Ethereum Unstaking Requests Now Face About a 17-Day Wait

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

The line is getting longer: Ethereum validators that have put in withdrawal requests following last week’s Shanghai upgrade will have to wait upwards of 17 days to get their staked ether (ETH) back, according to data from the blockchain analytics firm, Nansen.

That’s up from about 14 days late last week.

The unstaking request queue consists of some 28,436 validators looking to exit the Beacon Chain.

There are a total of 575,359 validators on the Ethereum blockchain, according to analytics firm Nansen, so roughly 5% of validators are choosing to leave Ethereum’s staking process. Validators are responsible for proposing and adding blocks of transactions to the Ethereum blockchain as part of the validation process. In return, they are eligible for rewards of newly minted ETH and a share of associated transactions fees.

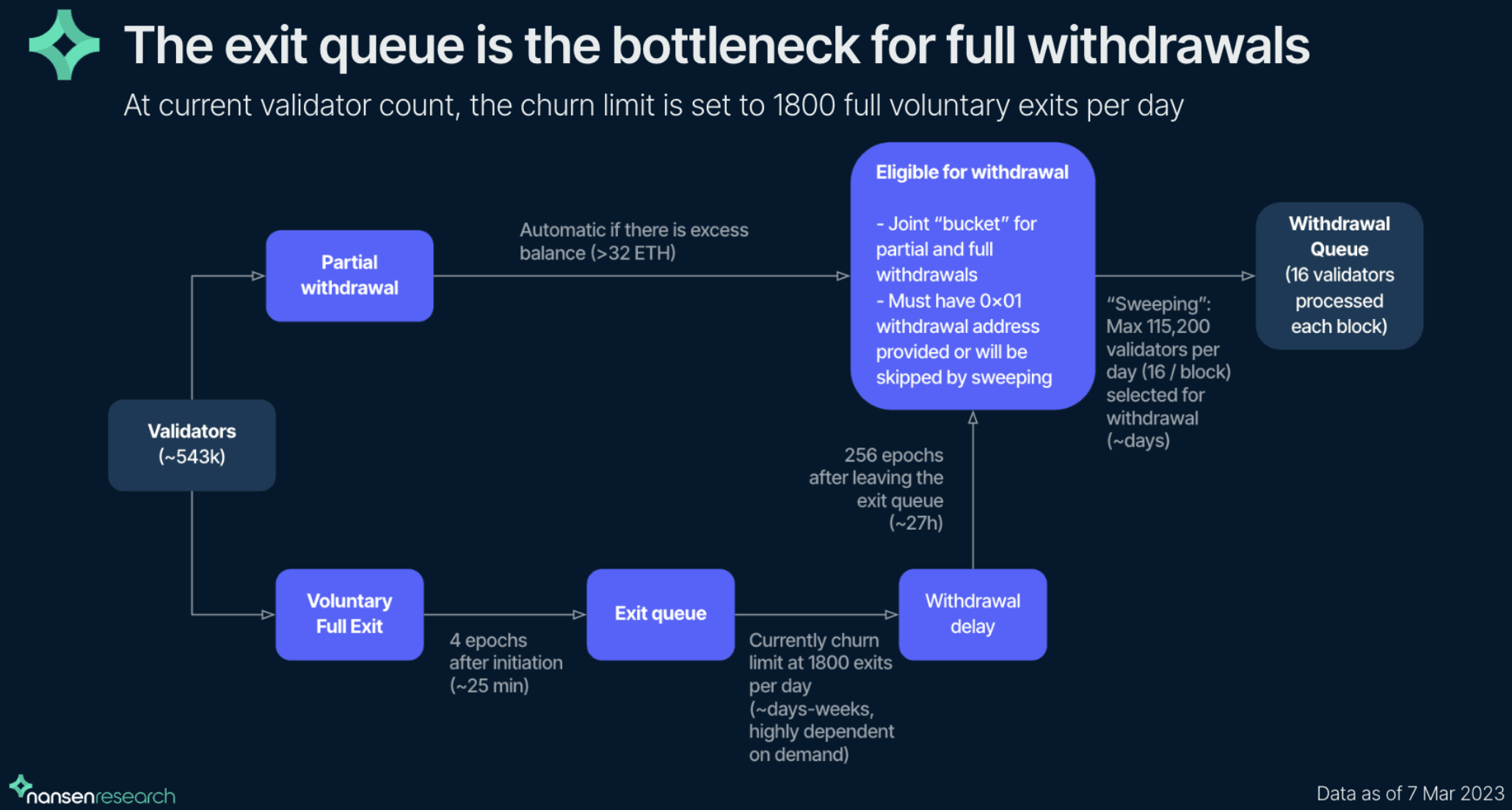

Exit Queue process (Nansen)

But for those who have chosen to exit, there’s a whole process that contributes to the length of the queue.

According to Niklas Polk, an analyst at Nansen, validators first send a voluntary message to exit, involving a 25-minute wait. Then these validators join the exit queue, which now sits at 11.7 days. Once they move out of this phase, they are faced with a withdrawal delay of about 27 hours. Finally, withdrawals are processed and deposited after another 4.25 days.

In short, this means that if a validator decides to join the exit queue today, it will be 17 days by the time their ETH is returned.

On the other hand, partial withdrawals only take about 4.27 days to process and are automatically deposited into validator addresses if their unstaking credentials are set up. A partial withdrawal means the validator is only withdrawing a portion of their staking rewards while keeping their staked ETH in play as part of the validating process.

Staking ETH is still gaining popularity

The developers behind the Ethereum blockchain have won plaudits for the mostly smooth execution of the network’s multi-year transition to a fully functional proof-of-stake network, from the more energy-intensive proof-of-work system its used originally, and which Bitcoin still uses.

And while crypto analysts have said that the ability to withdraw from the staking mechanism might make investors less reluctant to allocate capital toward staking, the length of the Ethereum exit queue has provided a stark reminder of just how long it can take to get the crypto back at a time of high demand – especially in fast-moving digital-asset markets where prices can and often do move by double-digit percentages in a single day.

According to Nansen, Kraken, the crypto exchange that was forced to shut down its staking service in a settlement with the Securities and Exchange Commission, makes up about 43% of the ETH withdrawal queue.

Concurrently, stakers over the last 24 hours have deposited more ETH into the chain than there have been withdrawal requests, creating a net 86,000 ETH staked, or 0.3% increase in staked ETH – despite all the withdrawals that have already taken place. This shows that since the upgrade, stakers have gained confidence in Ethereum’s staking process.

(The net ETH staked figure does not account for tokens due to be withdrawn by exiting validators that are still waiting in the queue.)

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.