Non-fungible token (NFT) lending platform Astaria is launching publicly after a lengthy closed beta period.

The platform, co-founded by former decentralized finance (DeFi) protocol SushiSwap CTO Joseph Delong, allows NFT holders to lease their assets to traders who may not be able to afford a blue-chip NFT in a single purchase. With support for over 300,000 NFTs, Astaria seeks to pump liquidity into the greater Ethereum-based NFT ecosystem.

However, unlike other NFT lending platforms that operate peer-to-peer with borrowers and lenders, Astaria is utilizing a third party to facilitate its lending market, tapping NFT appraisal service Upshot to serve as the “strategist” that will help liquidity providers enter the market while helping borrowers in leasing their assets.

Justin Bram, CEO and co-founder of Astaria, told CoinDesk that peer-to-peer lending models are hard to scale and utilizing a three-actor model helps make the lending process much easier.

“There’s sort of this bid and ask process that happens offline in Discord, where users are negotiating different rates for loans – it’s really cumbersome, you have to have capital and knowledge to lend out and as a borrower, and you don’t really know what you’re getting,” said Bram. “We’re extremely borrower friendly, we don’t force-liquidate anyone, you get fixed terms and you only get liquidated to pay – you don’t pay your debt at maturity.”

In order to manage the capital flow within the protocol, Astaria is releasing a pre-funded vault that Upshot will help control in order to manage risk and rewards options between borrowers and lenders.

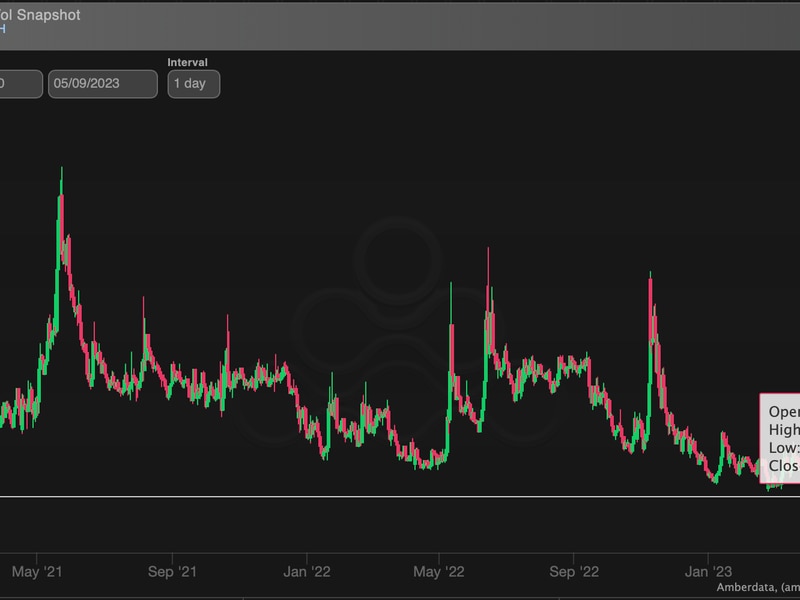

Astaria took advantage of the bear market to build out its protocol before releasing it to the public. In June 2022, Astaria raised $8 million in seed-funding to deliver robust NFT lending infrastructure.

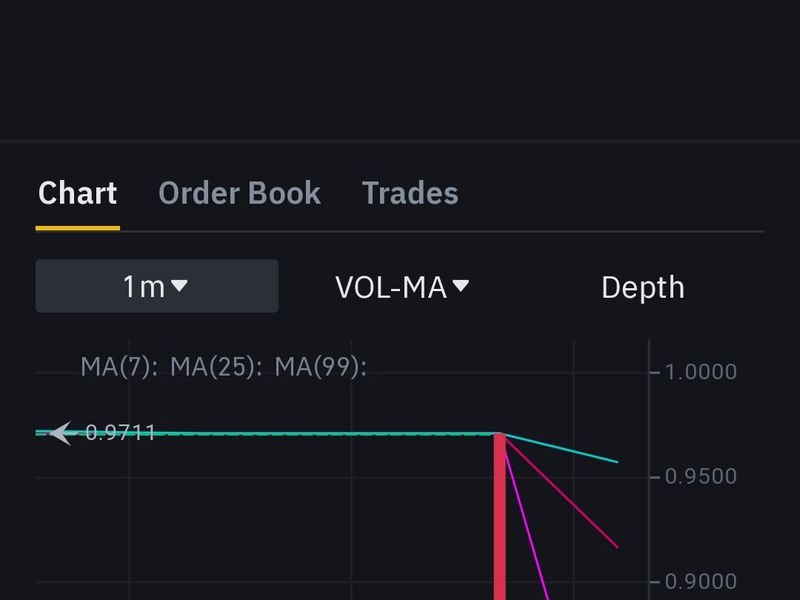

NFT lending has been on the rise since NFT marketplace Blur released its lending platform Blend in May. According to data from platform Dune Analytics, the marketplace has already loaned out 46,472 ETH, about $83.7 million.

Edited by Toby Leah Bochan.