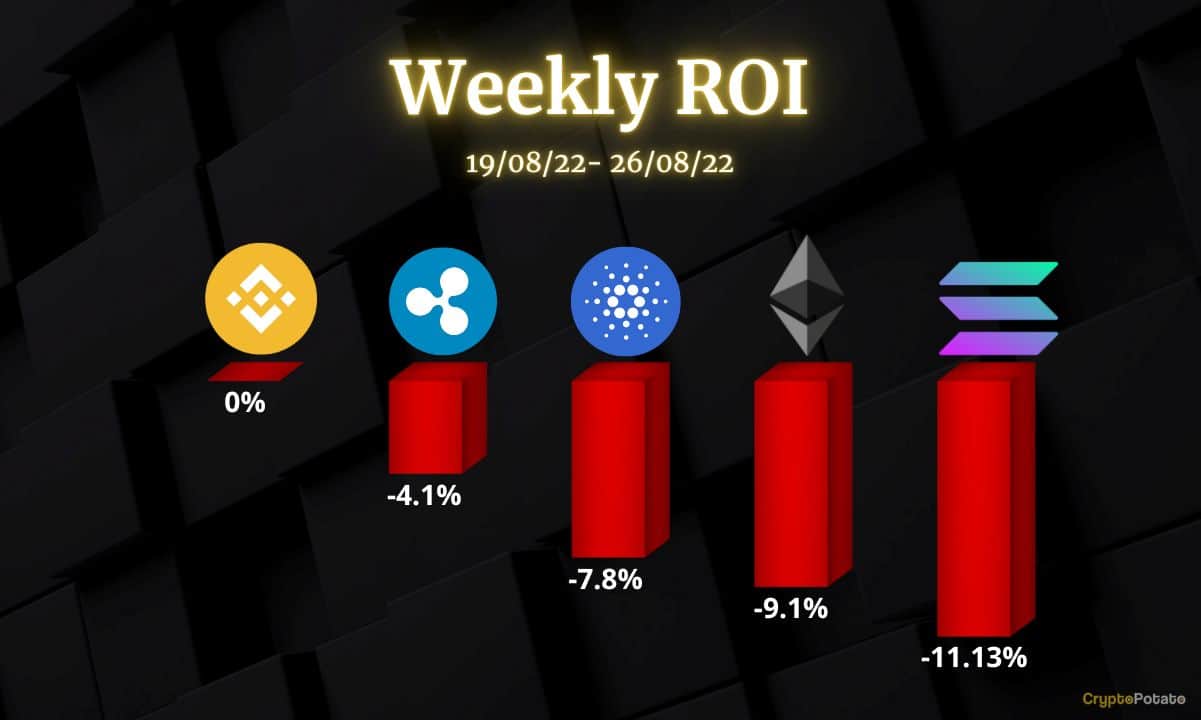

Based on this pattern, some are speculating that for the 2018 bear market, the yearly low price $3,100 could have been the capitulation candle. There is no way to confirm this as we are still floating in the nearby range and could quickly go further down.

Plus, the candle that reached $3,100 did not have a long wick at the end like the one in 2015. In technical analysis, a red candle with a long wick, followed by a green candle might be a sign that the trend is about the reverse (an end to the bear market). The above is also known as Bullish Tweezers candle formation. Like any other formation, the pattern becomes more reliable when followed by a massive amount of volume.

To conclude, based on this information and candle formation, we can’t be sure that we have seen the capitulation candle that will end the 2018 bear market, and will have to wait for clearer signals to get confirmation.

The post Exactly 4 Years Since The $152 Capitulation Candle Which Ended The 2014 Bear Market appeared first on CryptoPotato.