Europe’s First Spot Bitcoin ETF Set To Debut Amidst Growing Interest In The U.S.

Europe is on the verge of witnessing the launch of its first spot bitcoin exchange-traded fund (ETF). The long-awaited debut of the European spot bitcoin ETF comes after a significant delay, which has only intensified the anticipation surrounding its arrival. Coinciding with this news, the United States is also experiencing a surge of interest in a similar product, kicking off with the filing by BlackRock for an American spot bitcoin ETF.

Jacob Asset Management is responsible for the ETF listing, which was actually approved in 2021. Due to market conditions in 2022, the ETF was delayed — although there’s no official launch date yet, the development comes at an opportune time.

The ETF is designed to provide investors with an opportunity to gain exposure to bitcoin without directly owning the underlying asset, albeit at the costs of properties only offered by self-custody. By offering a regulated and easily accessible investment vehicle, the spot bitcoin ETF has the potential to attract a broader range of institutional investors.

The delay in launching the European spot bitcoin ETF had only heightened market expectations. Investors have been eagerly awaiting a regulatory green light that would enable them to tap into the Bitcoin market with the convenience and security of an ETF structure. Now, with the imminent arrival of Europe’s first spot Bitcoin ETF, many believe that it could herald a new era for bitcoin in the region.

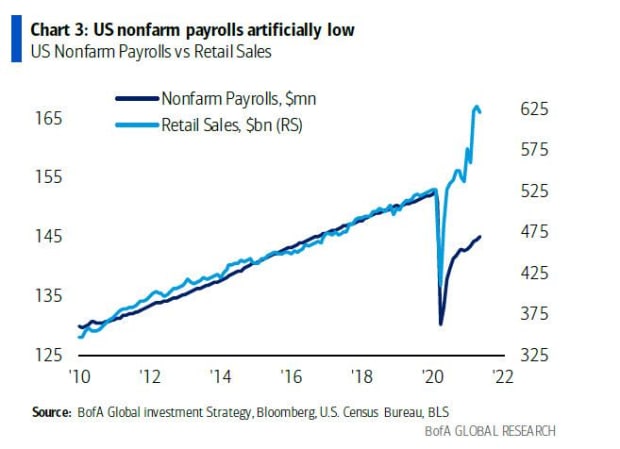

Simultaneously, the United States has witnessed a surge of interest in a spot bitcoin ETF following BlackRock’s recent filing. As one of the world’s largest asset management firms, BlackRock’s entry signals a significant shift in sentiment towards bitcoin. Indeed, several other similarly large firms filed spot bitcoin ETFs afterwards.

The filing indicates that even established traditional financial institutions are recognizing the growing demand for regulated exposure to bitcoin. If approved, a spot Bitcoin ETF in the U.S. could potentially provide a significant boost to the market, attracting institutional investors and further bringing bitcoin mainstream.