European Crypto Asset Manager CoinShares to Enter U.S. Hedge Fund Fray

Crypto asset manager CoinShares (CS) is establishing a hedge fund unit for qualified U.S. investors, marking an expansion outside its European base.

The St. Helier, Jersey-based company aims to provide institutional investors with actively managed exposure to digital assets, according to an announcement on Friday.

CEO Jean-Marie Mognetti described the move as “a natural progression”, given the “changing macro environment prominently marked by interest rates and inflation.”

“The long-awaited return of interest rate-driven volatility is a great opportunity that we plan to capture with our novel fund products,” Lewis Fellas, CoinShares’ hedge fund head, said in the statement. “Each product that will be offered is designed to mitigate counterparty risk whilst providing investors with clearly defined asset class and strategy exposures.”

A report by accounting firm PricewaterhouseCoopers (PwC) in July found that the proportion of traditional hedge funds investing in crypto assets fell to 29% from 37% in the previous 12 months. It also found that almost a quarter of hedge funds were reassessing their strategies due to the regulatory environment in the U.S., with around 12% considering relocating from there to more crypto-friendly jurisdictions.

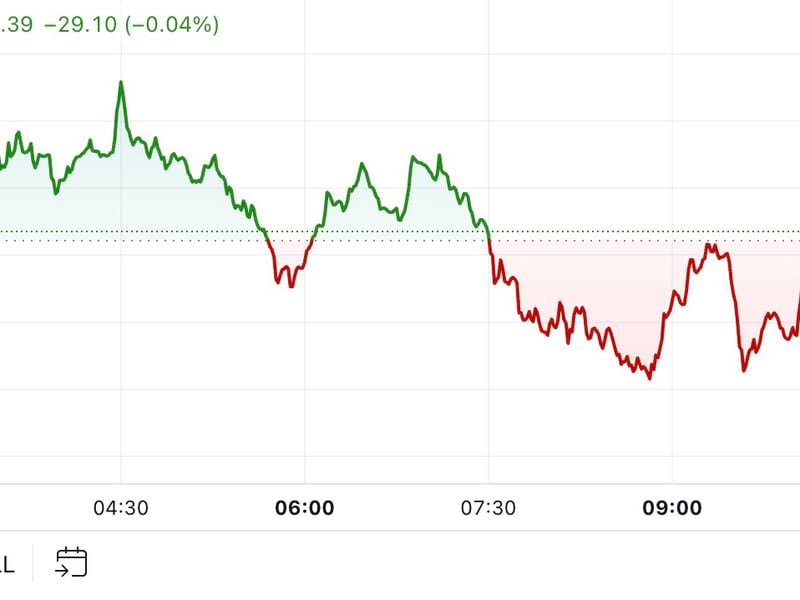

CoinShares stock rose 2.2% on the Stockholm stock exchange.

Edited by Sheldon Reback.