Ethereum’s Declining Hash Rate Increases the Chance of a 51% Attack

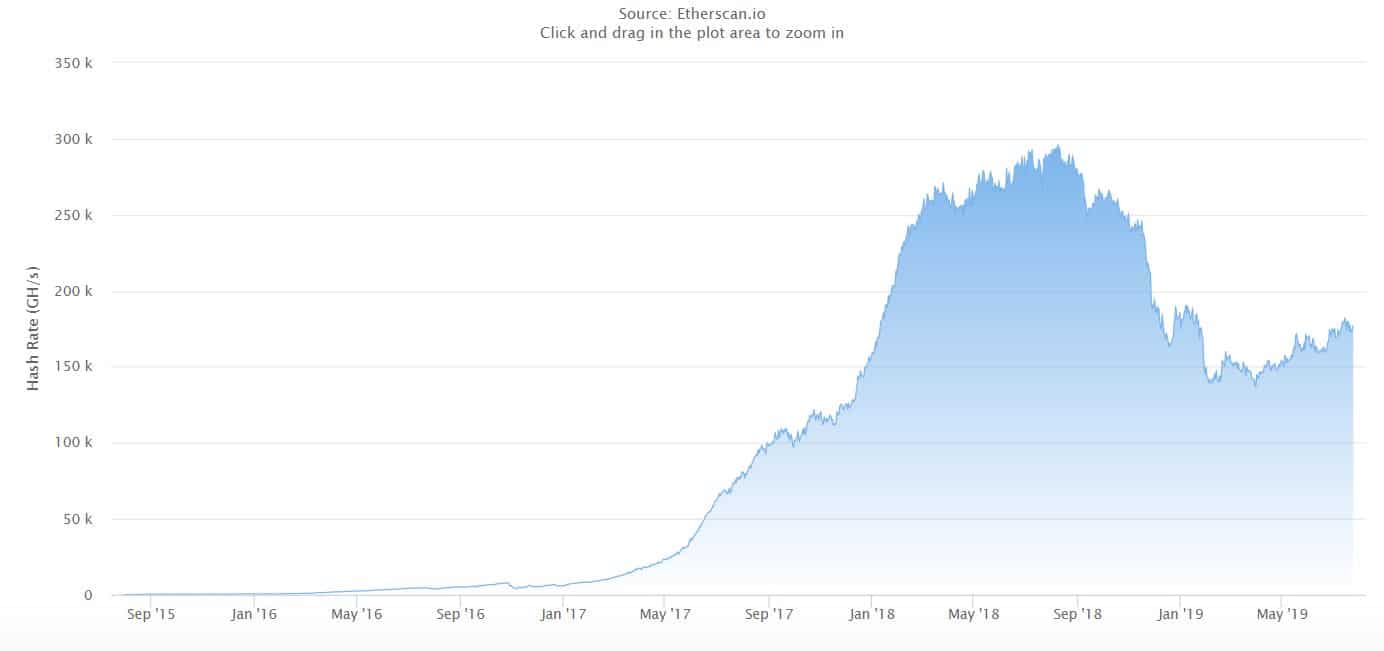

Ethereum is one of the few cryptocurrencies to have been among the Top 3 for a long, long time. Recently, however, the crypto community has raised security questions in regards to the network’s declining hash rate and the safety of its (still) PoW-based blockchain. Ethereum’s hash rate has marked a 42% decline from last year’s high, and the main question is whether or not Ethereum is still as safe as it used to be.

Ethereum’s Increasing Vulnerability

In August of 2018, Ethereum and other cryptocurrencies saw their hash rates peak. Since then, however, things have changed. Ethereum’s hash rate is down more than 42% over the past 11 months.

To put things into perspective, Bitcoin’s hash rate has been constantly increasing. To be exact, it surged 40% within the same time frame, making Bitcoin’s network even more secure.

According to a website that calculates the cost of running a potential 51% attack on the various blockchain networks, in order to jeopardize Bitcoin’s network, one would have to spend approximately $750,000 per hour. In order to put Ethereum’s network in the same jeopardy, the price would be significantly lower – around $100,000 per hour.

If Ethereum’s hash rate continues to go south, however, this cost will only decrease, making it a lot more affordable to cause serious disruption.

Now, it’s worth noting that Ethereum has been making serious efforts to transition from the Proof of Work-based mechanism to one that’s governed by Proof of Stake consensus. However, until that happens, all possibilities should be taken into consideration.

The 51% Attack and Its Consequences

51% attacks can take place when a single organization or entity takes control over the majority of the hash rate, leading to a disruption in the network. With such an attack, one can modify the ordering of transactions, reverse transactions and facilitate double-spending, prevent transactions from being confirmed, or even exclude miners.

For example, CryptoPotato reported in January that such an attack had been carried out on Ethereum Classic’s network. As a result, the attacker transferred a total of 54,200 ETC which were worth upwards of $250,000 at the time of the event. As you can imagine, this attack also caused massive damage to the reputation and the credibility of Ethereum Classic, shaking the public’s trust in it substantially.

Of course, whether or not an attack of the kind can and will happen to Ethereum’s main network is unknown. However, considering the decreasing hash rate, it’s certainly something that deserves a thought or two.

The post Ethereum’s Declining Hash Rate Increases the Chance of a 51% Attack appeared first on CryptoPotato.