-

The European Securities and Markets Authority (ESMA) flagged a technique employed by some crypto miners as a potential form of market abuse in its latest regulatory proposals under MiCA.

-

Crypto policy watchers want the regulator to clarify that reordering transactions to maximize profits, known as MEV, is not all bad.

The European Union markets regulator flagged maximum extractable value (MEV), whereby blockchain operators reorder user transactions to maximize their own profits, as a potential form of market abuse, a stance that is worrying some industry watchers who say the case is not clear-cut.

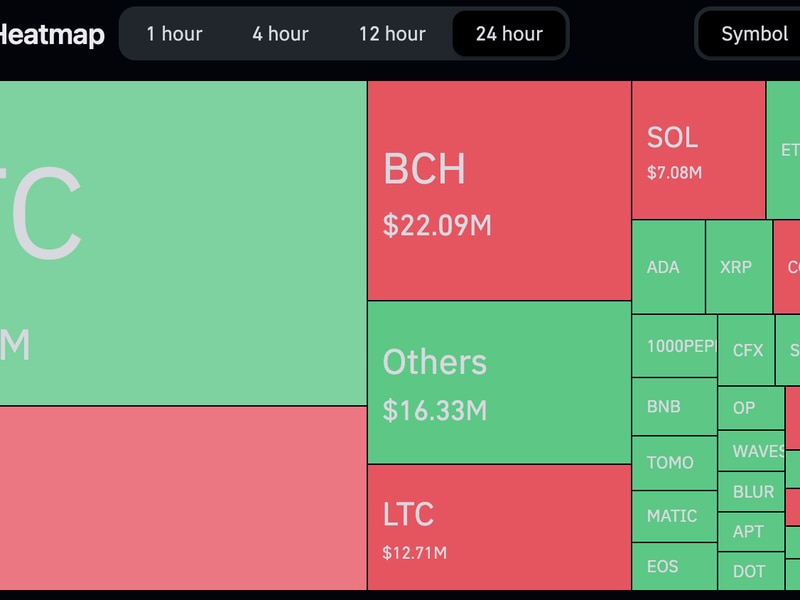

In regulatory proposals published last week by the European Securities and Markets Authority (ESMA) under the digital assets law known as MiCA, the watchdog referred to MEV as potentially suspicious. MEV is broadly defined, but it generally encompasses trading strategies where blockchain operators – the companies and individuals that add blocks to the chain – preview the network’s transaction queue to extract extra profits for themselves. Frequently, such tactics involve reordering user transactions – shifting how they’re ordered into blocks, or frontrunning them with new transactions – just before the trades are written to the chain’s ledger.

MEV is often called an “invisible tax” on users, since certain methods for extracting it, like sandwich attacks and frontrunning, can eat directly into end-user profits. While MEV is a controversial topic even within the industry, some industry advocates argue that MEV plays a positive role in general since it can help to improve blockchain network efficiency.

“MEV by itself should not at all be considered as a market abuse and should not have a negative connotation,” Anja Blaj, a policy expert at the European Crypto Initiative (EUCI), said in an interview over WhatsApp. “There are very limited scenarios and tactics that have similar effects to those of market abuse. This should be emphasized over and over again as MEV’s purpose in the first place is to compensate the good actors for the validation work they do.”

Some crypto policy watchers have argued that MEV is not even within MiCA’s scope, and EUCI has warned that applying MiCA to MEV could lead to overregulation. While it’s true the MiCA text does not mention MEV, ESMA’s consultation on proposals to tackle market abuse notes that the legislation extends the EU’s existing market abuse rules to include reporting suspicious activity resulting not just from transactions but also “the functioning of the distributed ledger technology such as the consensus mechanism.”

“MiCA is clear when indicating that orders, transactions, and other aspects of the distributed ledger technology may suggest the existence of market abuse e.g., the well-known maximum extractable value,” it said.

ESMA also noted that MiCA doesn’t require crypto service providers to report activity such as “scams, payments fraud or account takeover.”

Peter Kerstens, an adviser to the European Commission on financial sector digitalization and cybersecurity, said MEV is neither good nor bad but may lead to questions about market integrity.

Investors have a legitimate expectation that transactions on the blockchain will be validated in the order they were submitted, and MEV reordering can lead to frontrunning, where the “validators” that operate blockchains can move their own transactions ahead of others to ink an extra profit, according to Kerstens.

“So MEV may lead to questions about the integrity of the market and it may trigger market abuse/frontrunning, but it does not have to in every instance,” Kerstens, who was instrumental in the creation of MiCA, said in a statement to CoinDesk.

Search for regulatory clarity

The legislation, whose full name is Markets in Crypto Assets, was finalized last year and made the EU the first major jurisdiction to comprehensively regulate the burgeoning digital assets sector.

ESMA and the European Banking Authority (EBA) have been consulting on measures and guidance they’re required to issue under MiCA, with industry watchers engaging with the watchdogs to improve clarity on the rules – particularly for various service providers.

EUCI is seeking more clarity from ESMA, ensuring that the regulator is clear on what scenarios involving MEV constitute market abuse.

“When, if, a malicious MEV tactic is detected, it should further be elaborated who’s responsible for it,” Blaj said. “We cannot talk about effective enforcement without clarity around the ‘who’ and ‘what for.’”

Kerstens noted his thoughts on MEV are his personal views, but added that ESMA’s consultation seeking public feedback is in response to the European Commission – which proposed the MiCA framework – asking the regulator to provide advice on “if and when MEV is/leads to/can lead to market abuse.”

“So an official/institutional view on this may be forthcoming,” Kerstens said.

ESMA’s latest consultation is open for comments until June 25.

Edited by Sheldon Reback.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)