Ethereum Whales at an All-Time High as ETH Explodes Against Bitcoin

While some traders have panic-sold during the recent market-wide crash, Ethereum whales have continued accumulating massive chunks. As a result, the number of large ETH holders has surged to a new all-time high. Meanwhile, ETH is also charting serious intraday gains against BTC.

ETH Whales Keep On Buying

The second-largest cryptocurrency entered the new year at just over $700. Whether it was the massive usage of the Ethereum blockchain in DeFi and NFT, the impressive bull run in the whole market, or, perhaps, both, ETH went on a roll in the following months.

This led to April 16th, when the cryptocurrency registered a new all-time high of about $2,500. After this near 250% surge in less than four months, though, came the Sunday market crash and ETH slumped to a low of $1,950.

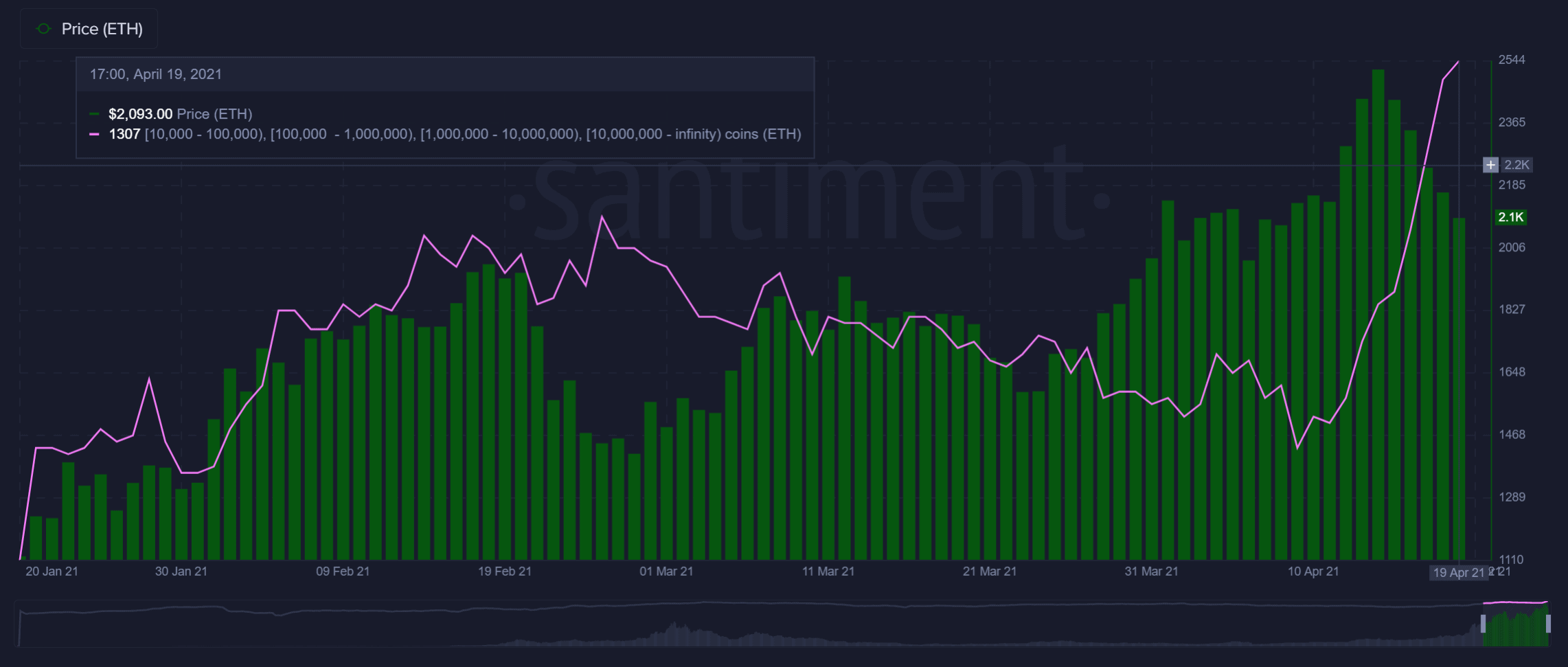

Data provided by the analytics company Santiment suggests that most retail traders either sold some portions or simply sat and watched the high fluctuations. In contrast, Ethereum whales went on a shopping spree.

The firm outlined that the number of such accounts, holding at least 10,000 ETH, has been rapidly increasing since the start of the year. However, they became particularly active since Sunday, resulting in a new record.

Ethereum Transaction Fees Update

The aforementioned high employment of the Ethereum blockchain led to significant issues for the network, primarily connected to scaling. As a result, the fees users have to pay while transacting on Ethereum kept increasing since the start of the year and reached a new peak in late February, as CryptoPotato reported.

Since then, the average transaction costs have decreased slightly but are still above $20, according to Ycharts data. The decline is not sufficient for users, and the Ethereum developers have introduced new proposals and upgrades to the network aiming to reduce the fees even more.

The latest hard fork, called Berlin, came last week. It initially caused some syncing problems for the network nodes. Although they were fixed, the upgrade has failed to lower the fees substantially.

Some reports also claimed that the controversial and long-anticipated EIP-1559 update might fail as well, which should arrive with the London Hard Fork in July 2021.

The paper argued that Layer-2 solutions are the only adequate options, at least until the migration from the proof of work consensus algorithm to proof of stake (also known as ETH 2.0) is complete.

Ethereum Surges Against BTC

It’s also worth noting that among all of the above, ETH has charted notable gains against Bitcoin today. As seen in the chart below, the cryptocurrency has surged by almost 7% against BTC in the past few hours alone, marking a substantial leg forward.